The Japanese Yen has finally reached stability against the USD. Early in the first full week of April, USD/JPY is neutral – it is moving close to 122.65 and expecting a lot of news.

Demand for the yen as a “safe haven” asset has been rather low recently – the “greenback” is too strong.

The weak JPY rate might support Japanese exporters but the global geopolitical uncertainty doesn’t provide many opportunities for economic growth in general.

This week, there will be lots of numbers from Japan and the most interesting of them is the Household Spending for February. The indicator is expected to add 2.8% y/y after leaping up 6.9% y/y the month before. the report is considered a leading indicator, that’s why strong readings will be absolutely positive.

As a rule, Japanese households are believed to spend more when they see economic stability. This time, it might be interesting to assess how it is happening under unusually high inflation in Japan.

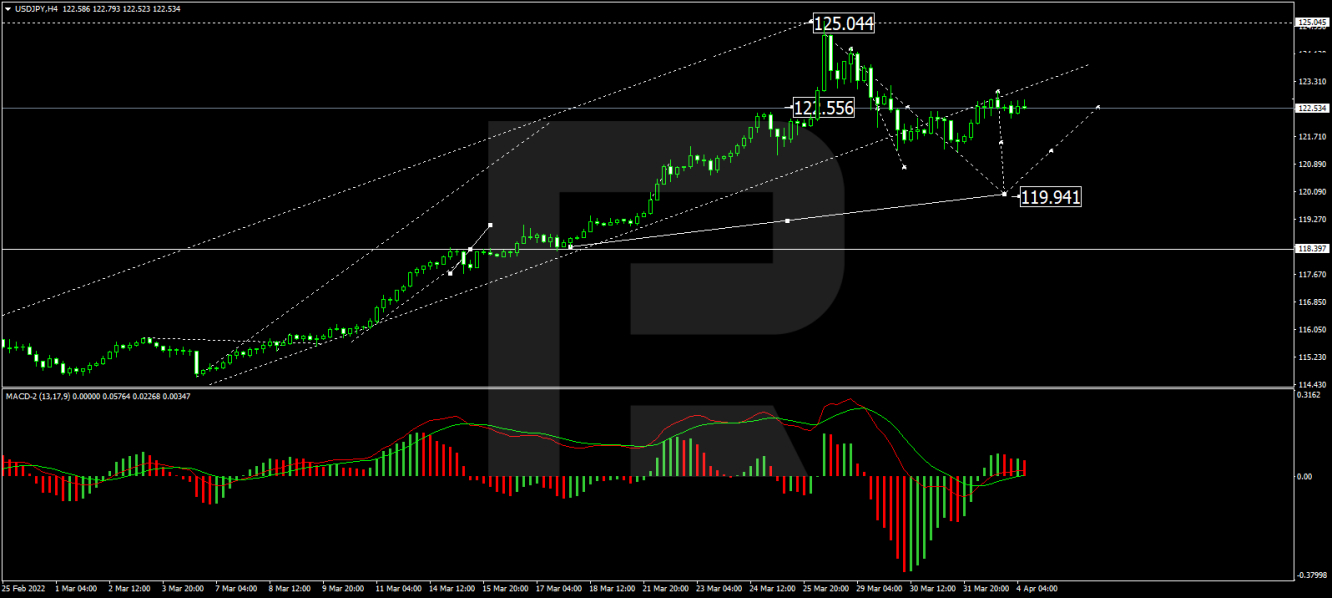

As we can see in the H4 chart, having finished the ascending wave at 125.05, USD/JPY is forming the first descending structure towards 119.94; right now, it is trading with the short-term target at 120.80. After that, the instrument may start another growth to reach 122.55 and then resume trading downwards to return to 119.94. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is growing to reach 0, a rebound from which may lead to another decline towards new lows.

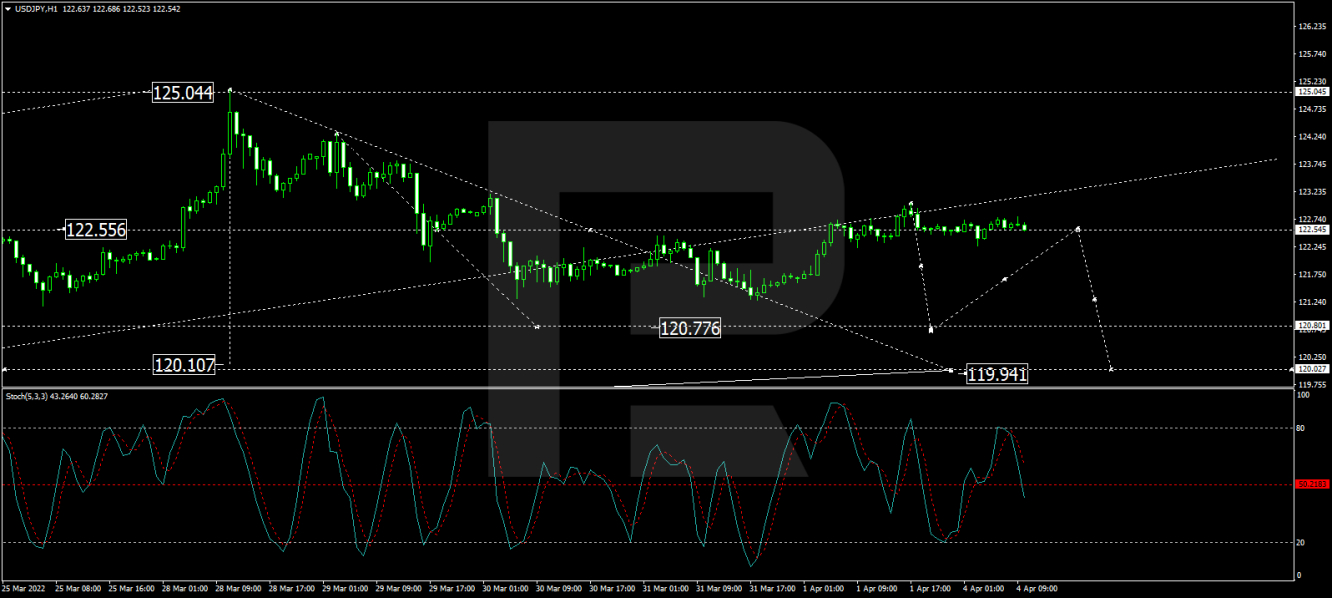

In the H1 chart, USD/JPY is forming the descending wave towards 120.80; it has already completed the correction at 122.55 and is currently consolidating around the latter level. Possibly, the pair may break the range to the downside and resume falling towards 121.65. If later the price breaks this level as well, the market may continue trading downwards with the short-term target at 120.80. From the technical point of view, this scenario is confirmed by the Stochastic Oscillator: after rebounding from 80 to the downside, its signal line is moving towards 50. Later, the line may break 50 and continue falling to reach new lows at 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.