Will the August NFP change anything for the dollar?

The August payrolls report will headline another data-packed week in the United States as it will be one of the last pieces of the puzzle for the Federal Reserve before it meets in September. But before the all-important jobs numbers, there’s a raft of other releases to get through.

Kicking things off on Tuesday are the S&P CoreLogic Case-Shiller Home Price index and the Conference Board consumer confidence index. On Wednesday, the Chicago PMI and the ADP employment report will be in focus, while on Thursday, the ISM manufacturing PMI will be closely watched following the further deterioration observed in the sector in S&P Global’s equivalent index.

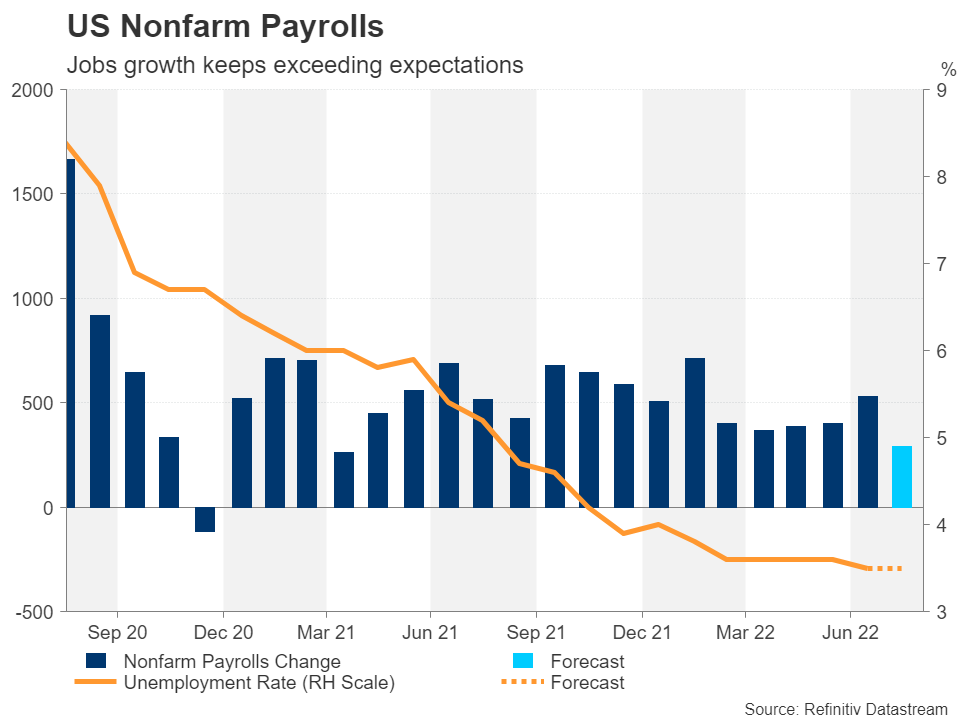

As for Friday, after last month’s unexpectedly hot print of 528k jobs, a somewhat softer report is anticipated in August, with analysts projecting a figure of 290k.

The unemployment rate is forecast to stay unchanged at the post-pandemic low of 3.5%. Average hourly earnings growth is expected to hold slightly above 5%.

The continued tightening of the labour market versus the early signs that inflation has peaked have put investors in a bind about the expected path of interest rates as the Fed won’t yet budge from its very hawkish stance even as fears of a recession are intensifying.

The rate hike odds for September are increasingly leaning in favour of a 75-basis-point one, but they could again tip towards 50-basis-point if the labour market starts to show signs of cracking. The weak employment readings in the PMI surveys suggest a disappointment in the headline print is more likely than not, although a positive surprise cannot be ruled out as it did last time.

Either way, the dynamics have not changed for the US dollar – its reserve currency status would probably keep any losses from poor data to a minimum, while strong numbers would bolster it further.

Eurozone inflation to hit 9.0%

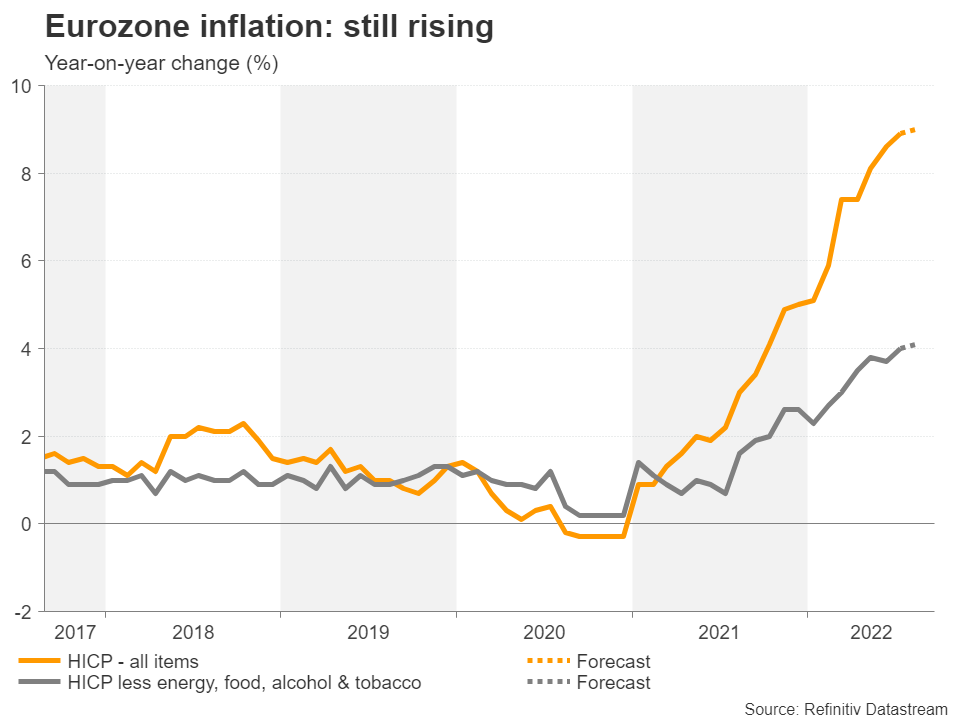

Whilst Americans may be seeing some relief from exorbitant price jumps, inflation has likely not yet peaked in Europe where the energy crisis just keeps getting worse. Natural gas prices are soaring again, sending European futures to record highs in the past week.

