- Reserve Bank of Australia could raise rates on Tuesday

- Chinese trade and inflation stats also in the spotlight

- UK economy likely contracted in Q3 - can sterling hold on?

RBA decision will be a close call

With most of the major central bank decisions in the rear-view mirror and volatility in bond markets coming down, a quieter week lies ahead for FX traders. Most of the focus will fall on the Reserve Bank of Australia's rate decision on Tuesday, where markets assign a 60% probability for a rate increase.

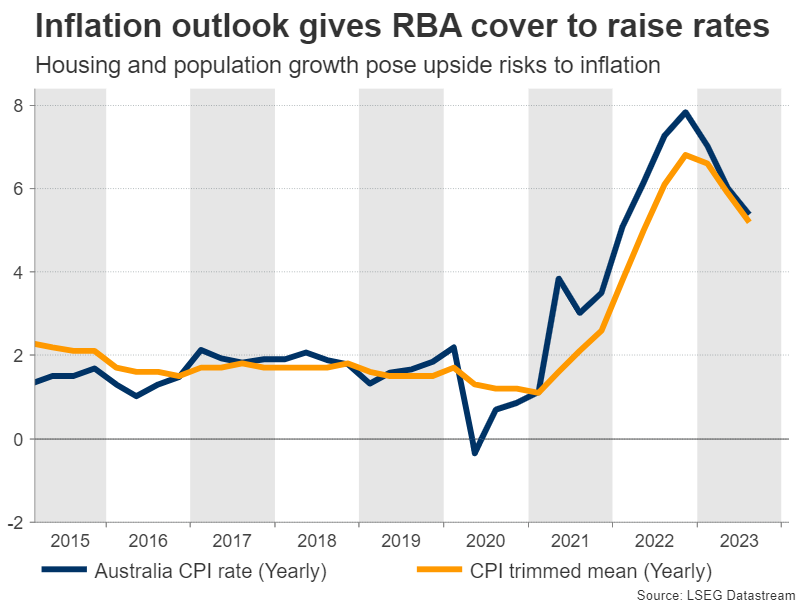

Recent developments in Australia certainly favor another rate increase. Last week, the RBA Governor stressed that her central bank will not hesitate to raise rates further “if there is a material upward revision to the outlook for inflation”. Directly after those comments, inflation data for the third quarter surprised on the upside.

Similarly, house prices continue to rise and almost touched a record high in October according to CoreLogic. That can also boost inflation, both by lifting rent prices and through the wealth effect, as higher home prices often translate into stronger household spending.

Even the IMF recently warned that the RBA needs to raise rates further to cool an economy that is running beyond full capacity, with a historically labor market and booming population growth reinforcing the risk that inflation might remain hot for some time.

Of course, not everything is rosy. For instance, the latest round of business surveys signaled that economic growth will probably slow heading into year-end, amid a decline in new orders. Likewise, the conflict in the Middle East raises uncertainty.

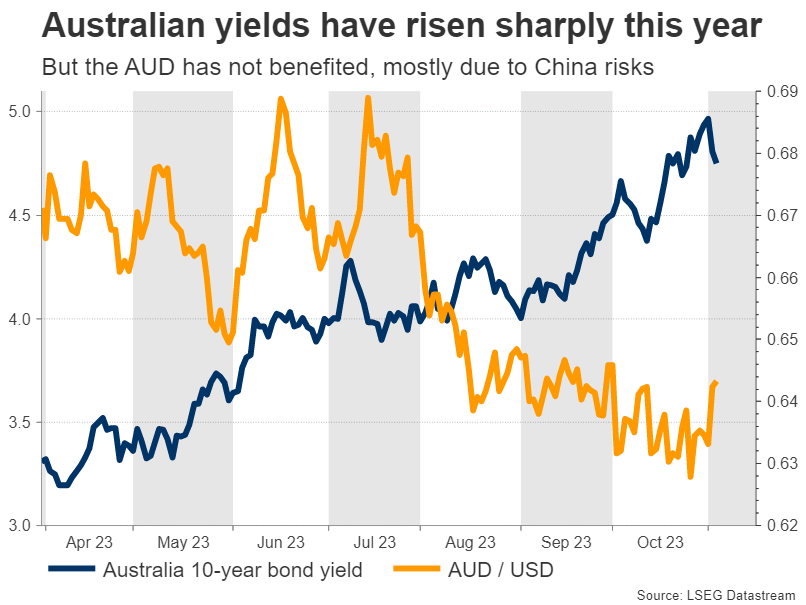

Most importantly, the global wave of rising bond yields has spilled into Australia. With Australian yields trading near their highest levels in a decade, the bond market has essentially done a lot of tightening for the RBA, reducing the need for further rate hikes.

Therefore, there are solid arguments both for raising rates and keeping them unchanged. That said, the case for a rate increase seems stronger based on the data pulse and RBA commentary. Considering that market pricing only implies a 60% chance for a hike, a decision to raise rates could help boost the Australian dollar.

Beyond the RBA decision, the longer-term trajectory for the Australian dollar will also be decided by global risk sentiment and any developments in China.

