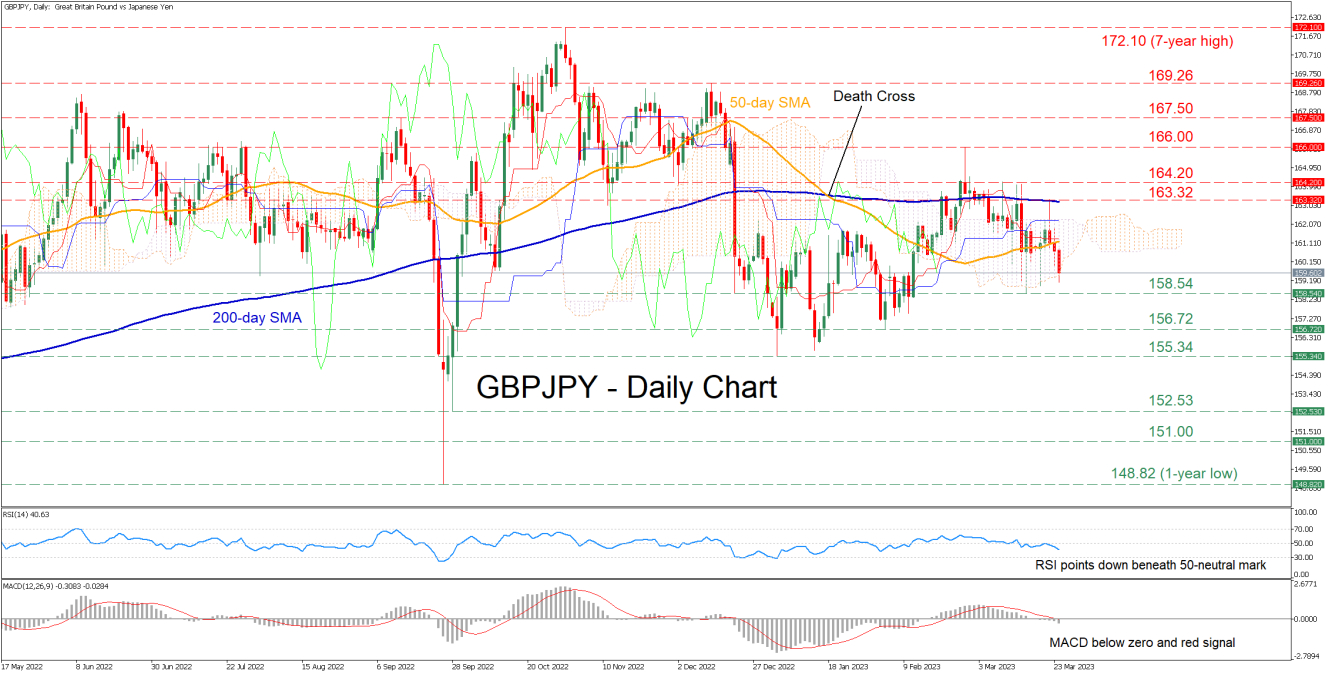

GBPJPY has been losing ground after its 2023 advance got rejected at the 166.00 region in early March. Even though the pair attempted to rebound after finding its feet near the 50-day simple moving average (SMA), the upper boundary of the Ichimoku cloud and the 200-day SMA curbed the upside.

The momentum indicators are endorsing this bearish near-term bias. Specifically, the RSI is sloping downwards below its 50-neutral mark, while the MACD histogram dropped below both zero and its red signal line.

Should selling pressures persist, the March low of 158.54 could act as the first line of defense. Sliding beneath that floor, the pair could decline towards 156.72, or lower to test the 2023 bottom of 155.34. Even lower, the 152.53 barrier might provide downside protection.

On the flipside, if the negative momentum fades and the price reverses upwards, the pair could challenge the recent resistance of 163.32, which overlaps with the 200-day SMA. Should that barricade fail, the bulls could aim for 164.20 before the 2023 peak of 166.00 appears on the radar. A break above the latter may pave the way for the September high of 167.50.

In brief, GBPJPY retraced lower and traded sideways between the 50- and 200-day SMAs after its recent advance got rejected. However, this rangebound pattern broke to the downside and a potential fresh lower low could lead to an acceleration of the retreat.