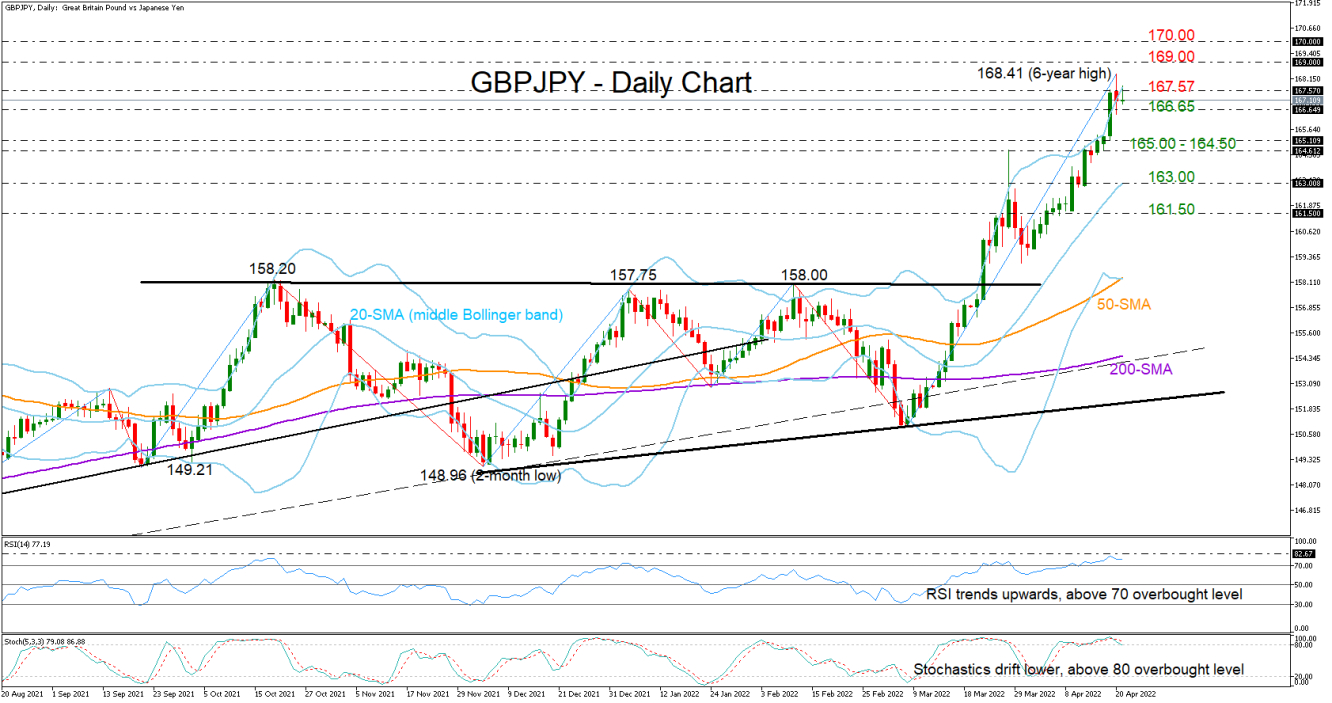

GBPJPY eased off after its exciting rally paused at a new six-year high of 168.41 on Wednesday, but the price continued to trade around its recent highs early on Thursday, feeding optimism that the bull run has not peaked yet.

From a technical perspective, a downside correction could be nearing as the price has already completed two daily sessions above the upper Bollinger band, while the RSI and the Stochastics have been hovering above their overbought levels for almost two weeks now. Yet, with the RSI currently preserving a clear uptrend above 70 and the latter holding above 80 despite its latest pullback, there is hope for another bullish breakout before a new bearish phase starts.

The question now is how far the price could fly if the bulls find the required momentum to close above 167.57. Well, if that turns out to be the case, traders may initially target the 169.00 level, which is the 261.8% Fibonacci extension of the 158.00 – 150.96 downleg, and then the psychological mark of 170.00. Should buyers appear even more energetic, the next obstacle could be the 175.00 number, which had been a key barrier to upside and downside movements during the 2013 – 2016 period.

On the downside, a break below 166.65, where the supportive 20-period simple moving average (SMA) is positioned in the four-hour chart, could activate firmer selling pressures towards 165.00 – 164.50 area. Lower, the middle Bollinger band at 163.00 may cancel any deceleration to 161.50.

Overall, GBPJPY looks to be in a cautiously bullish situation, where a step above 167.57 could add more fuel to the rally, whereas a slide below 166.65 could generate additional losses.