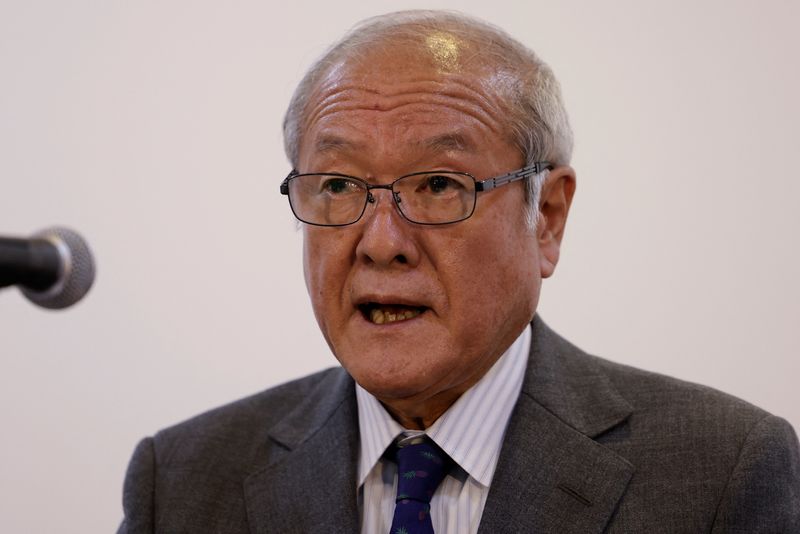

© Reuters. Japanese Finance Minister Shunichi Suzuki arrives for a news conference during the annual meeting of the International Monetary Fund and the World Bank in Marrakech, Morocco, October 13, 2023. REUTERS/Susana Vera/File Photo

© Reuters. Japanese Finance Minister Shunichi Suzuki arrives for a news conference during the annual meeting of the International Monetary Fund and the World Bank in Marrakech, Morocco, October 13, 2023. REUTERS/Susana Vera/File Photo

By Tetsushi Kajimoto and Kaori Kaneko

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki said on Tuesday that the government would take all possible steps necessary to respond to currency moves, repeating his usual mantra that excessive swings were undesirable.

Suzuki made the remarks when asked about impacts from the weak yen on households which have been pressured by rising living costs due to higher import prices for fuel and food.

The Japanese currency has fallen to near 152 yen versus the dollar, its lowest in more than a year, which helps boost profits at exporters and firms doing business abroad while burdening other companies and consumers with rising import bills.

"What's important is to maximise positive effects from the weak yen while mitigating negatives," Suzuki told reporters.

The government is already taking steps to ease the burden on households through a proposed economic package for this fiscal year ending in March 2024, Suzuki said, but made no mention of further measures including whether Japan would intervene in the currency market.

The yen has been under relentless selling pressure this year, weighed down by the Bank of Japan's pledge to maintain its ultra-easy monetary settings even as other developed economies have sought to keep rates higher for longer.

Many in the market are focusing on interest rate differentials, with the prolonged monetary tightening in the U.S. a factor in the recent forex moves, Bank of Japan's deputy governor Shinichi Uchida told lawmakers at the parliament.

Japan last intervened in the currency market - selling dollars and buying yen - in October last year. Intervention data released last month showed the authorities have steered clear of further such action since then.