At a time when correlations break down to the point of no return, the Gold-JPY correlation remains generally intact. Far from perfect, but sufficiently positive to the extent that if you had bought USD/JPY as well as XAU/USD, you'd have fared well—assuming you're able to sustain intraday (and intraweek drawdowns). I explain below the relationship between gold and the yen, as well as evidence of tradable actions in gold/yen.

The general fundamental reason to the positive relationship between JPY and gold is their relative vulnerability to rising bond yields. I emphasize “general”, because we saw earlier in the year how gold rose alongside rising real yields and declining yen. One reason to the breakdown in real yields-gold relationship is the breakouts in short-term breakevens covered in more detail here.

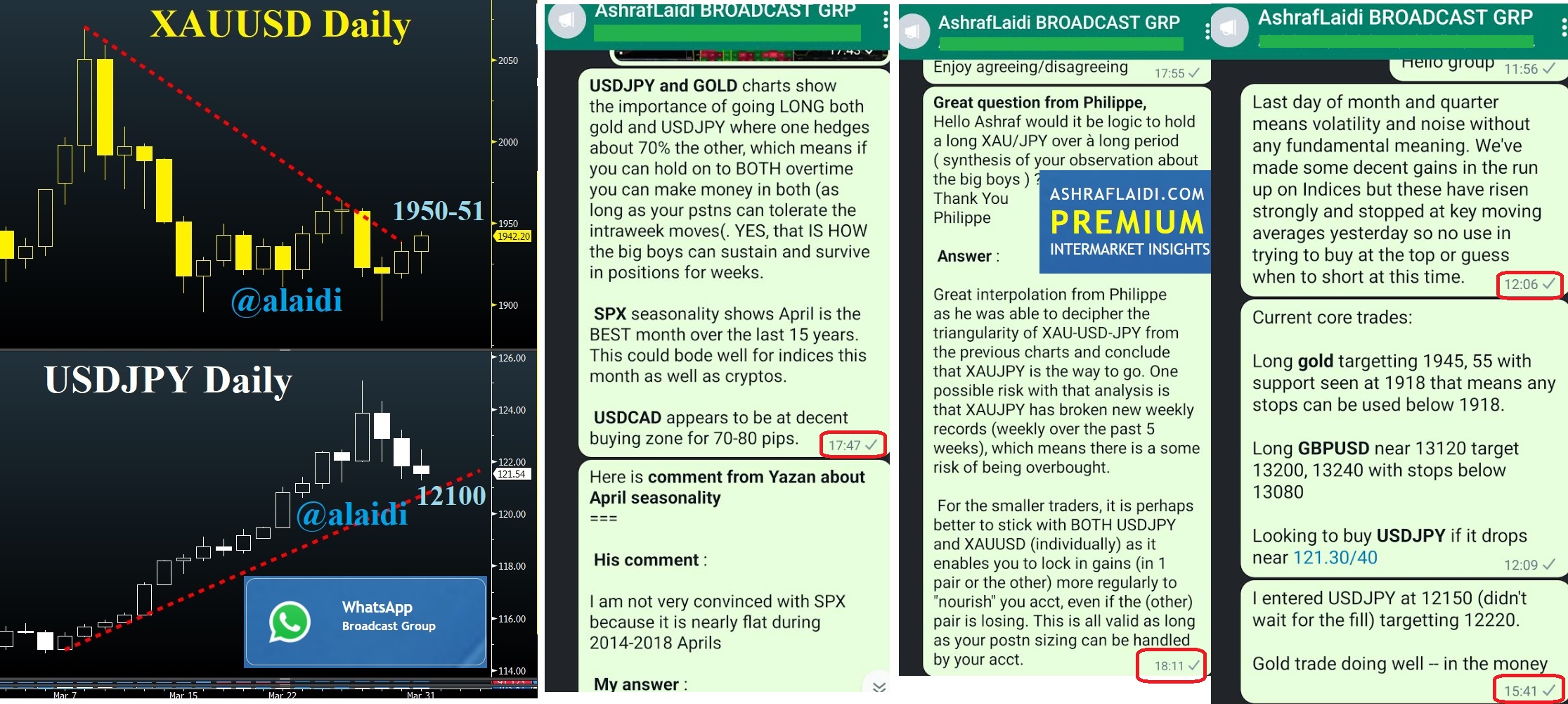

The above messages illustrate today's trades (far right box), followed by the explanation of the relationship (far left box) and a response to Group member in (center box). Hope you learn as well as you profit from it.