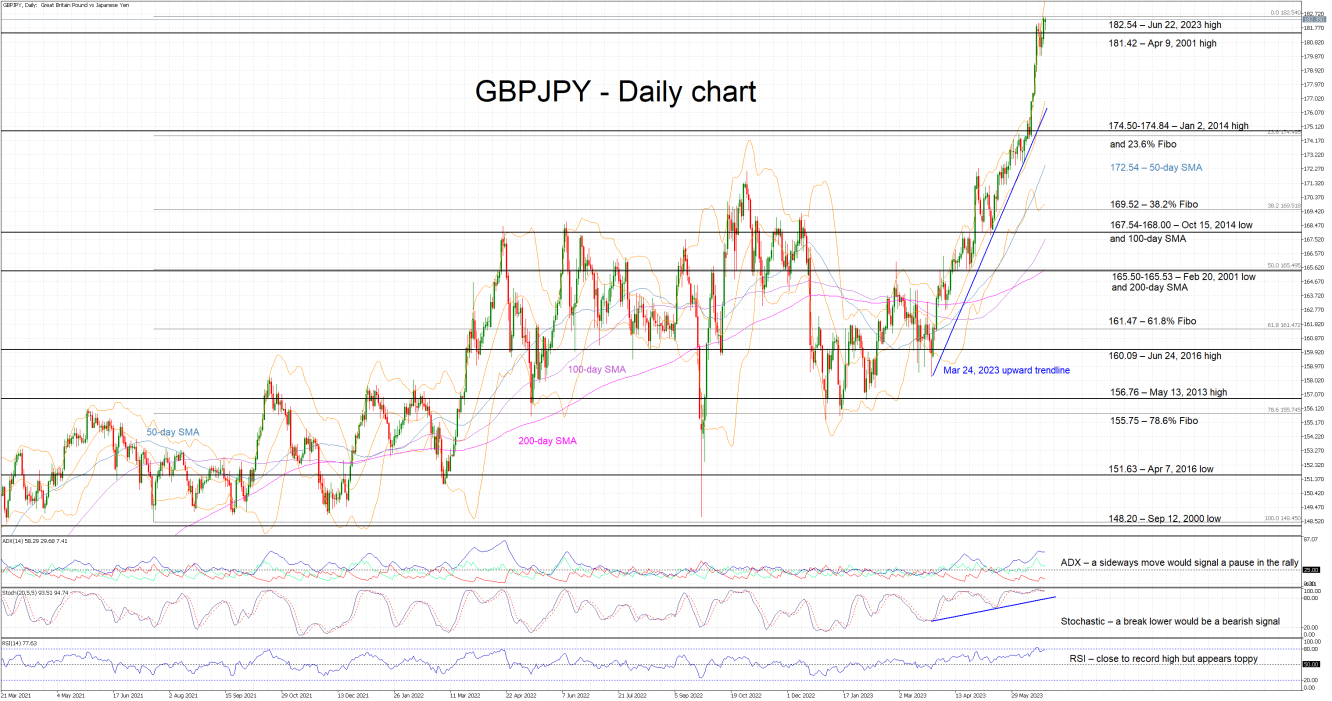

GBPJPY bulls continue to pursue higher highs as they are currently trying to stage a move above the recent 182.54 high. This is the strongest print for 7.5 years and stands 16% higher than the start of the current upleg on March 23, 2023. This move has been exponential, revealing the bulls’ determination but also making this rally susceptible to corrections. We have not seen a correction yet, but it will probably be a sizeable one when it finally occurs.

Understandably the bulls must be over the moon at this stage as on face value the momentum indicators are openly supportive of the rally.

However, there are some early exhaustion signs. More specifically, the Average Directional Movement Index (ADX) is hovering at its highest level since the March-April 2022 upleg. However, a potential failure to make a higher high would be a sign of a gradual trend reversal. Similarly, the stochastic oscillator continues to spend its time at the top of its overbought territory. While it can stay there for a considerable amount of time, a glide lower would potentially open the door to bearish pressure.

Should the bulls decide that the recent rally is not enough, they would first try to clear the 182.54 level. They then have the chance to record another 2023 high and push GBPJPY towards the 190 area, which is key from a long-term perspective.

On the other hand, the bears are desperate for some form of a pullback. If they manage to break the April 9, 2001 high at 181.42, they could set their eyes on the 174.50-174.84 range that is populated by the January 2, 2014 high and the 23.6% Fibonacci retracement of the July 20, 2021 – June 22, 2023 uptrend respectively. Breaking this area could be extremely important from a short-term sentiment perspective.

To sum up, GBPJPY bulls remain clearly in control of the market and in pursuit of higher highs. However, they should also prepare for a corrective move especially if the momentum indicators start exhibiting stronger rally-exhaustion signals.