- The US dollar is stabilizing after Friday’s big NFP-driven drop, but a Fed rate hike later this month remains the odds-on likelihood ahead of CPI tomorrow.

- GBP/USD dropped a quick 100 pips at the open after testing 1.2850 on Friday, but the evidence so far points to a continued upside.

- A confirmed break above 1.2850 could quickly expose the 1.2900 handles and previous-support-turned-resistance from March and April of last year near 1.3000.

It was a quiet start to a new week in today’s Asian and European sessions, with the US dollar broadly stabilizing after Friday’s big drop.

The ostensible culprit driving the move was, of course, the US nonfarm payrolls report, which despite its net positive reading, showed the first signs of cracks in the US labor market. Though the headline reading came in just a tick below estimates, the previous two employment reports were revised down by more than 100K net new jobs. For now, the Fed is still highly likely to raise interest rates at its meeting later this month, but the market is growing more skeptical that Jerome Powell and Company will be able to deliver the second, second-half rate hike they had previously planned on.

Speaking of interest rate expectations, tomorrow’s US CPI report will be a key release, even if it’s unlikely to move the needle on this month’s Fed decision. With last June’s 1.2% m/m surge in consumer prices “rolling off,” the annual rate of inflation is expected to drop from 4.0% to 3.1%, with the so-called “Core” (ex-food and -energy) reading anticipated to come in at 5.0%. Even a slightly below-expectation reading would be unlikely to deter the Fed from an interest rate increase later this month, but it would throw more doubt on anything after that, with potential downside risks for the US dollar.

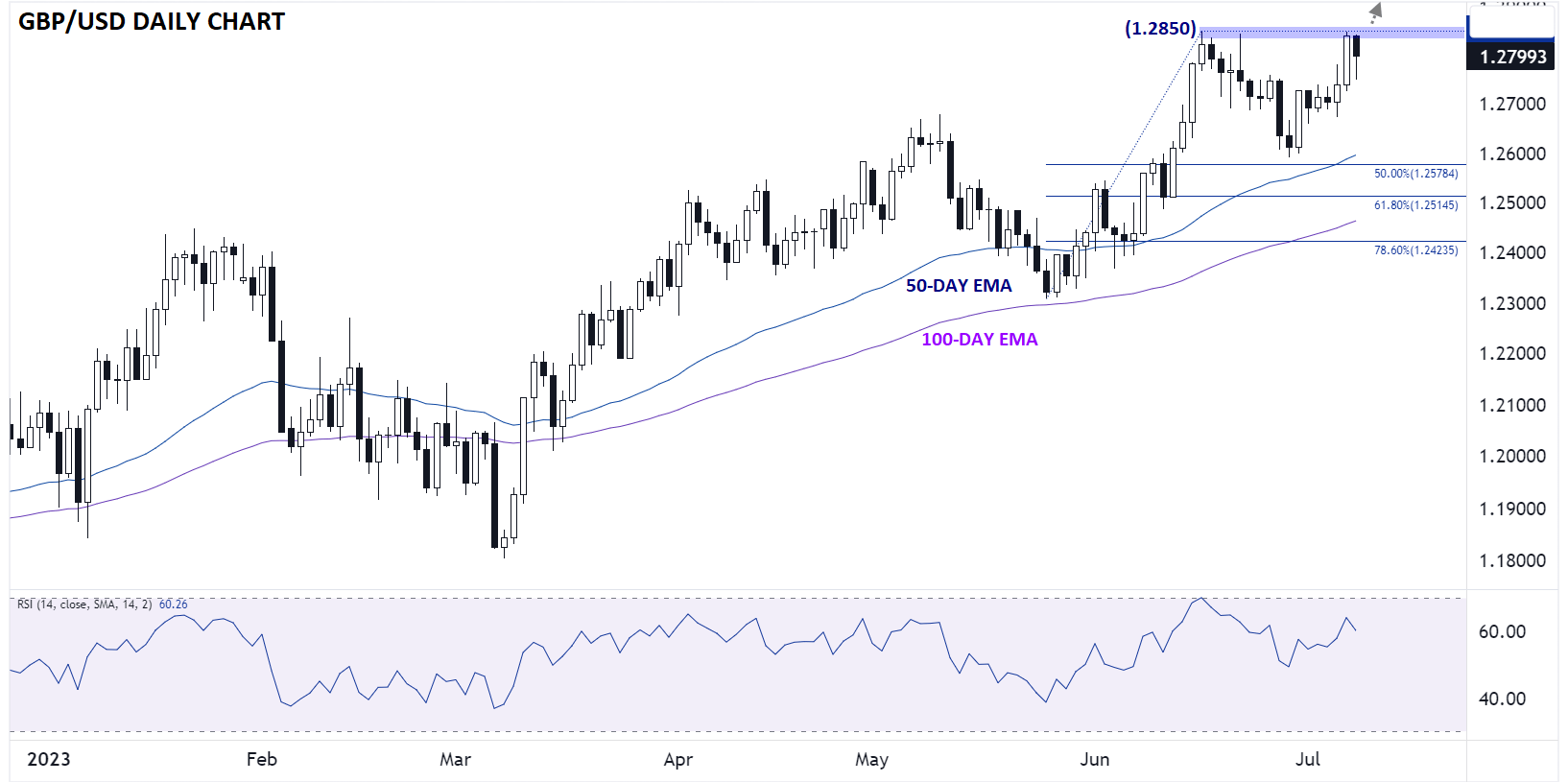

British Pound Technical Analysis – GBP/USD Daily chart

Keying in on GBP/USD, the pair rocketed up to set an incremental (1.1-pip) new year-to-date high based on our prices on Friday before pulling back in today’s Asian session. Many traders, especially newer ones, are constantly trying to pick tops and bottoms and may therefore be tempted to characterize this as a potential “double top” reversal pattern, but speaking from experience, this type of setup is more likely to see a short-term dip before resuming the longer-term, established uptrend.

As we go to press, the pair has recovered the majority of its intraday dip to trade back within 50 pips of key resistance at 1.2850. So far, today’s price action is showing an “inside candle,” suggesting consolidation after Friday’s big rally, so as long as the intraday low near 1.2750 holds, the bias will remain to topside. A confirmed break above 1.2850 could quickly expose the 1.2900 handle and previous-support-turned-resistance from March and April of last year near 1.3000.

Meanwhile, a break of the intraday low at 1.2750 would point to a deeper pullback toward 1.2700 or 1.2650 before the pair finds additional support.