The Japanese yen continues to drift this week. In the European session, USD/JPY was trading at 134.30, down 0.09% on the day.

All eyes on the Federal Reserve

The Federal Reserve holds its policy meeting later today. The central bank is widely expected to raise rates by 0.50% for a second straight meeting, but there are voices calling for a massive 0.75% hike, notably, the chief economist at Goldman Sachs.

It would be truly shocking if the Fed delivered a 0.75% increase, given the turbulent economic environment. The financial markets are very concerned (some are calling it “panicked”) about a recession in the US.

The recent US inflation report shows inflation continues to accelerate, raising doubts that an aggressive Fed can guide the economy to a soft landing and the inversion of US Treasury yields is adding to these concerns.

The US dollar enjoyed a spectacular day on Monday against most major currencies, and the dollar index surged above resistance at 105. US 10-year yields rose as high as 3.38% earlier in the day, and the upward movement continues to support the US dollar.

The Bank of Japan’s policy meeting tends to be a dull affair, but with the yen sliding lower, there is talk that the Bank could intervene aggressively on the yield curve at Friday’s meeting.

The BoJ has been quick to intervene to cap JGB yields at 0.25%, and with yields breaking above this line, the BoJ may decide to respond with a change in monetary policy.

The yen has lost 15% of its value this year and USD/JPY pushed above the 135 line on Monday. The BoJ and Ministry of Finance have been jawboning over the exchange rate, to little avail.

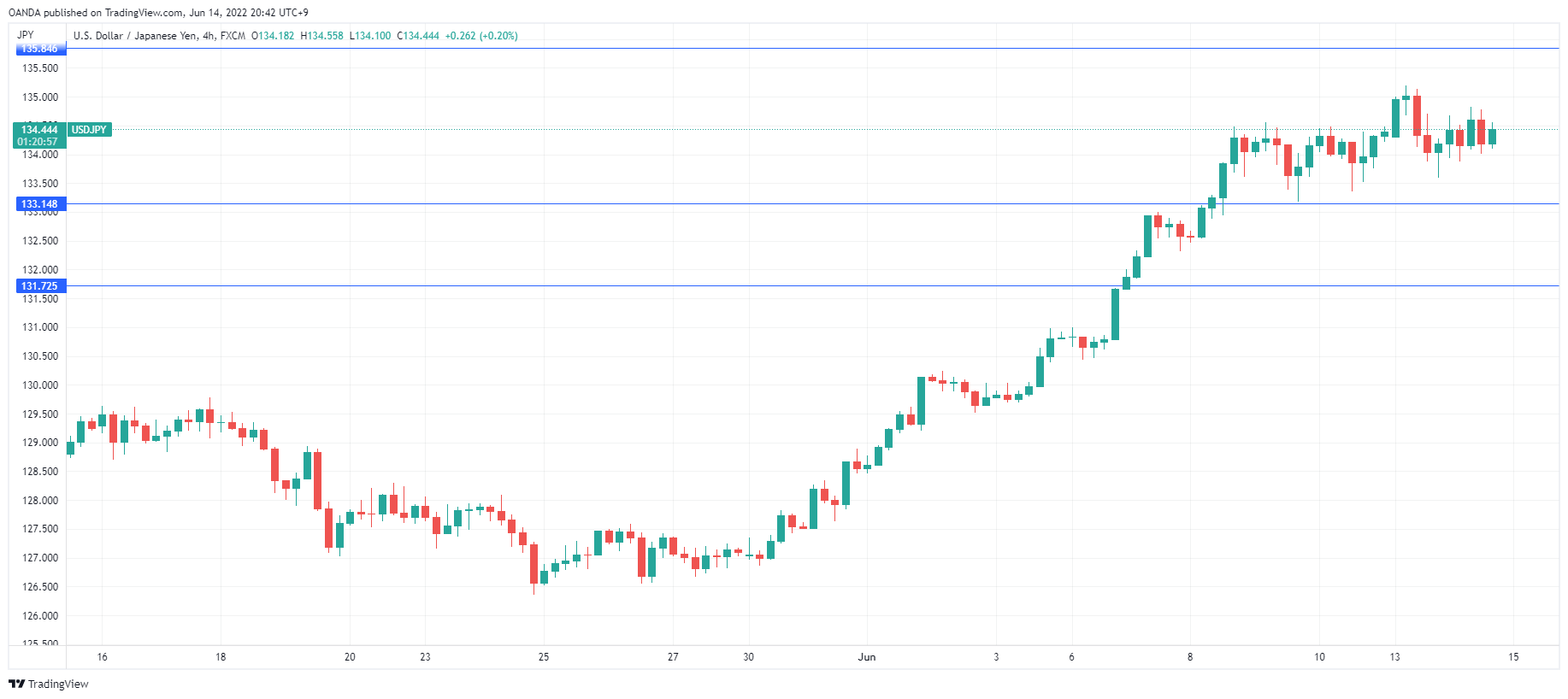

USD/JPY Technical

- USD/JPY is testing resistance at 133.68. Above, there is resistance at 1.3638

- There is support at 132.26 and 131.24