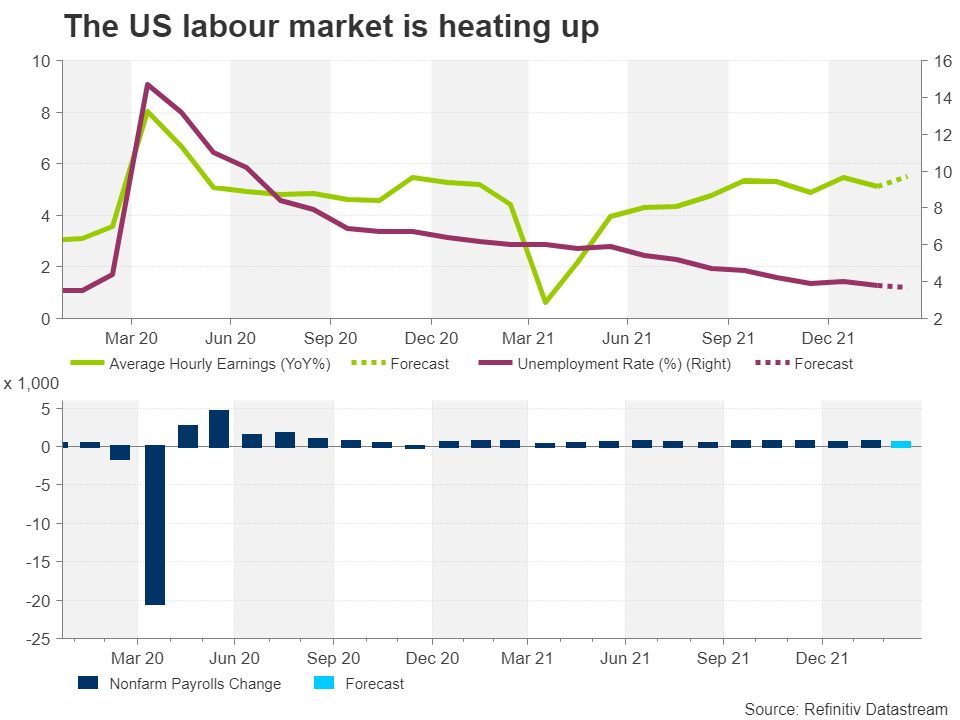

A very tight labour market

There can be no doubt that the US labour market is extremely tight right now and Friday’s jobs figures will probably show that hiring conditions got even tighter in March. Nonfarm payrolls are projected to have risen by 490k over the month – a lower pace than in February but a very healthy gain, nevertheless. Accordingly, the unemployment rate is forecast to have dipped by 0.1 percentage point to 3.7% in what would mark a new post-pandemic low.

Wage growth is expected to have accelerated after slowing down in February. Average hourly earnings are anticipated to have increased by 5.5% year-on-year in March, up from 5.1% in the prior month.

