Bold new sanctions on Russia and more weapons for Ukraine were announced over the weekend. Russia responded by raising the readiness of its nuclear forces. As a result, the risk-on seen ahead of the weekend has been reversed.

When then-US President Trump ordered the assassination of Iran's Major-General Soleimani in January 2020, it seemed to signal a year of geopolitics. Instead, it was about COVID. At the end of last year, Omicron threatened to keep the pandemic front and center. Instead, with Russia's invasion of Ukraine and the large-scale response, geopolitics has eclipsed the pandemic.

Asia Pacific equities edged higher except for Hong Kong and Singapore. Led by the financial and energy sectors, the Stoxx 600 was off by about 1.6%. US futures around 1.3% lower. Bonds caught a bid. The US 10-year yield was off four basis points to 1.92% and the 2-year was off six basis points to 1.50%. European core benchmark yields were 1-2 bp lower, while the peripheral yields in Spain and Italy were edging higher.

In the foreign exchange market, the dollar was firm, while the Swiss franc and Japanese yen were the most resilient among the major currencies. The Scandis were leading the losses, off 1.0%-1.6%. A small number of Asian currencies, including the Chinese yuan were steady to firmer against the dollar, while most were heavier. The Russian ruble (~-18.5%) and central European currencies (~-2%) were it hit the hardest. The JP Morgan Emerging Market Currency Index was off 2.2%, which would be the most since mid-March 2020.

Gold and oil rallied, as one would expect, but did not take out last week's highs. Gold stalled near $1930 (last week's high ~$1975) and fell to $1893.5 in the European morning before stabilizing to straddle the $1900-level. April WTI rallied to almost $100 but had steadied around $96.

US natgas prices were up around 2% to recoup the last pre-weekend loss. Europe's natgas benchmark surged but was coming off its highs. It held below last week's highs and was up almost 15% on the day. Iron ore rallied about 4%. Copper was about 0.8% higher. The price of May wheat was up about 5.5% after falling 8% before the weekend.

Asia Pacific

China was taking a more nuanced position vis-à-vis Russia than may meet the eye. Although it tends not to receive much attention in the US press, Chinese banks typically follow OFAC (US Office of Foreign Asset Control) rules and sanctions. They adhere to them for the same reason many others do: fear of being excluded from the dollar market.

Four of the largest Chinese banks complied with US sanctions against Iran, North Korea, and even top officials in Hong Kong. Reports suggested Chinese refiners have stopped taking fresh seaborne oil from Russia. Two large banks also have restricted funding for the purchases of Russian commodities.

Other international lenders are imposing restrictions on trade finance linked to Russia. One report told of a state-owned Chinese coal importer unable to get a credit line from banks in Singapore for shipments to Russia. China may dislike NATO, which did not appear to play the proclaimed defensive role in Afghanistan, but fears its banks would be sanctioned for transgressions.

Japan's economic data confirmed what the market already knew. The virus and social restrictions have made for a weak start to the New Year. Retail sales fell for the second consecutive month in January. The 1.9% decline was more than expected and followed December's 1.2% decline (initially reported as a 1.0% fall). Industrial output contracted by almost twice what the market expected. The 1.3% loss of output on the month followed a 1.0% decline in December.

The dollar initially fell to JPY114.90 and recovered to trade a couple of pips above the pre-weekend high (~JPY115.75). It settled into a narrow range of around JPY115.40, where a $1 bln option expires today, and about JPY115.60 range. On Russia's initial invasion, the dollar spiked to nearly JPY114.40.

The Australian dollar was confined to its pre-weekend range and was probing the $0.7200-area near midday in Europe. The Reserve Bank of Australia's meeting ends first thing tomorrow morning in Sydney. Last week's high, before the invasion, was around $0.7285. That may be a bridge too far today, but the session high may not be in place yet, and the pre-weekend high near $0.7235 could be approached.

The dollar fell to a new four-year low against the Chinese yuan by CNY6.3065. Last week's low was a little above CNY6.31. The reference rate was set at CNY6.3222, a bit above the median market projection (Bloomberg survey) of CNY. 63200.The PBOC fix was also the highest in four years. Exporters were reported dollar sellers, while a few state-owned banks were on the bid. The yuan strengthened further on a trade-weighted basis, aided by the ruble's drop. The ruble's weighting in the basket was about 3.65%.

Europe

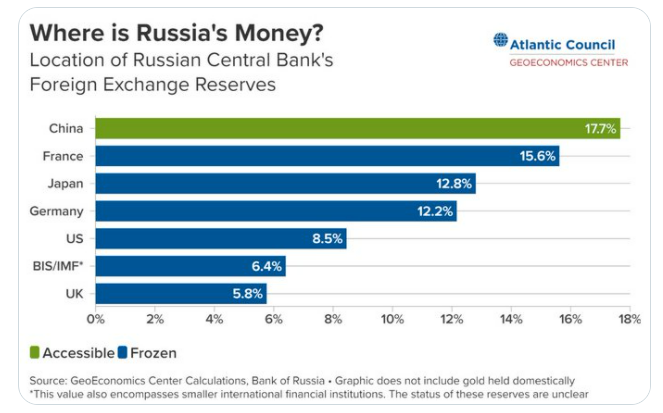

The combination of excluding most Russian banks from the SWIFT messaging system, sanctioning most of Russia's large banks, and targeting Russia's central bank (EU banned all transactions) will deal a crippling blow to Russia's economy. Sanctions were also aimed at the oligarch's offshore assets. Switzerland looked poised to freeze Russian assets. Even before the latest round of sanctions, S&P cut Russia's rating to BB+, below investment grade, and warned that further downgrades were possible (negative outlook).

