The GBP/USD is in focus ahead of this week’s key events: FOMC and BoE rate decisions. We also have UK CPI and retail sales, as well as global PMI figures to look forward to this week. The BoE could deliver a final 25 bps hike, while the FOMC is seen holding policy unchanged. I think the cable could be heading towards the low 1.20s.

Key Macro Highlights for the Cable This Week

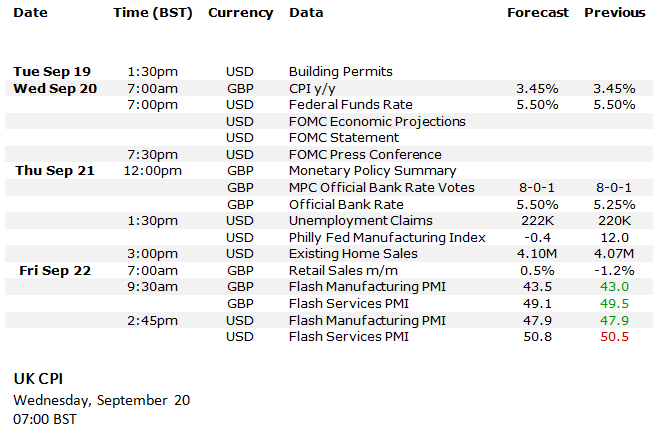

Before discussing the FOMC and BoE, i.e., this week’s key macro events for GBP/USD, let’s have a quick look at the economic calendar relevant to the cable in order to be aware of the other important data releases that could influence the GBP/USD outlook:

UK economic pointers have deteriorated in recent months, owing to high inflation, and rising borrowing costs. But wages have continued to rise sharply, as workers demand higher pay. Inflation now needs to come down fast to arrest this price-wage spiral before it gets out of control. Last month, CPI did fall sharply from the 7.9% y/y recorded in June, albeit to a still-very-high 6.8% in July. CPI is expected to continue dropping rapidly in the next few months due to base effects. For August, however, it is seen rising back to 7.1% y/y from 6.8% in July. Core CPI is expected to print 6.8% compared to 6.9% the month before, while RPI is seen rising to 9.3% from 9.0% previously.

FOMC Policy Decision

Wednesday, September 20

19:00 BST

Strong US inflation numbers and surprising strength in some other key parts of the world’s largest economy have given rise to speculation that the Fed’s tightening cycle may not be over just yet. While no policy changes are expected at this FOMC meeting, traders will be looking for clues with regard to the next meeting. If there’s a strong inclination towards a final hike before the year is out, then this should support the dollar on any short-term dips.

So, keep a close eye on the policy statement and the latest dot plots, and hear what Powell says at the FOMC press conference. The Fed may indicate that one more hike is likely before the year is out – thanks to a slower disinflation process that has undoubtedly been boosted by a stronger US consumer and higher inflation expectations. The FOMC may upwardly revise the 2024 median plot to point to fewer rate cuts than the 100 bps it had projected previously. If so, this would further discourage bearish bets on the dollar, keeping the pressure on the GBP/USD.

There are not any important US data pointers to impact the Fed’s thinking until its policy meeting this week. Michigan confidence data on Friday revealed that consumer sentiment was little changed in September, but expectations for the economy and inflation did improve, with inflation expectations for one year ahead falling to 3.1%. On Thursday, we saw August retail sales come in better than expected (+0.6% month-on-month), albeit it was boosted largely by fuel sales. PPI was also higher than anticipated and jobless claims fell slightly following last week’s big drop, adding to optimism that a hard landing will be avoided.

BOE Policy Decision

Thursday, September 21

12:00 BST

The recent weakness in the pound is a reflection of investors scaling back their hawkish BoE bets, thanks to weaker-than-expected UK data. Last week it was GDP which disappointed, raising recession alarm bells. But wage growth remains strong, which points to a pick-up in consumption. Is this something that will worry the MPC about the risks of the price-wage spiral getting out of hand?

The BoE will have seen the latest CPI data that will be released the day before their rate decision. Given that economists expect an uptick in CPI from the month before, this is unlikely to discourage the MPC from voting for, what many expect, another 25-basis point rate increase to take the Bank Rate to 5.50%.

But will that be the peak in interest rates? Analysts at Goldman Sachs certainly think so. They now expect the BoE to go on pause in November, dropping their previous view that the central bank would hike again. This is because they “see a greater chance that sequential wage and price pressures will have cooled sufficiently to allow the MPC to go on hold, given their preference for a flatter peak."

Goldman is not alone in massively scaling back expectations for any future tightening. Investors also seem to have made up their minds. Weaker data from the UK has seen investors re-price their Bank of England rate hike expectations lower. Around 75 bps worth of hikes was priced in about a month ago. Now, the markets are expecting around 35 bps until the peak. This means that the is a good chance the BoE could deliver a final 25bp hike on Thursday, like the ECB signalled last week.

Let’s see whether the BoE’s rate-setters will agree to that view by dropping that key phrase from their rate statement that previously read: 'If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required.'

If the BoE makes it clear that this is the peak like the ECB did last week by suggesting, for example, that rates are “sufficiently restrictive,” then this should hurt the pound. It is certainly what I am expecting anyway, and for that reason reckon that the GBP/USD could be heading to low 1.20s from here.

GBP/USD Could Be Heading to Low 1.20s

Mirroring the price action on the EUR/USD, the GBP/USD also broke down on Thursday, before falling further on Friday. At the start of this week, it was staging a small bounce amid profit-taking ahead of this week’s key macro events. But the technical damage is already done, with rates closing below the 200-day average on both Thursday and Friday. So, watch out for renewed weakness in the cable as it tests key resistance here around 1.2400 (give or take a few pips), which was previously supported. Like the EUR/USD, the GBP/USD could take out its corresponding low made in May at 1.2308 next, below which there are not many obvious reference points apart from the round figures like 1.22, 1.21, and possibly even 1.20 next. Given the growing bearish momentum, the bulls must wait for a key reversal pattern to emerge before potentially looking for bullish trade ideas.

Source: TradingView.com