(Bloomberg) -- The dollar holds the crown as the world’s dominant currency and rivals have so far failed to unseat the greenback — making fresh rallies likely.

That’s the thinking of Goldman Sachs (NYSE:GS) analyst Isabella Rosenberg who says signs of global growth have made European and Chinese assets more attractive in recent months, but she sees little evidence foreign investors are rushing in to support either currency.

“The dollar has peaked on our forecasts, but downside looks constrained by limited appetite for euro and yuan assets so far,” Rosenberg wrote. “The lack of a clear ‘challenger’ to the dollar’s dominance is one of the main reasons we expect phases of renewed dollar appreciation in the coming months.”

Aggressive rate hikes in the US and demand for safe haven assets drove a dollar surge last year. A gauge of the greenback’s strength touched an all-time high in late September, but an easing in interest-rate increases by the Federal Reserve has sucked the wind out of the rally. The bank’s analysts have since dialed back their forecasts for near-term gains in the dollar, according to Rosenberg.

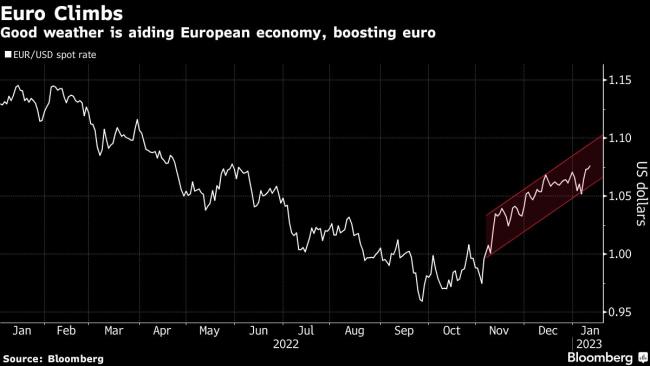

The Bloomberg Dollar Spot Index, which measures the currency against a basket of major peers, has lost more than 8% from its peak and continued to lose strength in early 2023 while the euro and offshore yuan have advanced.

The euro climbed for the fourth day straight on Wednesday while the yuan approached August highs.

Still, foreign inflows remain subdued. Natural gas supply constraints in Europe and “relatively unattractive” returns for fixed income in China might be to blame, Rosenberg said.

“Unless the global growth backdrop continues to improve more materially, we expect dollar downside to remain constrained,” Rosenberg wrote.

©2023 Bloomberg L.P.