Other decoupling measures were announced. British Petroleum said it will sell its 20% stake in Rosneft (OTC:OJSCY). Although the Chairman of the Board of Rosneft, former German Chancellor Schroeder, has not resigned, the BP (NYSE:BP) CEO resigned from the board.

Norway's sovereign wealth fund was considering divesting its Russian holdings, estimated to be worth around $3.3 bln at the end of last year. Yes, the chokehold has some loopholes, like Gazprom (MCX:GAZP)'s banking arm not being sanctioned. However, it was to facilitate gas shipments and payments still necessary for Europe. The US and Europe were still reluctant to target Russia's energy sector.

Russia's economic response was quick. The ruble slumped 8% at the open on the Moscow exchange and fell to the daily limit. The central bank was believed to have intervened. It hiked its key target rate to 20% from 9.5% and instituted capital controls. Businesses were forced to sell their foreign exchange holdings, and non-residents were banned from selling securities.

The military response was also dramatic. Most surprising was the German government's decision to reverse itself and send weapons and fuel to Ukraine. German Chancellor Scholz also committed 100 bln euros to modernize its military this year and, by 2024, spend at least 2% of GDP on defense.

US presidents had been haranguing Berlin for this for more than a decade. Many other countries committed to sending weapons, and the EU announced it would send fighter jets, a significant escalation. Sweden also eschewed its neutrality, sending weapons to Ukraine. A new "arsenal for democracy" has been born.

Turkey recognized over the weekend that Russia's invasion of Ukraine constituted a war, allowing it to block Russian warship transit through the Turkish straits and into the Black Sea. Meanwhile, US intelligence estimated that Russia had deployed about 2/3 of its forces. Putin put Russian nuclear forces on higher alert, which did not help risk appetites. He also fired his military Chief of Staff, Gerasimov, and some reports linked it to the nuclear decision.

The euro fell to almost $1.1120 in the initial sell-off as traders first reacted to the weekend developments. Last week's low was slightly above $1.1100. It recovered to about $1.12 before stalling. Around 1.5 bln euro options at $1.1250 expire today. While we suspected the euro may have a bit more room on the upside today, that may be too far away to be impactful. We note that Spain today followed France before the weekend in reporting higher than expected February CPI figures today (0.7% vs. Bloomberg median forecast of 0.4%).

The harmonized year-over-year pace rose to 7.5% from 6.2%. Germany reports its figures tomorrow ahead of the aggregate report on Wednesday.

Sterling fell to almost $1.3310 initially. Last week's low was slightly below $1.3275. It recovered to trade to almost $1.3390 in the European morning. The session high may not be in place yet. We saw a cap around $1.3425 today.

America

The US reports the January advanced goods trade balance, inventory data (wholesale and retail), and the Dallas Fed's manufacturing survey. Recall that in December, the US goods deficit hit a record of almost $100.5 bln. A small improvement was expected in January. Inventories accumulation accounted for around 70% of the rise in Q4 21 GDP.

We suggest the inventory cycle was maturing and will not be that tailwind going forward. Inventory growth may continue here in early 2022, but not nearly at the same pace. The highlight of the week is the national jobs report on Friday, where the median forecast was for a 400k increase after 467k in January.

The Federal Reserve's two-day meeting concludes on Mar. 16. The odds of a 50 bp move have fallen sharply, from more than 80% before the US warning that a Russian attack could take place at any time on Feb. 11 to less than a 17% chance now. At least five Fed officials speak this week, starting with Bostic later today.

Three events stand out. First, Chair Powell testifies before Congress on Wednesday and Thursday. Second, the Beige Book will be released on Wednesday. Third, also in the middle of the week, the Fed's Logan discusses the Fed's asset purchases. Logan is the Manager of the System Open Market Account (SOMA).

Canada reports the Q4 current account balance and industrial/raw material prices. These are not the stuff that typically moves the market. Tomorrow, it will report Q4 GDP, which may show a flat December. The highlight of the week is the Bank of Canada meeting on Wednesday. The swaps market downgraded the chances of a 50 bp to less than 60% from around 75% before the weekend. On balance, we expected a 25 bp move and forward guidance that suggested the balance sheet can begin shrinking in Q2.

Mexico reports the January unemployment rate, which likely rose for the first time in six months. Worker remittances were due tomorrow and may have slowed to around $4.2 bln from $4.76 bln in December. Last January, worker remittances were a little shy of $3.3 bln. They averaged $4.3 bln last year and almost $3.4 bln in 2020. In 2018-2019, they averaged $2.8-$3.0 bln a month.

The economic data highlights for Brazil this week include the February trade balance, which should jump back into surplus from the small deficit in January and Q4 21 GDP (small expansion expected).

The US dollar was within the pre-weekend range (~CAD1.2695-CAD1.2820) against the Canadian dollar. It initially pushed above CAD1.28 but came back off to CAD1.2740. More gains can be pared but support was seen in the CAD1.2720 area, which may be sufficient today. Options for about $625 mln at CAD1.28 expire today.

The greenback was more resilient against the Mexican peso. It found support near MXN20.4765 and took out the pre-weekend high (~MXN20.58) to see MXN20.6555. Last week's high was set closer to MXN20.7855. While the US dollar's gains may be pared more, support today may be seen ahead of MXN20.40.