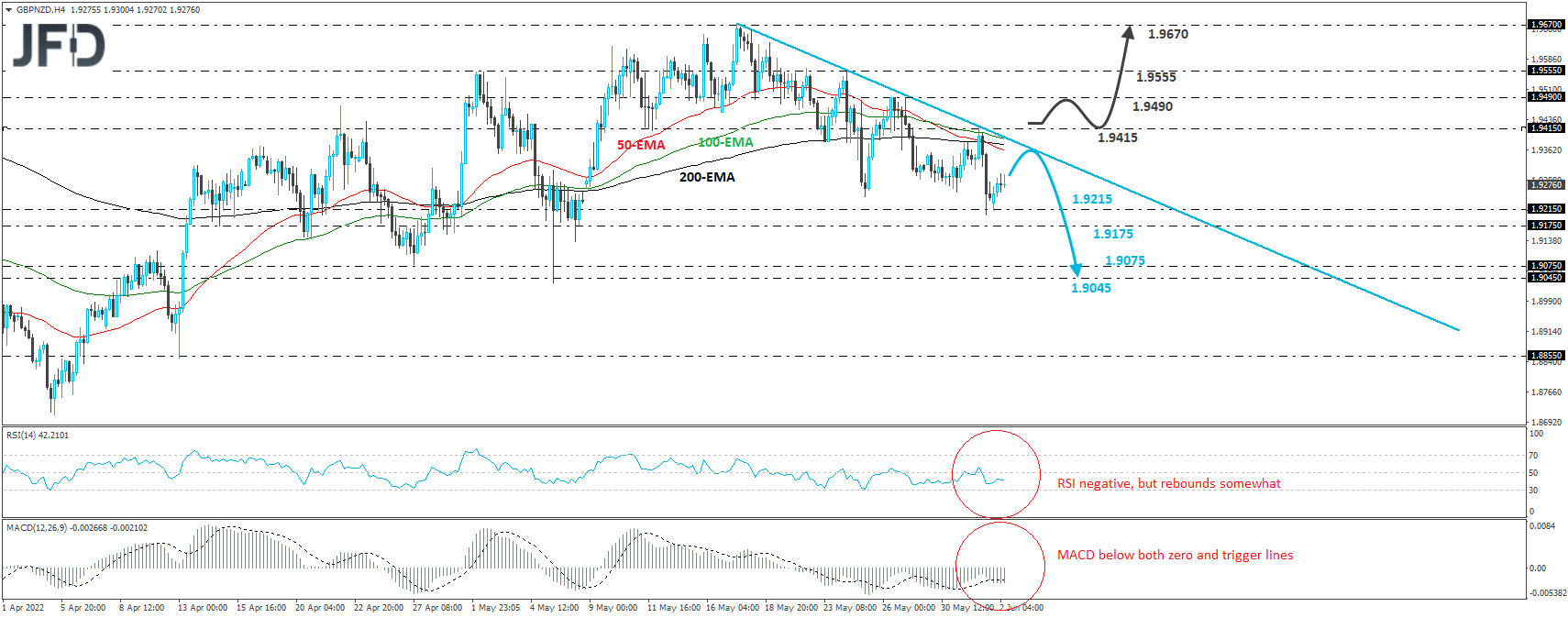

GBP/NZD traded lower yesterday after hitting resistance near the 1.9415 zone. The slide was stopped near the 1.9215 area, with the rate rebounding somewhat. However, the pair is still trading below the downside resistance line drawn from the high of May 17, and thus, we will consider the short-term picture to be still negative.

The bears may retake charge from near the downside line and perhaps aim for another test near 1.9215 or the 1.9175 territory, which attracted some buyers on May 5 and 6. If neither zone can stop the slide, we could experience extensions towards the 1.9045/75 area, marked by the lows of May 5 and Apr. 27.

Shifting attention to our short-term oscillators, we see that the RSI lies below 50, but it has turned up recently, while the MACD, although below both its zero and trigger lines, shows signs it could turn up. Both indicators detect slowing downside speed and support the notion of some further recovery before the next leg south.

To start examining whether the bulls have gained complete control, we would like to see a clear break above 1.9415. This could confirm the break above the aforementioned downside line and may initially target the 1.9490 barrier, marked by the highs of May 26 and 27. Slightly higher lies the peak of May 24, which, if also broken, could extend the advance towards the high of May 17, at 1.9670.