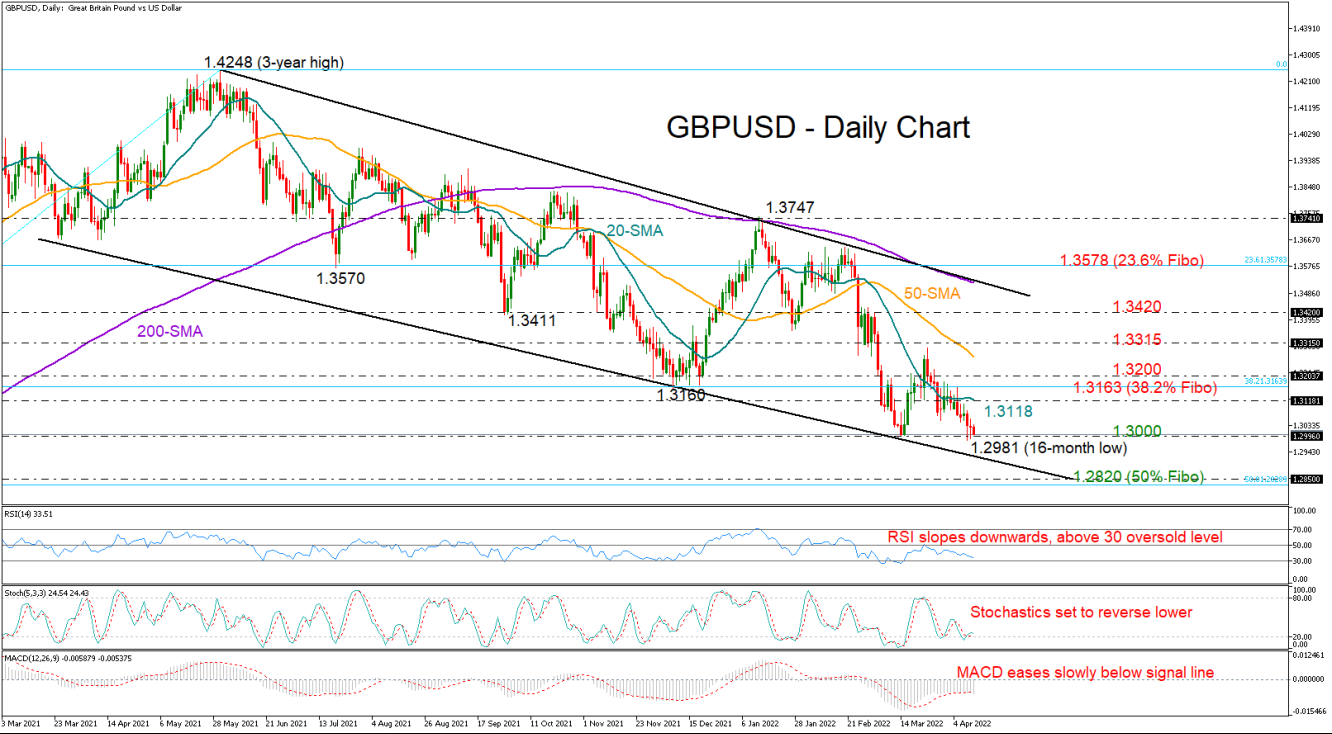

GBPUSD keeps hovering with weak momentum marginally above the 1.3000 level despite its flash slide to a new 16-month low of 1.2981 last Friday.

The bearish bias remains intact as the RSI is maintaining a clear negative trajectory and is still some distance above its 30 oversold level. The Stochastics are preparing for another negative intersection, while the MACD is gradually stepping below its red signal line, all painting a blurry short-term picture for the market.

The 1.3000 floor, however, could act as a safety net. If the price manages to set a foothold around that area, the pair could stage an upside reversal towards the 20-day simple moving average (SMA) at 1.3118. Slightly higher, the 1.3163 – 1.3200 region, which includes the 38.2% Fibonacci retracement of the 1.1409 – 1.4248 upleg (2020 – 2021) could immediately cap any additional bullish actions towards the 50-day SMA at 1.3267. Beyond the latter, the rally could stretch up to the 1.3420 resistance unless the 1.3315 constraining zone blocks the way.

In the event sellers breach the 1.3000 bottom, a crucial battle could take place around the lower boundary of the one-year-old bearish channel at 1.2925. Failure to bounce here could press the price towards the 50% Fibonacci of 1.2820, while a more aggressive decline could even test the September 2020 low of 1.2670.

Overall, GBPUSD is still in a bearish mode. Unless the 1.3000 support region stands firm, the sell-off could mark new lower lows at the bottom of the long-term downward-sloping channel.