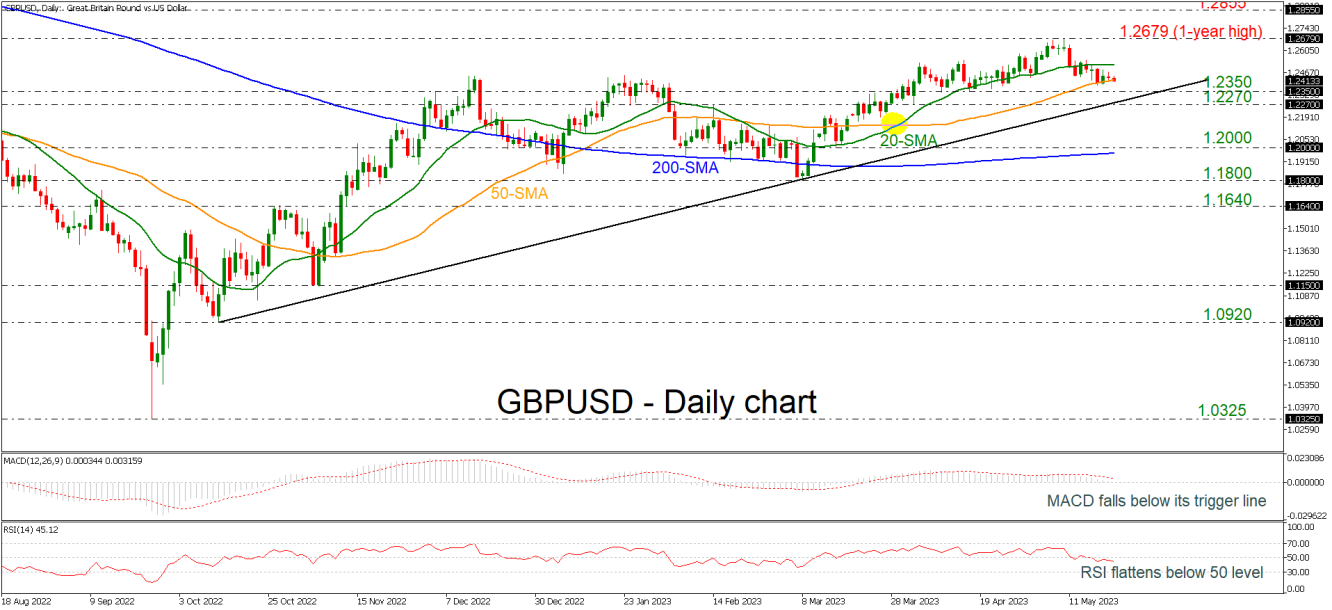

Any bullish actions above the 20-day SMA could open the way for the next key levels such as the one-year peak of 1.2679, registered on May 10, before resting near the 1.2855 barrier, which is overlapping with the 200-weekly SMA.

In the negative scenario, a successful decline beneath the 50-day SMA could reach the 1.2350 support and even lower the 1.2270 barrier, which is also near the long-term ascending trend line. If the bears drive the market below the aforementioned line, they would test the 1.2000 psychological mark and the 200-day SMA around 1.1970.

All in all, GBPUSD is still positive in the long-term view, but in the short-term the view is currently neutral after the drop within the SMAs.