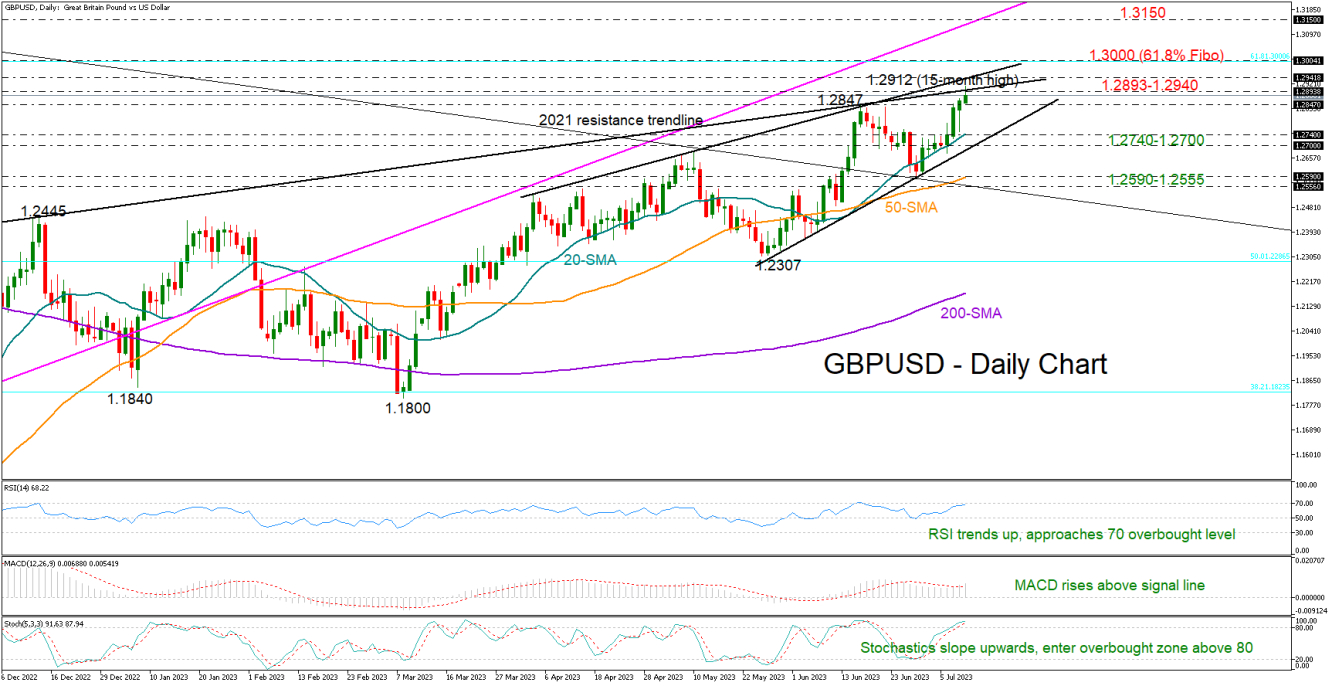

GBPUSD opened the week with mild gains, expanding its NFP rally above June’s peak and to a fresh 15-month high of 1.2912 early on Tuesday.

There is room for further development, as the technical indicators maintain a clear positive trajectory. Yet, with the RSI and the stochastic oscillator prodding their overbought levels, the bullish wave could soon take a breather.

The pair is currently testing the tentative ascending line from last December at 1.2893, while the resistance trendline from April is marginally higher at 1.2940. Notably, the 50- and 200-period simple moving averages (SMAs) in the weekly and monthly timeframes are limiting bullish activity within the same boundaries. Hence, if the bulls knock down this wall, the 61.8% Fibonacci retracement of the 2021-2022 downtrend could immediately attempt to halt the uptrend around 1.3000. If not, the uptrend could continue towards the long-term constraining zone of 1.3150, last seen in April 2022. The 1.3270-1.3300 zone could be the next target.

In the event the price falls below 1.2847, it could initially seek support near 1.2700. If selling forces dominate there, the pair could sink towards the 1.2590-1.2550 region, where the 50-day SMA and the broken 2021 descending trendline are positioned. Note that the price rotated northwards within the same neighborhood in June.

All in all, GBPUSD has upgraded its short and long-term outlook, raising hopes for a bullish continuation higher. Still, some profit taking is possible as the pair is currently hovering near key resistance lines.