Another close call for the RBA?

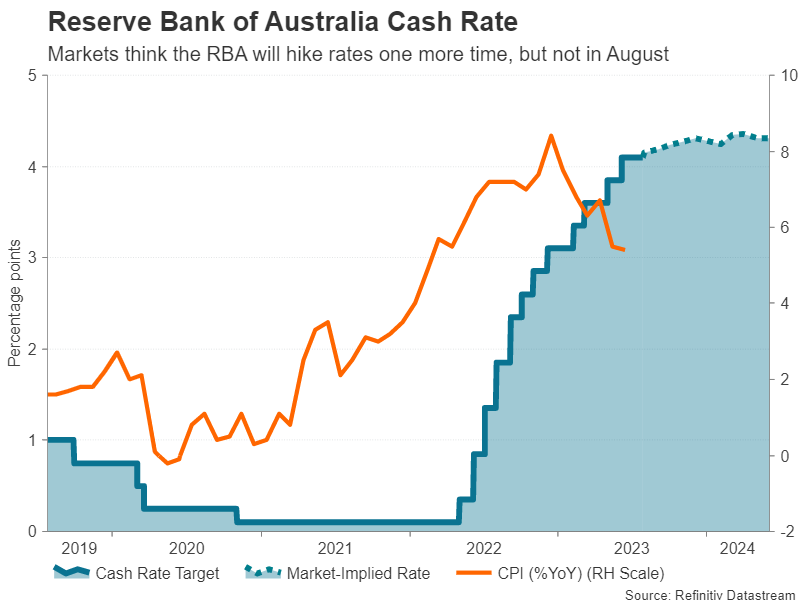

The Reserve Bank of Australia meets on Tuesday for its August policy decision and markets and economists are split as to what the outcome will be. Analysts are predicting a 25-basis-point increase in the cash rate to 4.35% following a pause in July. However, the minutes of the July meeting revealed the decision was a close call and that the Board would “reassess the situation” in August.

The Bank will publish updated economic projections on Friday but it’s doubtful how much clarity they will provide. Economic data has been somewhat mixed lately – the jobless rate dipped to 3.5% in June, but inflation also fell more than expected, with CPI cooling to 6.0% year-on-year in Q2.

However, other indicators have been gloomier as the manufacturing and services PMIs both contracted in July. That’s why the markets aren’t convinced that policymakers will press the hike button, although they do foresee one final 25-bps increase over the next nine months. But there is reason to be optimistic as Australian exporters stand to benefit from China’s renewed efforts to stimulate its economy.

Therefore, if policymakers choose to stay on the sidelines for another meeting, the decision might not be very negative for the Australian dollar as a hawkish hold is the most dovish scenario. But neither are they likely to close the door to additional hikes if they decide not to wait and raise rates next week, boosting the local dollar.

BoE to downshift again

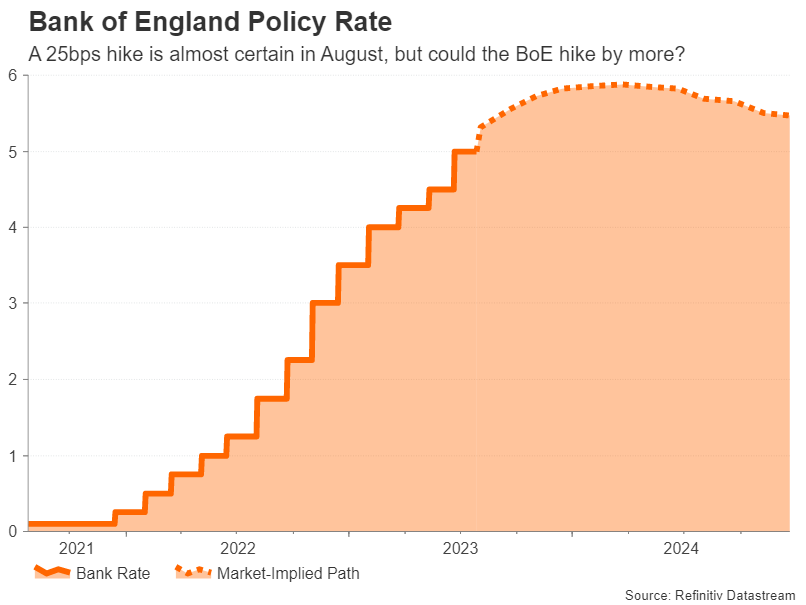

The Bank of England is certain to raise the Bank Rate again when it meets on Thursday but there is less confidence about the size of the hike. A 25-bps increase is fully baked in, but markets have assigned around a 30% probability of a larger 50-bps move. Following the June inflation figures when UK CPI finally tumbled below 8% and core CPI eased too, the arguments for a second consecutive double hike have weakened considerably, and even more so after the recent dismal PMIs for July.

Very poor flash PMI estimates tend to get revised up and that could happen when the final readings are released on Tuesday (manufacturing) and Thursday (services). However, the UK economy is clearly struggling amid a slowdown in its biggest trading partners and households being squeezed from soaring mortgage costs. Hence, the Bank of England is unlikely to go big even as it stresses the need for further tightening.

In the event that the BoE doesn’t surprise, what might be more relevant for the pound is the BoE’s latest set of inflation forecasts, in particular, how fast it sees CPI falling to the 2% target.

Is the US labour market coming off the boil?

