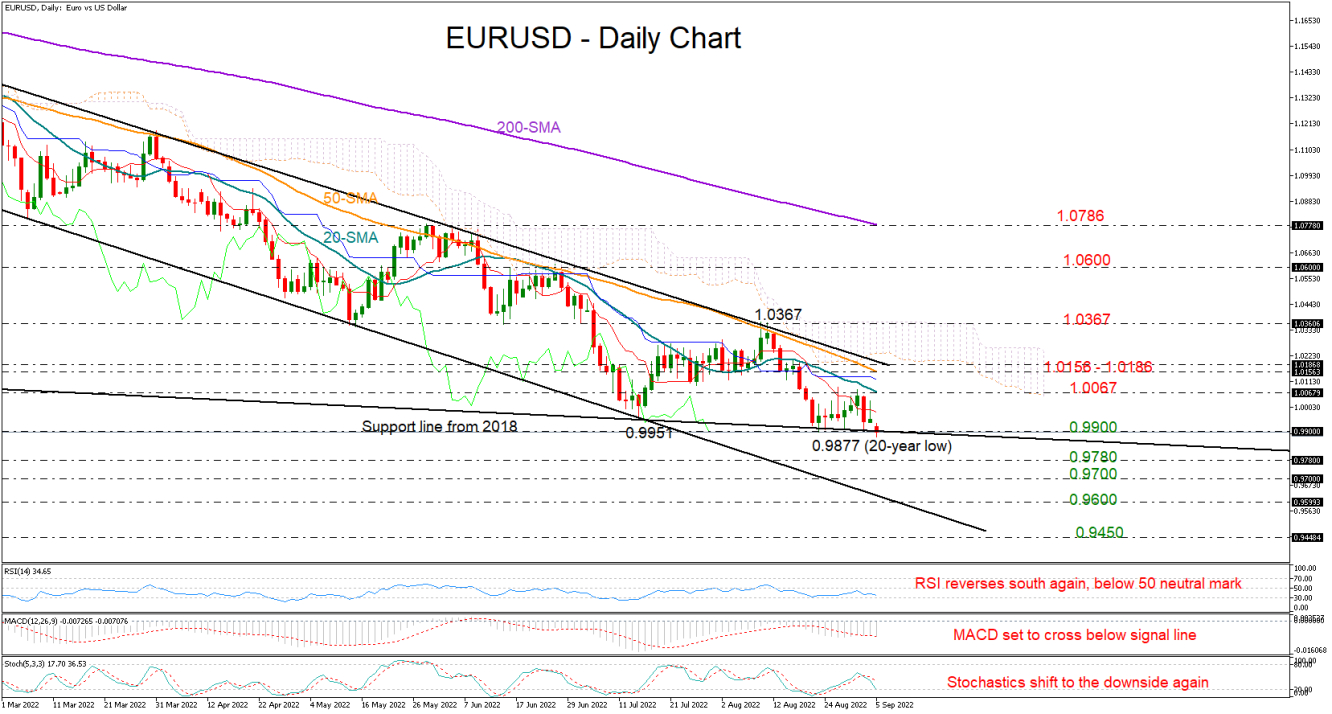

EURUSD opened with a gap lower on Monday to chart a new 20-year low at 0.9877.

The constraining descending line, which connects all the lows from August 2018, continued to buffer downside pressures ahead of Thursday’s ECB policy announcement, but despite that floor, the technical picture cannot detect any buying appetite. The RSI has erased its latest bounce and is heading south again. Likewise, the Stochastics have also pivoted to the wrong side, while the MACD is trying to resume its bearish wave below its red signal and zero lines.

As regards the market trend, there is no improvement here either, with the pair maintaining a series of lower lows and lower highs within the 2022 bearish channel. The negative slope in the simple moving averages (SMA) is backing the bearish direction too.

Should the bears claim the 0.9900 region, the pair could directly descend towards the 2002 limits registered within the 0.9780 – 0.9700 area. A sharper decline could shift all attention to the the channel’s lower boundary at 0.9600. Another disappointment here could see an extension towards the 0.9450 barrier last seen during 2000 – 2001, further worsening the bearish outlook.

In the event of an upside reversal, the 20-day SMA could once again ruin any recovery around 1.0067. Higher, the 50-day SMA and the channel’s upper band both seen within the narrow 1.0156 – 1.0186 territory may defend the negative direction in the market. If they prove fragile this time, the bullish correction could fasten towards the August peak of 1.0367, a break of which is needed to reverse the bearish trend.

Summarizing, the odds have once again shifted in bears’ favor and unless the 0.9900 base stands firm, the sell-off could exacerbate towards the 0.9780 – 0.9700 zone.