The drought across the continent, which has dried up rivers, has increased the reliance on natural gas by making it more difficult to transport other types of fuel via the quickest shipping routes. And now, Europeans face the prospect of a fresh disruption to gas supplies after Gazprom (MCX:GAZP) announced that it plans to hold a three-day unscheduled maintenance of the Nord Stream pipeline, starting on August 31.

Inflation in the euro area hit a record high of 8.9% year-on-year in July. The flash estimates for August are due on Wednesday, with the harmonized index of consumer prices for August forecast to edge up to 9.0%.

Policymakers will undoubtedly also be paying close attention to the underlying measures of inflation ahead of the European Central Bank’s next policy meeting on September 8.

Even if the recent pullback in oil does bring down headline inflation via cheaper petrol prices, the ECB will be reluctant to let its guard down so soon after commencing with its first rate hike cycle in more than a decade if core inflation readings are too high.

The euro could receive a small boost from hotter-than-expected inflation figures, but only if the dollar doesn’t go on another rampage.

Other indicators that will put the euro on recession watch are the Eurozone’s economic sentiment indicator on Tuesday, the final manufacturing PMIs on Thursday, and producer prices and German trade data on Friday.

Commodity currencies at the mercy of external forces

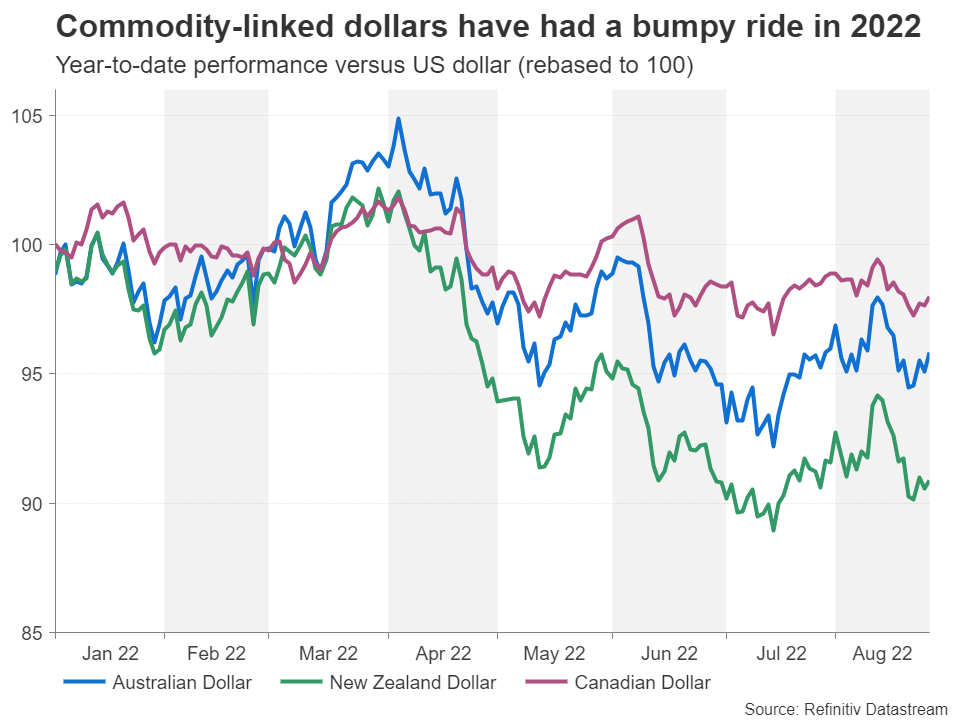

The commodity-linked Australian, Canadian and New Zealand dollars have been on a roller-coaster ride over the last month or so, being held hostage to wavering risk appetite and shifting Fed rate hike expectations.

All three currencies have managed to stay above their July lows, but the path forward remains obscure as China’s economic troubles have injected a fresh dose of uncertainty to the outlook and the Fed is nowhere close to a dovish pivot, which market participants are still betting will happen in 2023.

Thus, domestic data is not the primary driver for the commodity dollars at the moment even though they do have substantial bearings on the pace of monetary tightening in the respective countries.

Nevertheless, the Canadian dollar has been outperforming its aussie and kiwi counterparts this year as Canada’s economy is less exposed to China risks and has overall been more robust over the last year.

GDP numbers out on Wednesday will probably confirm that this trend was maintained in the second quarter.

In Australia, Q2 construction and capital expenditure estimates are due on Wednesday and Thursday, respectively, but the highlight for aussie traders will likely be the August PMIs out of China. The government’s own manufacturing PMI is released on Wednesday and the Caixin one will follow on Thursday.

Concerns that China’s economy is stuttering have been weighing on risk-sensitive currencies, as well as on broader risk assets. However, even if the PMIs disappoint, the hit to sentiment might be limited this time following the announcement this week of additional stimulus measures by Beijing, which went some way in relieving the anxiety.

Meanwhile in New Zealand, investors will want to see whether business confidence, which had slumped to the lowest since the onset of the pandemic in June, bounced back further in August when the ANZ business outlook survey is published on Wednesday.