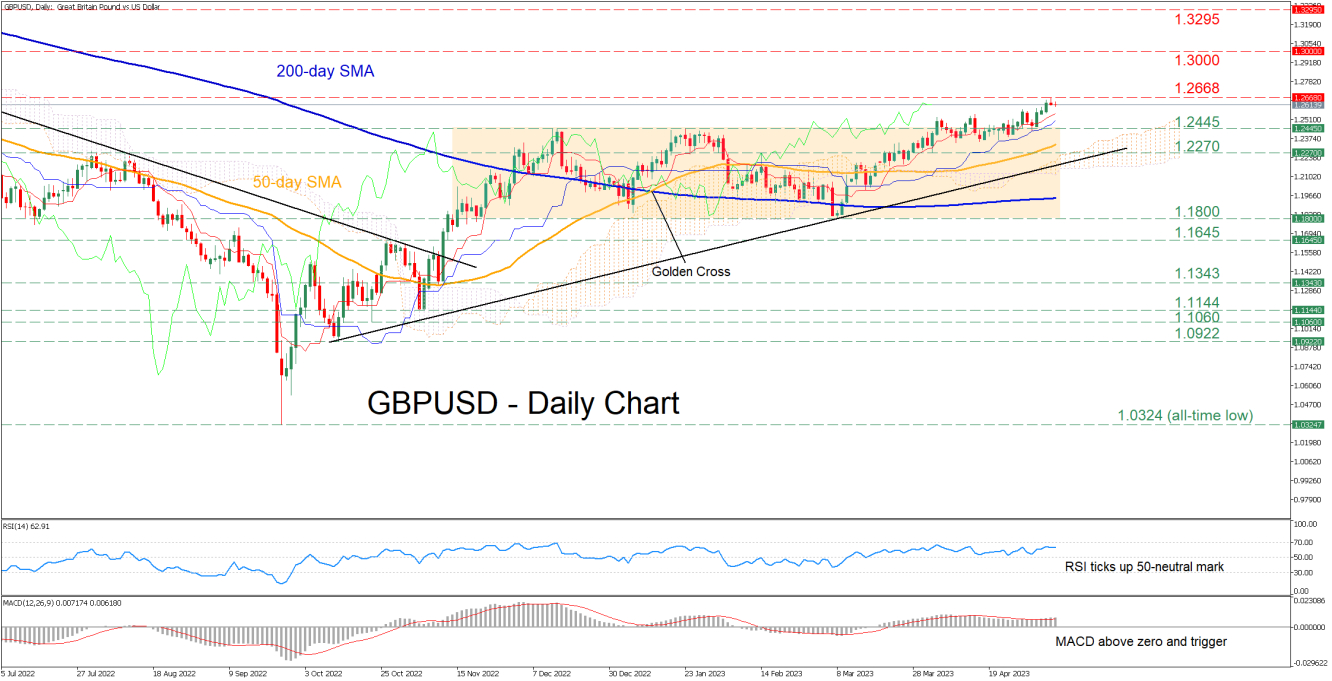

GBPUSD has been in a steady uptrend and recently managed to escape its rectangle pattern, which was in place since November 2022. In the previous daily session, the pair generated a fresh 11-month high of 1.2668 before paring some gains.

The momentum indicators currently suggest that near-term risks are tilted to the upside. Specifically, the RSI has flatlined above its 50-neutral mark, while the MACD histogram is strengthening above both zero and its red signal line.

If bullish pressures intensify, the price could attempt to post a fresh higher high, surpassing the 1.2668 region. Violating that zone, the pair could ascend towards levels not seen in the past year, where the 1.3000 psychological mark could prove to be a tough obstacle for the bulls to overcome. Further advances might then come to a halt at the March 2022 peak of 1.3295.

Alternatively, should the pair experience a pullback, the previous resistance of 1.2445 could serve as initial support. If that floor collapses, the spotlight could turn to 1.2270 before the March low of 1.1800 appears on the radar. Even lower, the 1.1645 hurdle might provide downside protection.

In brief, GBPUSD has been edging higher in the short-term, creating a structure of higher highs and higher lows. However, traders should not rule out a temporary downside correction before the uptrend extends higher.