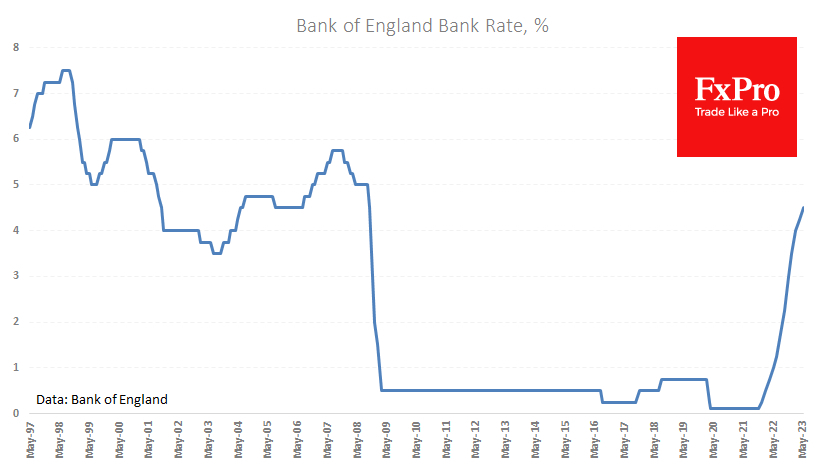

The Bank of England raised its key interest rate by 25 points to 4.5% on Thursday, marking the twelfth consecutive policy tightening. Two of the nine members have voted to keep rates on hold in the last four meetings.

The accompanying commentary left the door open for a further hike and a pause. Arguing in favour of further tightening is the more resilient inflation in the UK, forcing the central bank to raise its rate forecasts regularly. On the other hand, the central bank has done a considerable amount of work so far, and it will take some time for the hikes already made to have their full effect on the economy.

You could say that the Bank of England is trying to go in the same direction as the Fed by stopping rate hikes. A similar signal from the Bank of England could be stronger than the Fed. But the nominal interest rate level in the UK is now lower than in the US when historically the opposite is true.

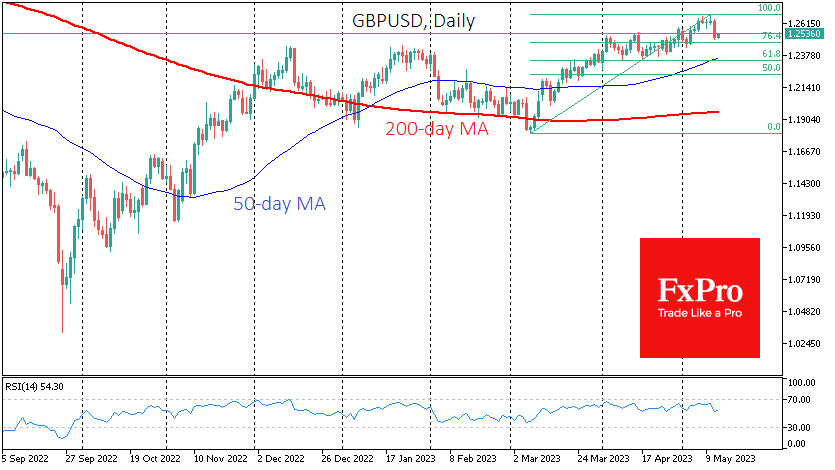

The reaction of sterling has been interesting. The initial rise of a third of a per cent was wiped out by a triple-digit fall before the end of the day, taking GBPUSD back to 1.25. The market players continued to pocket profits after the Pound's rally since early March, recalling the adage 'sell in May and go away'. A retracement of the GBPUSD could occur around 1.2350, a 61.8% retracement of the March-May rally, local support from April and the 50-day moving average.

It is also worth noting that the Bank of England is now benefiting from the appreciation of its currency against its main rivals, as rising import prices significantly contribute to inflationary pressures. As such, we expect the Bank of England to adopt more hawkish rhetoric than the Fed in the coming months, which will support the GBPUSD to rise to the 1.30 area after the correction of the recent rally with a pullback to 1.2350.

The FxPro Analyst Team