The New Zealand dollar has started the week on a positive note. NZD/USD is trading at 0.6405 in Europe, up 0.41%.

Consumer Confidence Falls to a Record Low

New Zealand’s Westpac Consumer Confidence dropped to its lowest level since 1988 when records first started. The Q4 reading of 75.6 was sharply lower than the Q3 release of 87.6. A double-whammy of a sharp rise in consumer prices and higher borrowing costs has hit consumers.

The cost of living has soared with sharp price increases, particularly in food, housing, and energy. This has translated into a gloomy mood for consumers as the economic outlook is poor, with a recession projected from mid-2023. Often the lead-up to Christmas boosts consumer confidence, but this time around, the holiday season hasn’t provided any cheer to consumers.

New Zealand’s Service PMI remained in expansion territory in November but fell to 53.7, down from 57.1 a month earlier. This follows last week’s Manufacturing PMI, which slowed to 47.4 in November, down from 49.1 in October. This marked the first back-to-back months of contraction since New Zealand’s first nationwide lockdown in 2020. With a gloomy outlook for global manufacturing, it could be a bumpy start in 2023 for the country’s manufacturing sector.

The New Zealand economy might be struggling, but NZD/USD has been on fire, climbing 14.4% since Oct. 1. The New Zealand currency received a massive boost as risk appetite soared courtesy of some soft US inflation reports, which raised hopes that the Federal Reserve would pivot.

Last week’s FOMC meeting was a rude shock for the markets as the Fed pledged to remain aggressive, and NZD/USD plunged close to 2%. If the markets heed the Fed’s hawkish message, the US dollar could continue to gain ground.

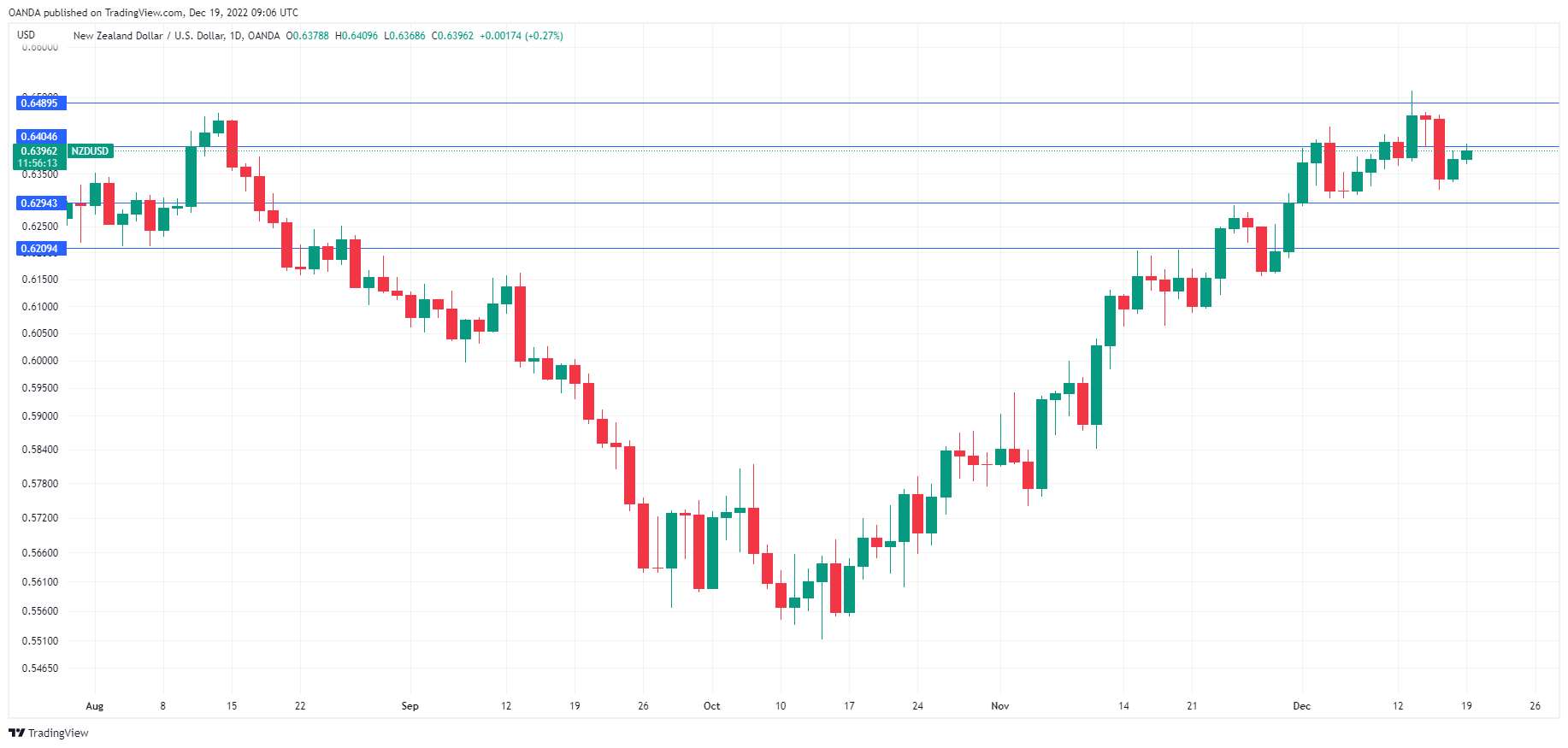

NZD/USD Technical

- NZD/USD is testing resistance at 0.6404. Above, there is resistance at 0.6489

- There is support at 0.6294 and 0.6209