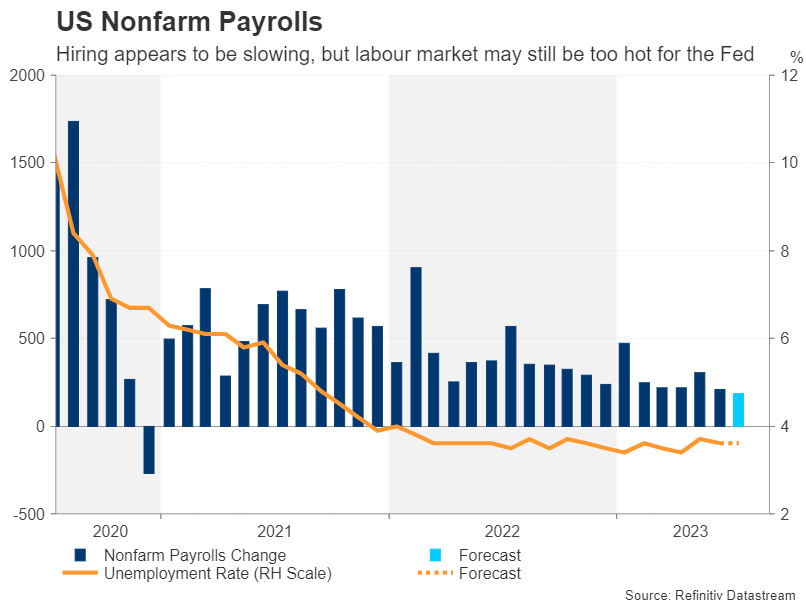

The Fed decision may be out of the way but the upcoming jobs report could prove more vital for the markets as Powell kept his options open for the September meeting. The jobs market in America has been steadily losing steam this year but not nearly fast enough to ease concerns about a wage-price spiral. However, the Fed may finally be getting what it wants as employment grew at the slowest pace in two-and-a-half years in June and that trend likely continued in July.

Nonfarm payrolls are expected to have risen by 184k in July, down from 209k previously. The unemployment rate is forecast to have held steady at 3.6%, while average earnings probably kept growing by slightly more than 4% y/y.

The weekly jobless claims have been edging lower for most of July so a positive NFP surprise is possible, though the markets might not necessarily welcome a strong print as it would bolster the case for a September rate hike.

Aside from the payrolls numbers, what could also move the US dollar the most are the ISM PMIs on Tuesday (manufacturing) and Thursday (non-manufacturing). Like in Europe, the US manufacturing sector has been in recession this year but in stark contrast, the services economy has continued to expand, and the non-manufacturing PMI unexpectedly bounced higher in June.

With the Fed undecided about whether to raise rates again, the incoming data could swing the odds in the dollar’s favour if they are stronger-than-expected.

Euro eyes flash CPI as ECB ponders pausing

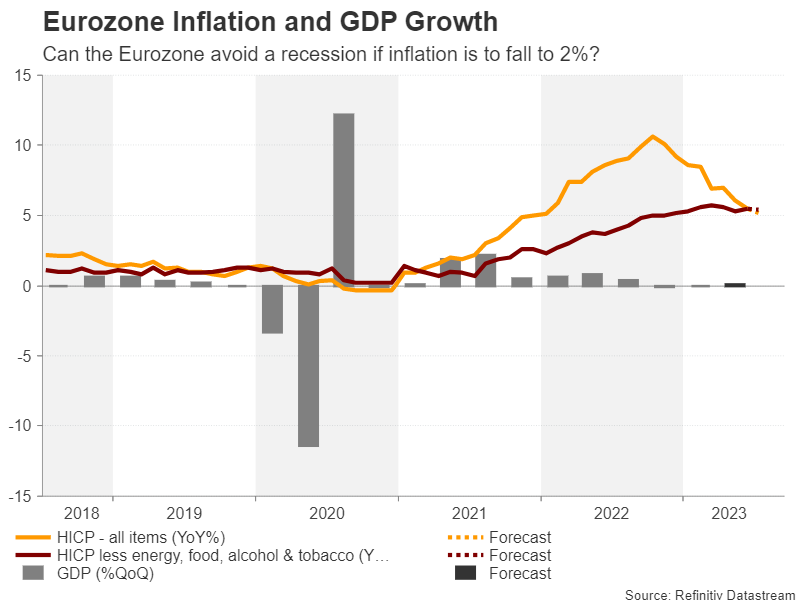

The European Central Bank made a dovish turn this week by not committing to further rate hikes. The change in stance came on the back of softer inflation readings as well as growing signs that the Eurozone economy could be headed for a recession.

Monday’s flash CPI numbers for July will therefore be crucial in shaping expectations about additional rate hikes in the euro area this year. The headline rate of inflation slipped to 5.5% y/y in June and is projected to fall again to 5.3% in July to a one-and-a-half year low.

However, underlying inflation is proving to be a lot stickier as core CPI that excludes all volatile items such as food and energy edged up in June to 5.5%. It is forecast to inch lower to 5.4% in July, but any upside surprises could lead to some scaling back of bets that the ECB is done raising rates.

Preliminary GDP estimates for the second quarter are also released on Monday. Economic growth was flat in the first quarter, but GDP likely managed a modest expansion of 0.1% in the three months to June.

With future rate hikes hanging in the balance, the euro will be very sensitive to price and growth indicators in the run up to the September meeting.