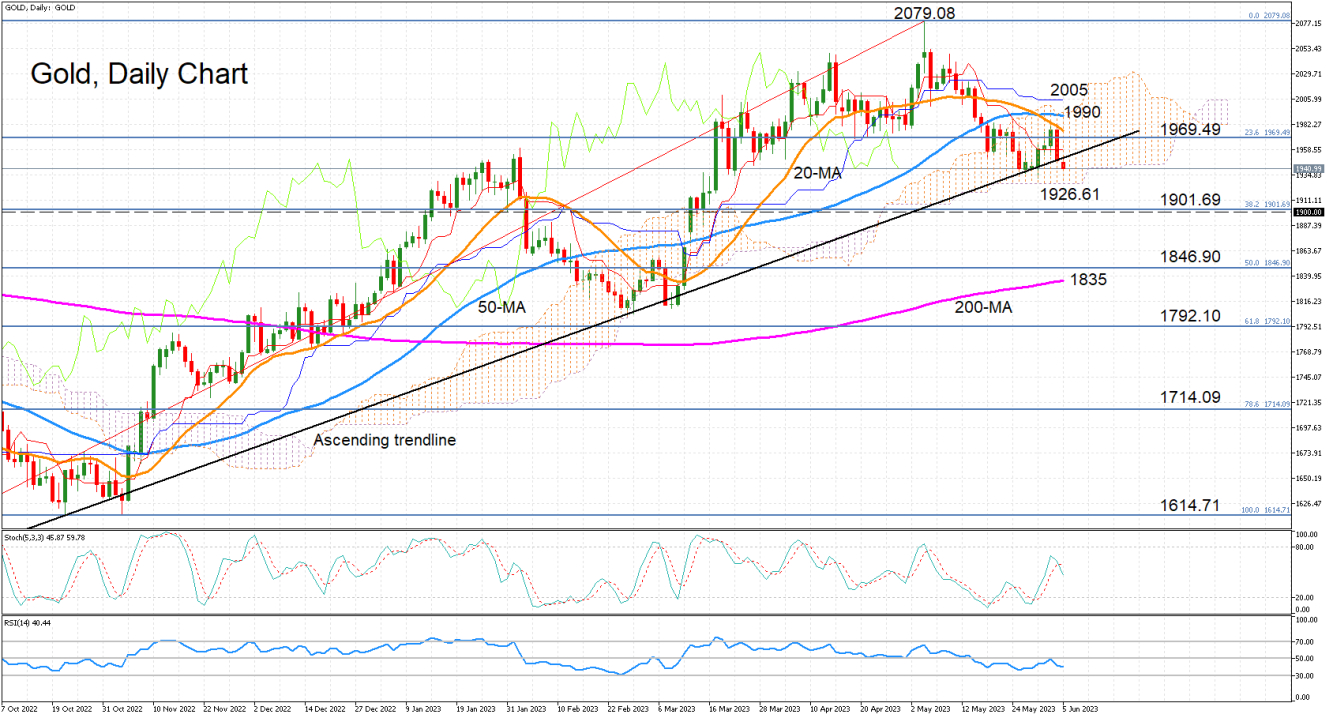

. The %K and D% lines of the stochastic oscillator have posted a bearish crossover, while the RSI is heading lower after failing to climb above the 50 neutral threshold.

Immediate support is likely to come at the cloud bottom just above 1,926, while the crucial 1,900 barrier is not that far below and is being reinforced by the 38.2% Fibonacci retracement of the September 2022-May 2023 uptrend. If the selling pressure deepens and gold plummets below 1,900, the bears are likely to set their sights on the 200-day simple moving average (SMA) around 1,835. Although, they would first have to get through the 50% Fibonacci of 1,846.90.

In the event that the precious metal is able to claw back above the trendline, there are several obstacle ahead. The 20-day SMA is inclining downwards and about to intersect the 23.6% Fibonacci of 1969.49, the 50-day SMA is blocking the exit from the cloud at 1,990 and the Kijun-sen line is waiting at 2,005.

Even if gold is able to clear those hurdles, it is some distance away from the May peak of 2,079.08, which it needs to surpass to put its uptrend back on track. Otherwise, there’s a risk that the slide will eventually hit the 200-day SMA, which breaching it would endanger the longer-term bullish picture.