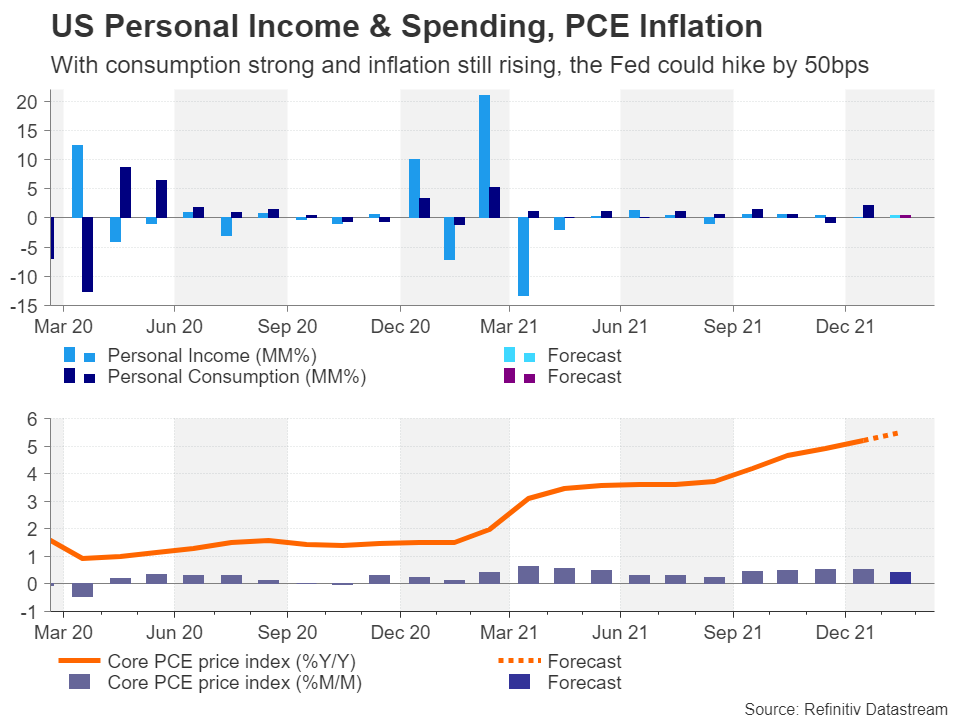

Fed getting more hawkish as inflation continues to surge

A day earlier, data on personal income, consumption and PCE inflation is expected to be equally upbeat. Personal income and spending likely both rose by 0.5% month-on-month in February, while the core PCE price index is forecast to have edged higher to 5.5% y/y to yet another multi-decade high.

Speculation about how many times the Fed will hike interest rates this year went into overdrive last week after Chair Jerome Powell hinted that the central bank might need to move faster at the upcoming meetings following the 25-basis-points liftoff in March. All the economic indicators so far support a more aggressive tightening cycle, but the main worry is that the positive outlook might not last very long.

Are US consumers about to turn more cautious?

In Europe, the latest survey data suggest both consumer and business confidence have started to take a hit from the fallout of the war in Ukraine. Policymakers at the European Central Bank and increasingly, the Bank of England as well, are cautious about committing to a specific rate path as they anticipate that some of the inflationary pressures will begin to fade as demand stumbles due to the squeeze on consumers and businesses from soaring prices.

There’s only mild evidence of a weakening outlook among US businesses and Friday’s ISM manufacturing PMI should shed more light on this. However, some measures of consumer sentiment tell a different story. Specifically, the University of Michigan’s closely watched gauge fell to the lowest since 2011 in March, suggesting consumers are becoming more and more alarmed by the worsening spiral in the cost of living.

Risk of Fed overtightening

The problem, though, is that the Fed is already so behind the inflation curve, it’s unlikely to backtrack from its hawkish stance unless inflation shows signs of peaking – the chances of which are very slim as long as the sanctions against Russia stay in place – or the labour market recovery goes into reverse.

Traders have currently priced in a more than 200 basis points increase in the fed funds rate by December, implying at least two hikes of 50-bps increments. The bond market seems to agree. But even though both short- and long-term Treasury yields have rallied extensively since the start of the year, parts of the yield curve have either briefly converted or are close to inverting, signalling a possible recession.

However, for most investors, it is too soon to be getting overly concerned about the risk of a US downturn and the Fed is only at the very early stages of policy normalization. Hence, the dollar rally potentially has a few more legs to go.

