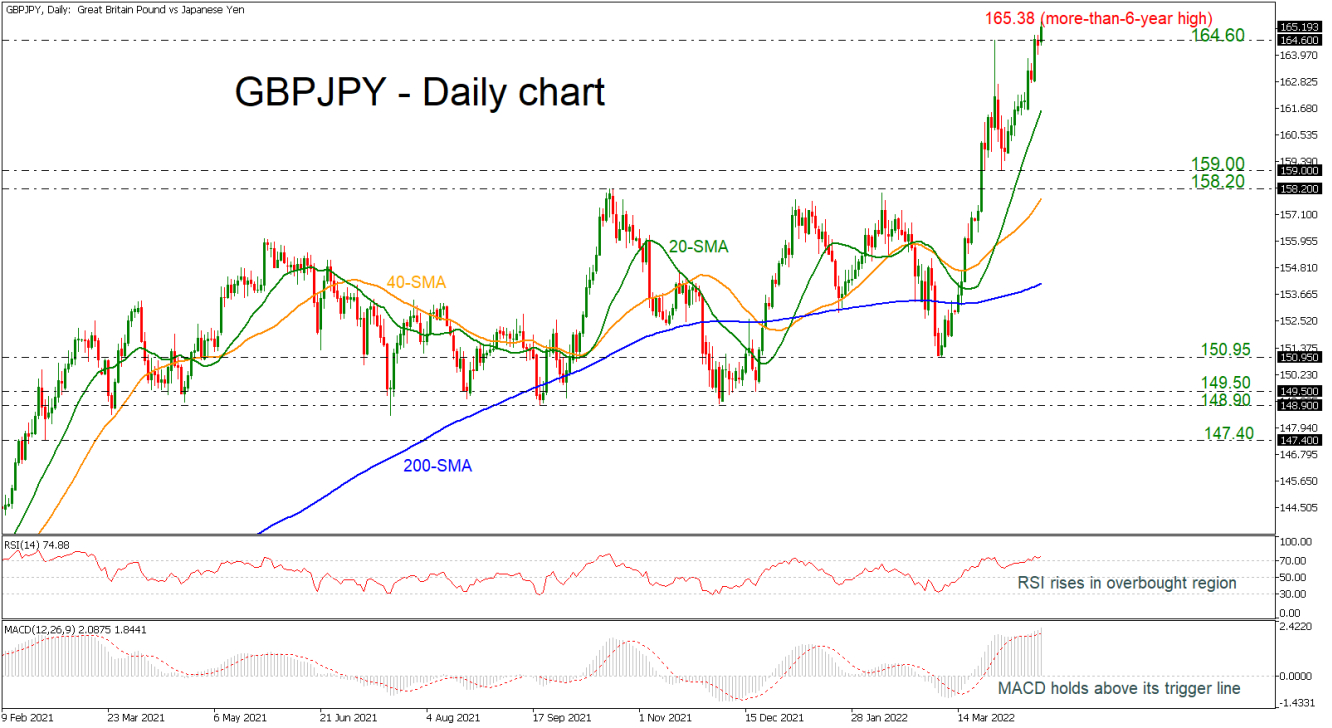

GBPJPY is flying to a more-than-six-year-high of 165.22 after the bounce off the 159.00 round number. The 20- and 40-day simple moving averages (SMAs) are following the current market action confirming the strong bullish rally. The technical indicators are looking overbought as the RSI is standing above the 70 level and the MACD is extending its move above its trigger and zero lines.

An extension to the upside and above the intraday high, the price could meet the area near the 168.10 barrier, registered in October 2014. Further up, resistance could run towards the 175.00 psychological level, taken from the inside swing high in April 2015.

On the other hand, if the pair weakens, the 164.60 hurdle could provide immediate support ahead of the 20-day SMA at 161.60. Even lower, the 158.20-159.00 zone could attract a greater attention as any leg lower could worsen market’s bearish outlook, opening the way towards the 40- and then the 200-day SMA at 157.77 and 154.17 respectively.

To summarize, GBPJPY looks bullish in the short-term and only a significant fall back below 158.20 and the 200-day SMA may switch the outlook back to neutral.