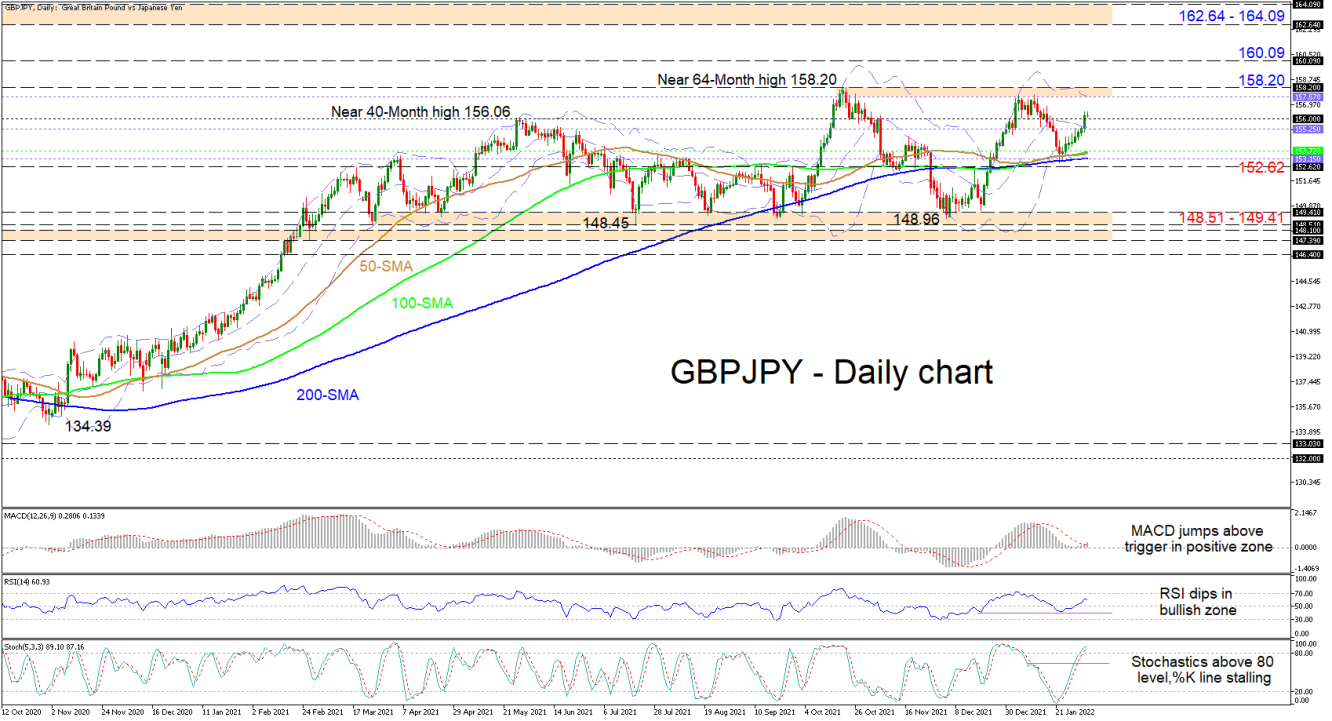

Nonetheless, the gradual incline in the SMAs, is suggesting that the neutral-to-bullish mood remains active.

The short-term oscillators mirror the bullish demeanour in the pair but are currently reflecting a slight waning in upside momentum. The MACD, a tad above zero, is endorsing positive momentum with its climb back above its red trigger line. Currently, the RSI in the bullish region has marginally rolled over and in the overbought territory, the stochastic %K line is stalling, thus together promoting lifeless upside forces.

Lifting off the 156.00 handle, the pair could encounter preliminary bullish constraints around the 157.57-158.20 zone, formed by the upper Bollinger band and the more than 5-year high of 158.20. Conquering this tough barrier, which has restrained the pair to a broad trading range since October 2021, the price could challenge the 160.09 high from back in June 2016, where the pair collapsed 27 full points. Should this resistance fail to terminate additional gains from evolving, the price may then seek out the 162.64-164.09 obstacle, which is linked to an area of highs over the March-May 2016 period.

Otherwise, if the price slips beneath the 156.00 hurdle, prompt footing could arise from the mid-Bollinger band at 155.25. In the event the mid-Bollinger band is overlooked, a dive in the price may then encounter a hardened area of support stretching from the 100-day SMA at 153.72 until the 152.62 barrier. If selling pressures break down this buffer zone, which encompasses the 50- and 200-day averages, the lower Bollinger band and the January 24 trough, the price may snowball towards the 148.51-149.41 base that has held since March 2021.

Summarizing, GBPJPY is exhibiting a neutral-to-bullish bias north of the SMAs and the fresh trough at 152.89. A break above the portrayed ceiling of 157.57-158.20 could juice up the bullish bias, while a retreat stretching beneath the 152.62 barrier may reinforce negative tendencies.