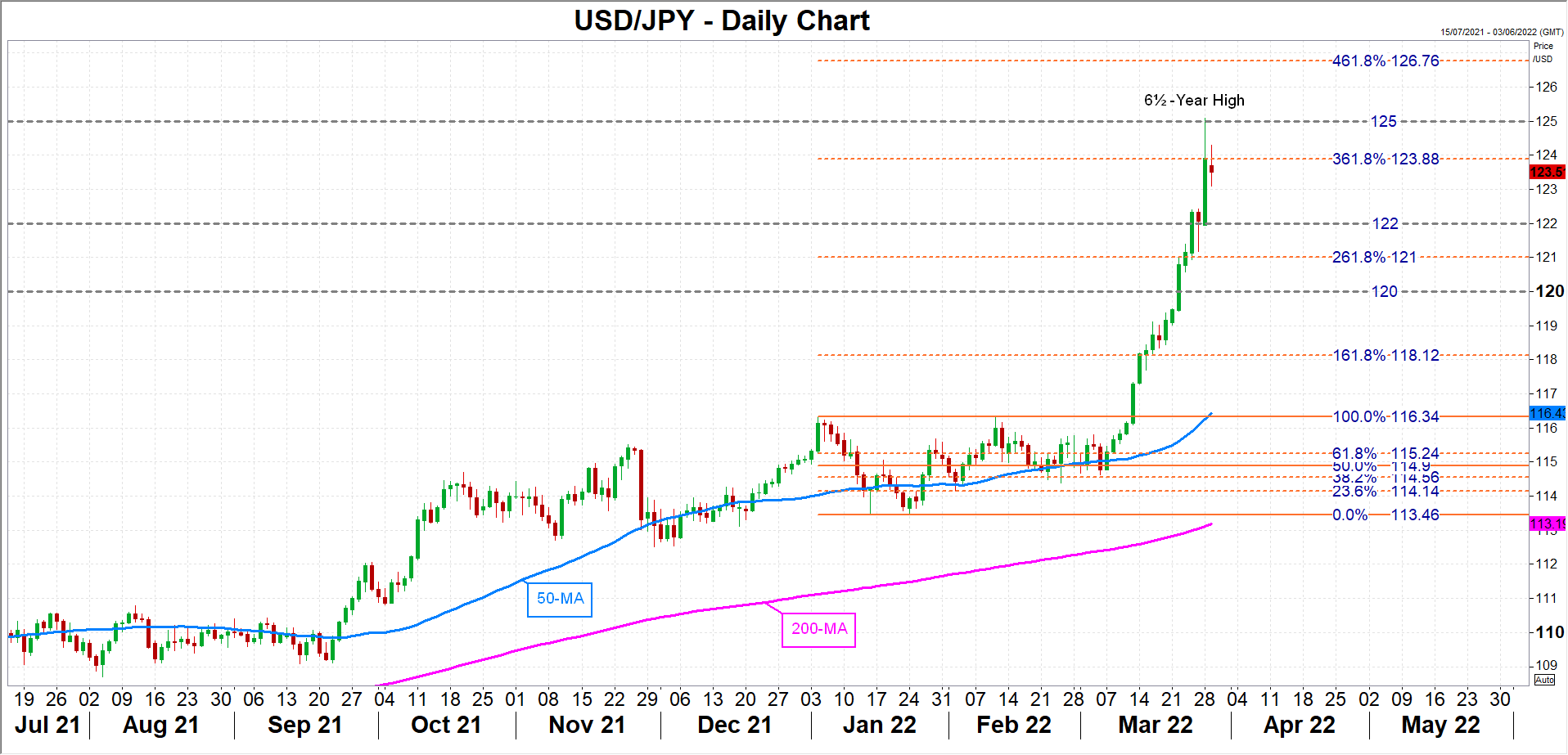

Can the dollar extend its impressive uptrend?

The mighty greenback hit a 6½-year high of 125.10 yen on Monday before retreating to nearer 123 yen. If the upcoming data are stronger-than-expected, the dollar might stretch its gains a bit more, although they’re unlikely to dramatically change the policy outlook for the Fed.

Dollar/yen could climb back towards the 125 handle and if it has better luck second time to overcome this barrier, the 461.8% Fibonacci extension of the January downleg at 126.76 could be the next target for the bulls.

Alternatively, should dollar/yen fall back, the 122 level followed by the 261.8% Fibonacci extension of 121 could stall any declines, while steeper losses would bring the 161.8% Fibonacci of 118.12 into focus.

Judging from the CPI report and the recent weekly jobless claims, big negative surprises are not looking too likely in either the NFP or PCE inflation numbers, so it’s possible there might be a bigger reaction to any shocks in the ISM manufacturing print.