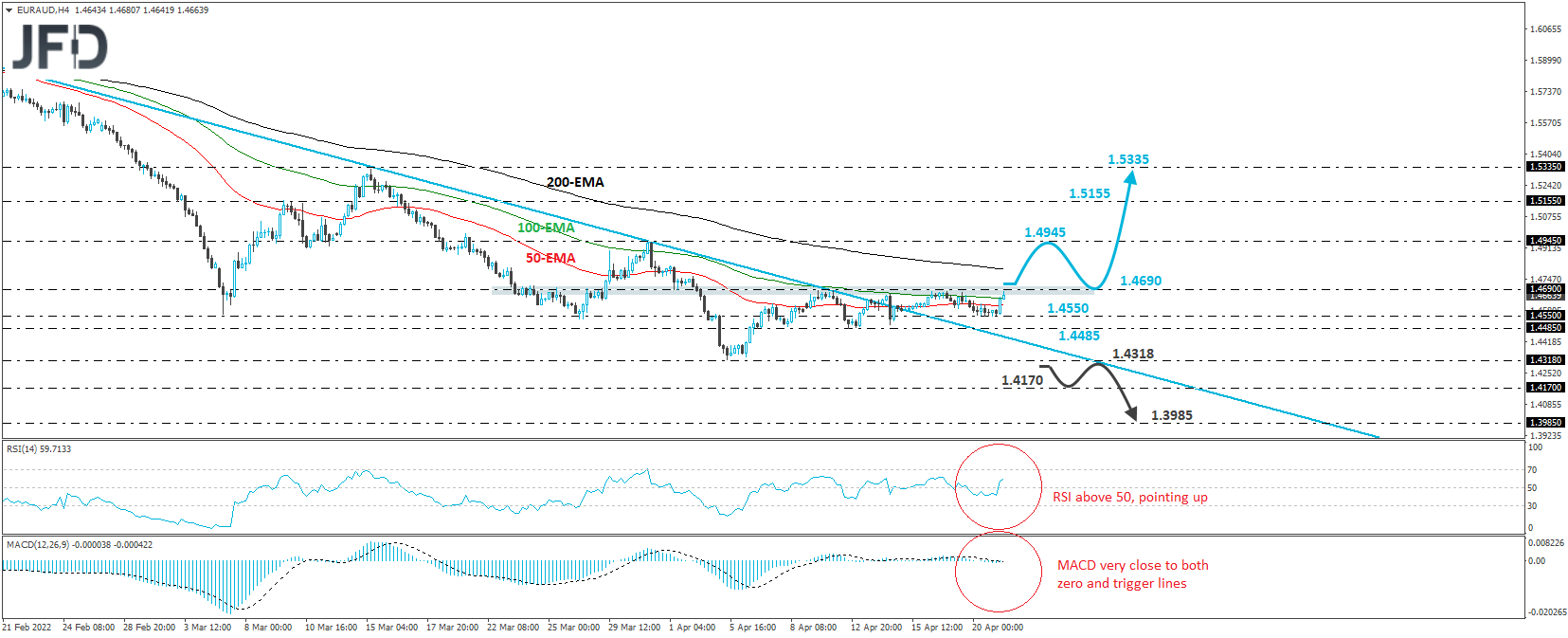

EUR/AUD traded slightly higher today, after it hit support at 1.4550 yesterday. On Apr. 15, the rate broke above the downside resistance line drawn from the high of Feb. 4, but it has yet to break above the key resistance zone of 1.4690. We prefer to wait for that break to happen before we start examining the case of a bullish trend reversal.

Such a move would confirm a forthcoming higher high on the 4-hour and daily charts and may initially pave the way towards the high of Mar. 31, at 1.4945. A break even higher could extend the advance towards the peaks of Mar. 9 and 10, at 1.5155, and if that barrier doesn’t hold either, then we may see the bulls climbing all the way up to the high of Mar. 15, at 1.5335.

Shifting attention to our short-term oscillators, we see that the RSI rebounded and moved above its 50 line, but the MACD remains very close to its zero and trigger lines. The RSI suggests that the rate has gained some positive speed, which could allow for a break above 1.4690 soon. However, the MACD still points to lack of directional speed, which adds to our choice of waiting for now.

In order to start examining whether the bears have gained the upper hand again, we would like to see a clear dip below 1.4318, marked by the low of Apr. 5. This could confirm the rate’s return back below the aforementioned downside line, and also a forthcoming lower low on the daily chart. The next stop may be the 1.4170 barrier, marked by the low of Apr. 21, 2017, the break of which could extend the fall towards the low of Apr. 16, 2017, at 1.3985.