The New Zealand dollar is under pressure on Wednesday. In the European session, NZD/USD is trading at 0.6478, down 0.41%.

Markets eye New Zealand CPI

The New Zealand dollar reacted negatively to today’s CPI release, falling as much as 0.60% before paring these losses. Fourth-quarter CPI remained unchanged at 7.2%, a notch above the consensus of 7.1%. More importantly, the reading was below the Reserve Bank of New Zealand’s forecast of 7.5%, which could mean that the central bank will ease up on the pace of rate hikes.

The central bank has been aggressive, raising rates by some 325 basis points in 2022, bringing the cash rate to 4.25%. Similar to the Fed’s experience, the markets aren’t buying into the RBNZ’s hawkish message and are betting that rates will peak at 5.0%, lower than the RBNZ’s projection of 5.5%.

The central bank delivered a supersize 75-basis point hike in November, and before the inflation release, the market had priced in a 75 bp or 50 bp hike as a 50/50 toss-up. Following the CPI reading, that has changed to 70/30 in favor of a 50-bp move. Inflation has been falling globally, while domestically, consumer spending and confidence have fallen due to the rising cost of living. This has raised speculation that the RBNZ could wind up its current rate cycle earlier than anticipated.

The US releases GDP for the fourth quarter on Thursday, and we could see some volatility from the US dollar. GDP is expected to slow to 2.8%, down from 3.2% in Q3 but still a respectable pace of growth.

On Wednesday, US PMIs pointed to contraction in the manufacturing and services sectors, pointing to cracks in the US economy as high rates continue to take their toll. The US dollar remains under pressure as soft readings have raised hopes that the Fed will ease up on rate policy due to the slowing economy.

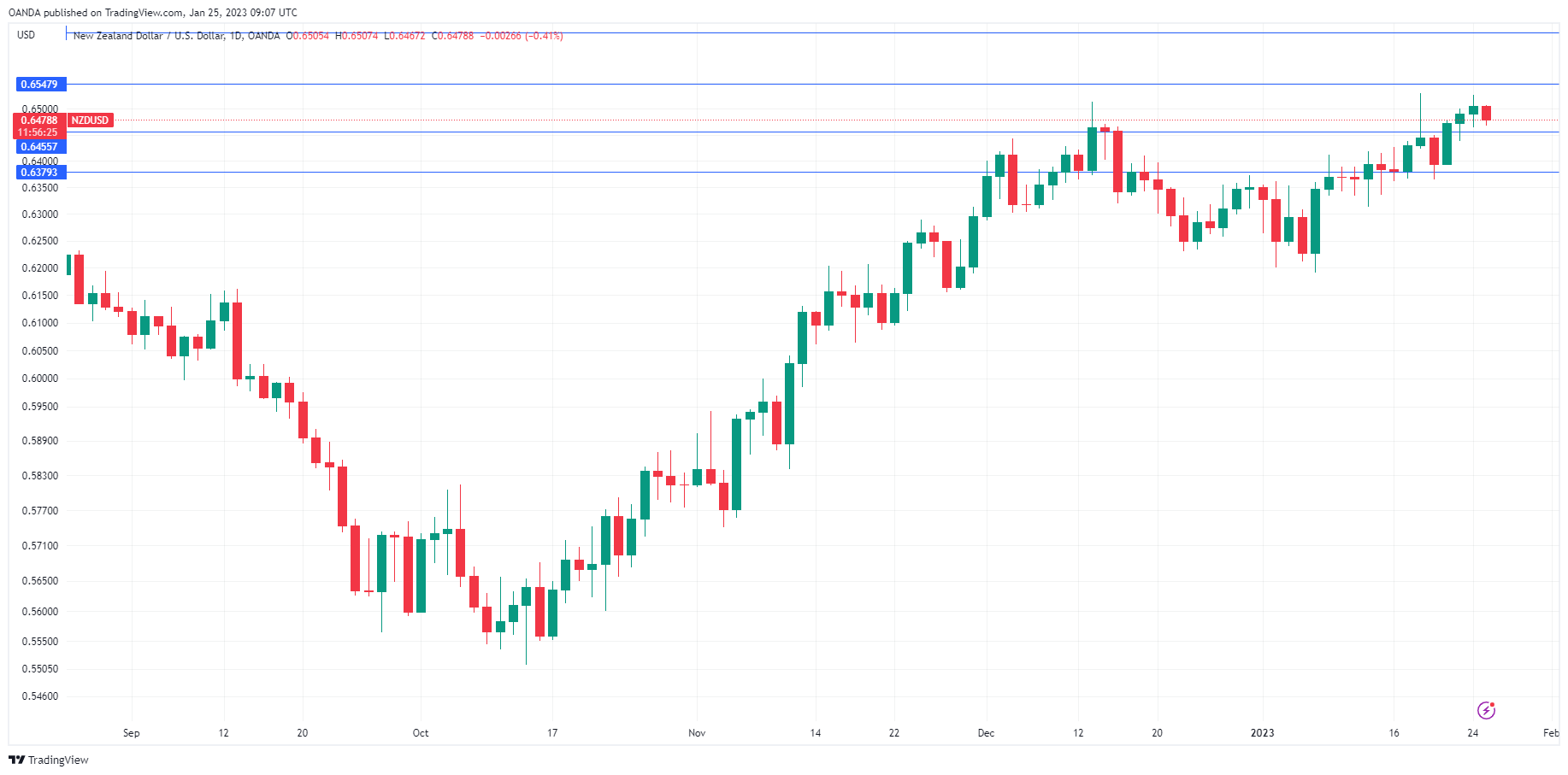

NZD/USD Technical

- 0.6455 is under pressure in support. The following support line is 0.6379

- There is resistance at 0.6547 and 0.6648