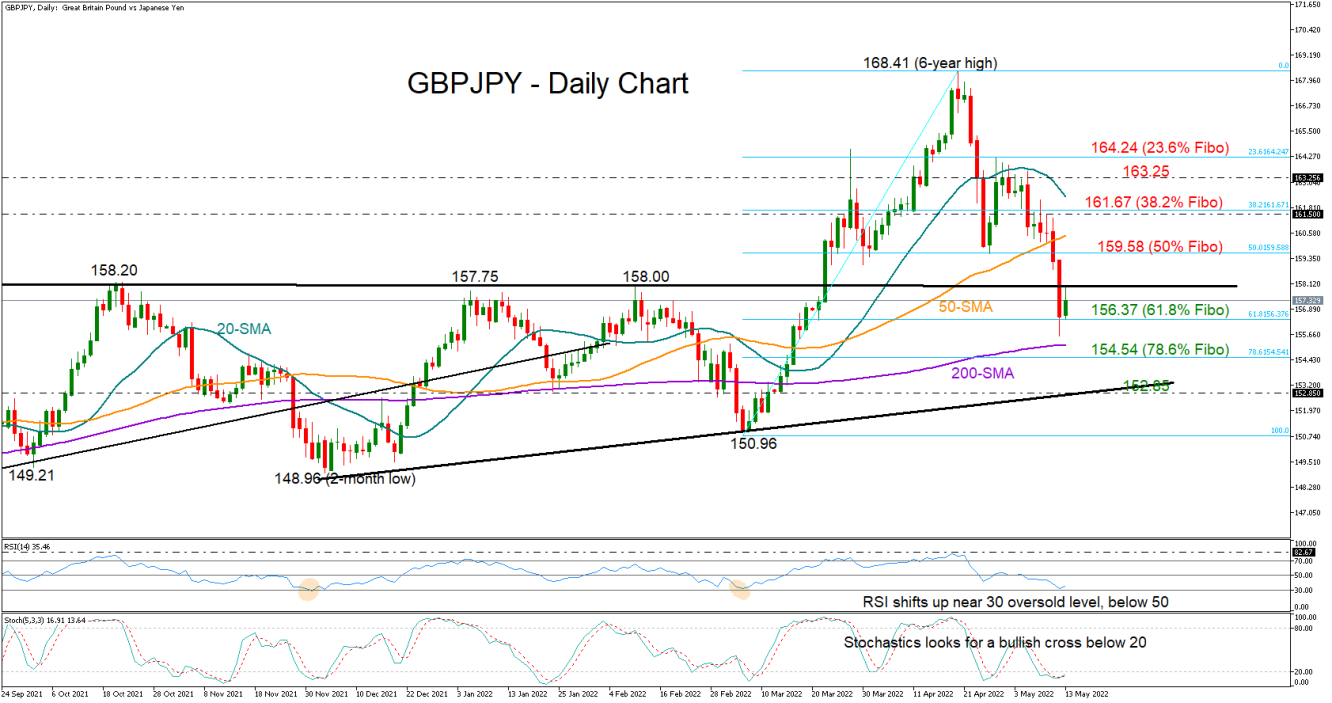

GBPJPY is trying to heal its wounds after Thursday’s brutal sell-off cut 1.6% of its value and neutralized its long-term outlook back below the key 158.00 former resistance area.

The RSI is looking for a rebound, repeating the sequence previously formed around its 30 oversold mark, while the Stochastics are also setting a bullish cross near April’s lows and below 20, raising optimism that the soft bounce off the two-month low of 155.58 may see a continuation.

That said, as long as the aforementioned indicators remain in bearish territory, negative risks will remain intact, keeping the focus on the downside and particularly on the 61.8% Fibonacci retracement of the latest upleg, which is currently buffering selling tendencies at 156.37. If that base cracks, the 200-day simple moving average (SMA) and the 78.6% Fibonacci of 154.54 could prevent an extension towards the tentative supportive trendline at 152.64.

Moving to the upside, the bulls will need to reclaim the 158.00 mark to gain fresh momentum. If that turns out to be the case, immediate resistance may develop around the 50% Fibonacci of 159.58. Another step higher could test the 38.2% Fibonacci of 161.67, where the constraining 20-day SMA is converging, before all eyes turn to the 163.25 - 164.24 zone.

Summarizing, GBPJPY is currently congested between the 158.00 resistance and the support of 156.37. Any move out of this range could direct the market accordingly.