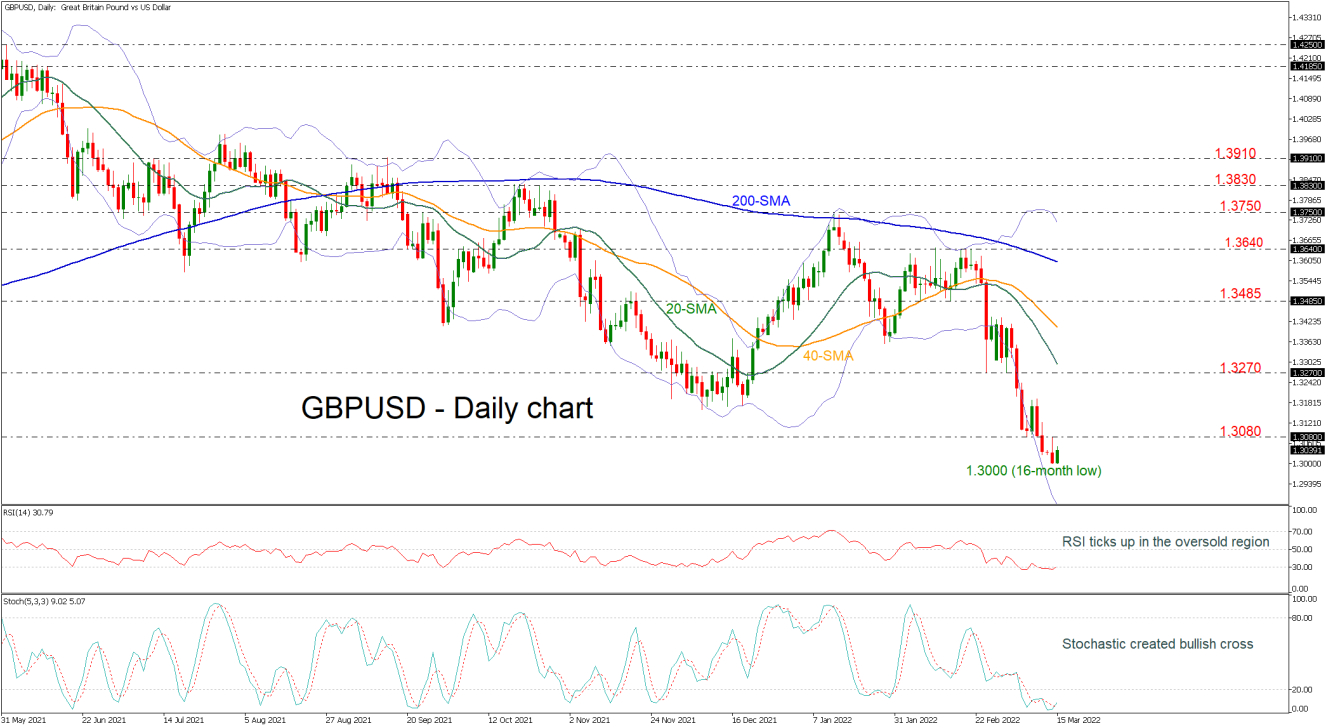

GBPUSD is posting a selling interest move, testing the 1.3000 psychological level, which is a fresh 16-month low.

The RSI indicator is pointing upwards in the oversold zone, while the stochastic oscillator created a bullish crossover within its %K and %D lines below the 20 level. Both are suggesting that the bearish mode has come to an end and the next move may be to the upside.

If the price recovers and returns above the 1.3080 resistance, the next target could be the 1.3270 resistance and the 20-day simple moving average (SMA) at 1.3295. Surpassing these lines, the 40-day SMA at 1.3410 and the 1.3485 may act as crucial restrictive levels for the bulls.

If sellers take the upper hand again and declines below the 1.3000, the next support level could come from the 1.2850 hurdle, taken from the lows in November 2020. Even lower, the market could have a pause near 1.2670, registered in September 2020.

All in all, GBPUSD has been in a falling move since May 2021 but any advances beyond the 200-day SMA may switch this outlook to neutral.