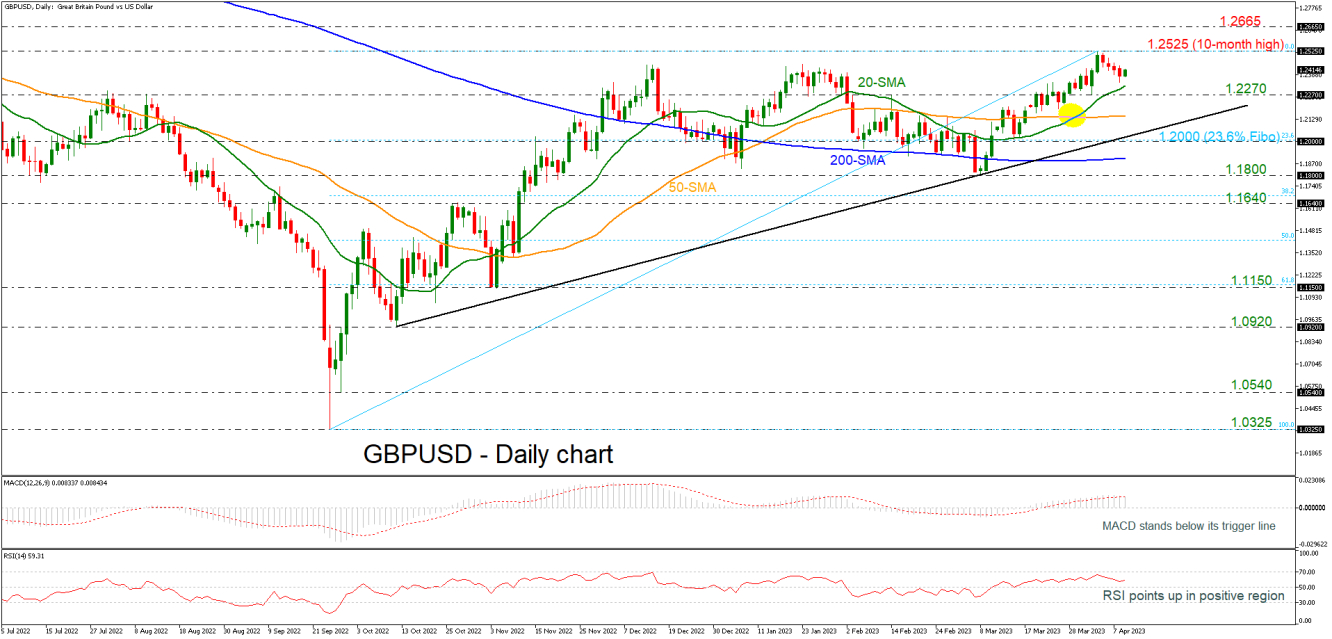

The momentum indicators are showing some contradictory signs as the MACD is still standing beneath its trigger line in the positive area, while the RSI is pointing slightly up above the neutral threshold of 50. The 20- and the 50-day simple moving averages (SMAs) posted a bullish crossover, and the price is still well above the long-term ascending trend line.

However, further losses should see the 20-day SMA at 1.2320 ahead of the 1.2270 support level and the 50-day SMA at 1.2145 which is acting as a major support level. A drop below the uptrend line would hit the 23.6% Fibonacci retracement level of the upward wave from 1.0325 to 1.2525 at 1.2000 and open the way towards the 200-day SMA at 1.1905.

In the event of an upside reversal, the ten-month peak of 1.2525 could act as a barrier before being able to re-challenge the 1.2665 resistance, registered in May 2022. Further gains would lead the way towards the 1.2850 barrier, which coincides with the 200-weekly SMA and the low in November 2020.

Briefly, in the long term, the outlook remains positive since prices hold above all the moving average lines and the bullish cross between the 20- and the 50-day SMA stays in place.