China awaits trade and inflation data

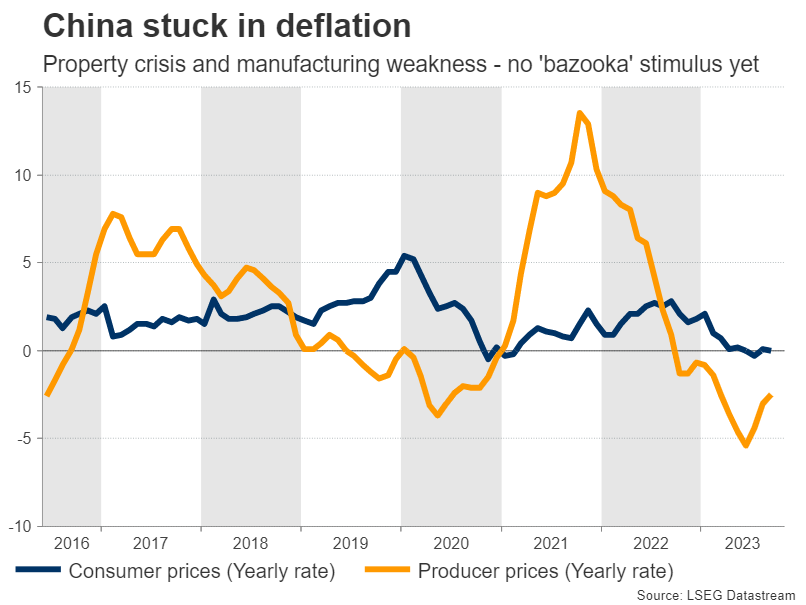

The Australian currency is sensitive to China news because of the close trading relationship between the two nations. Australia and New Zealand rely on Chinese demand to absorb their commodity exports, so the outlook for China directly influences the growth prospects of these economies.

This correlation helps explain why both currencies have been pummeled this year, amid an unfolding property crisis and a severe manufacturing slowdown in China. Investors have been waiting in agony for Beijing to roll out bigger stimulus measures, but so far, the policy response has been underwhelming.

China’s central government announced last week it would boost its budget deficit, approving 1 trillion yuan ($137 billion) in debt issuance. This was a signal that fiscal spending is coming. However, this support package only amounts to 0.8% of GDP, so it might lack the ‘firepower’ to truly kickstart the stalled economy.

In this sense, the upcoming releases will be closely monitored by investors. Trade data for October will hit the markets on Tuesday, ahead of inflation stats for the same month on Thursday. All these numbers are important, but markets often focus on exports and producer prices, which are seen as proxies of global factory demand.

Aside from the commodity-linked currencies, these releases could also impact global risk sentiment, driving stock markets in Asia and other regions accordingly.

UK GDP could be ugly

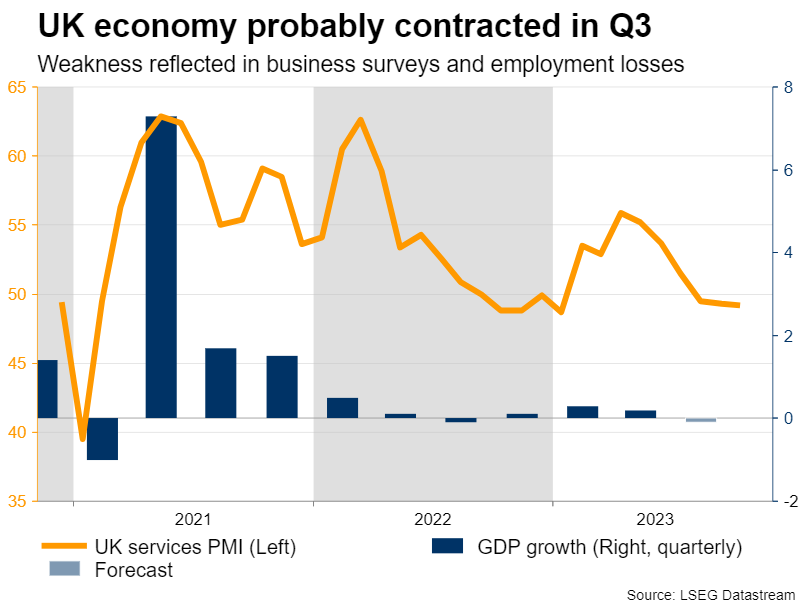

Turning to the United Kingdom, the highlight will come on Friday in the form of quarterly GDP numbers. The British economy most likely fell into contraction in the third quarter, something reflected in the monthly GDP readings that have already been released and gloomy business surveys.

Even more worrisome, the UK economy is suffering job losses. The labor market started losing jobs back in June, and this pattern continued through September. Faced with weaker demand conditions and shrinking margins, UK businesses are scrambling to slash costs. One option is to fire workers.

Employment losses are how every recession begins, so this is a massive red flag. In turn, the prospects for sterling appear dim. Economic growth is rolling over while inflation continues to burn hot, painting a stagflationary picture of the UK economy.

On top of that, Cable continues to exhibit strong correlation with stock markets, which leaves it vulnerable in case equities turn lower again as the global economy loses power.

Finally in the euro area, the latest data on producer prices are out on Tuesday, ahead of retail sales on Wednesday.