The answer may not come until later in the week.

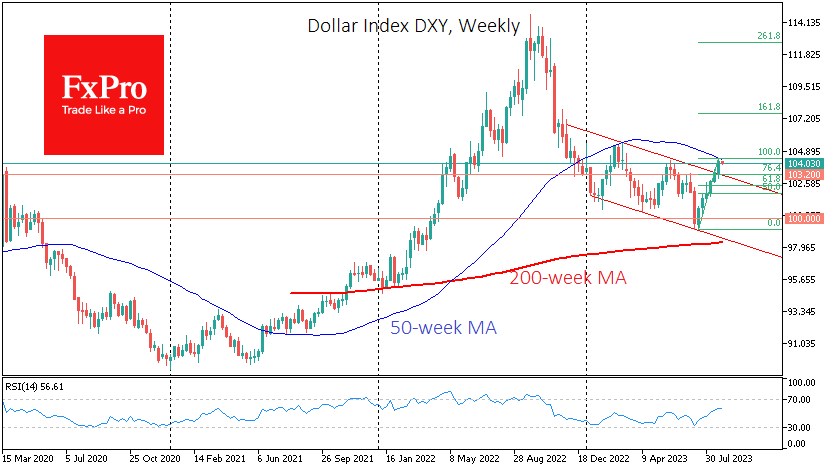

The dollar index finished with growth for the sixth week in a row, climbing on Friday to its highest since March and trading above 104.

The dollar formally broke a multi-month downtrend by climbing above the May highs. The trend breakdown is also indicated by the fact that the DXY last week rebounded solidly from the 200-day moving average and the previous resistance line of the descending channel.

Also, the 50-day moving average reversed to the upside last week, providing further evidence of a bullish trend reversal.

At the same time, the multi-week dollar rally created certain risks of a short-term correction, as the RSI index entered the overbought area, exceeding 70 on daily intervals. During the dollar's rally in the first nine months of last year, the dollar was running out of steam after entering overbought territory, but it could take anywhere from a week to three weeks.

If the dollar correction starts, the index may roll back to 102.1-102.4 from current levels, clearing the way for a new growth impulse.

If one looks beyond the short-term moves, the latest rise cleared the way for the dollar to make more critical highs near 105.3 before the end of the quarter. The DXY can return to 107.5 in the longer term, last seen back in November.

Speeches at Jackson Hole last week failed to stoke the fire of volatility in the markets, and now a meaningful trigger won't come until Friday in the form of the monthly labour market report.

The FxPro Analyst Team