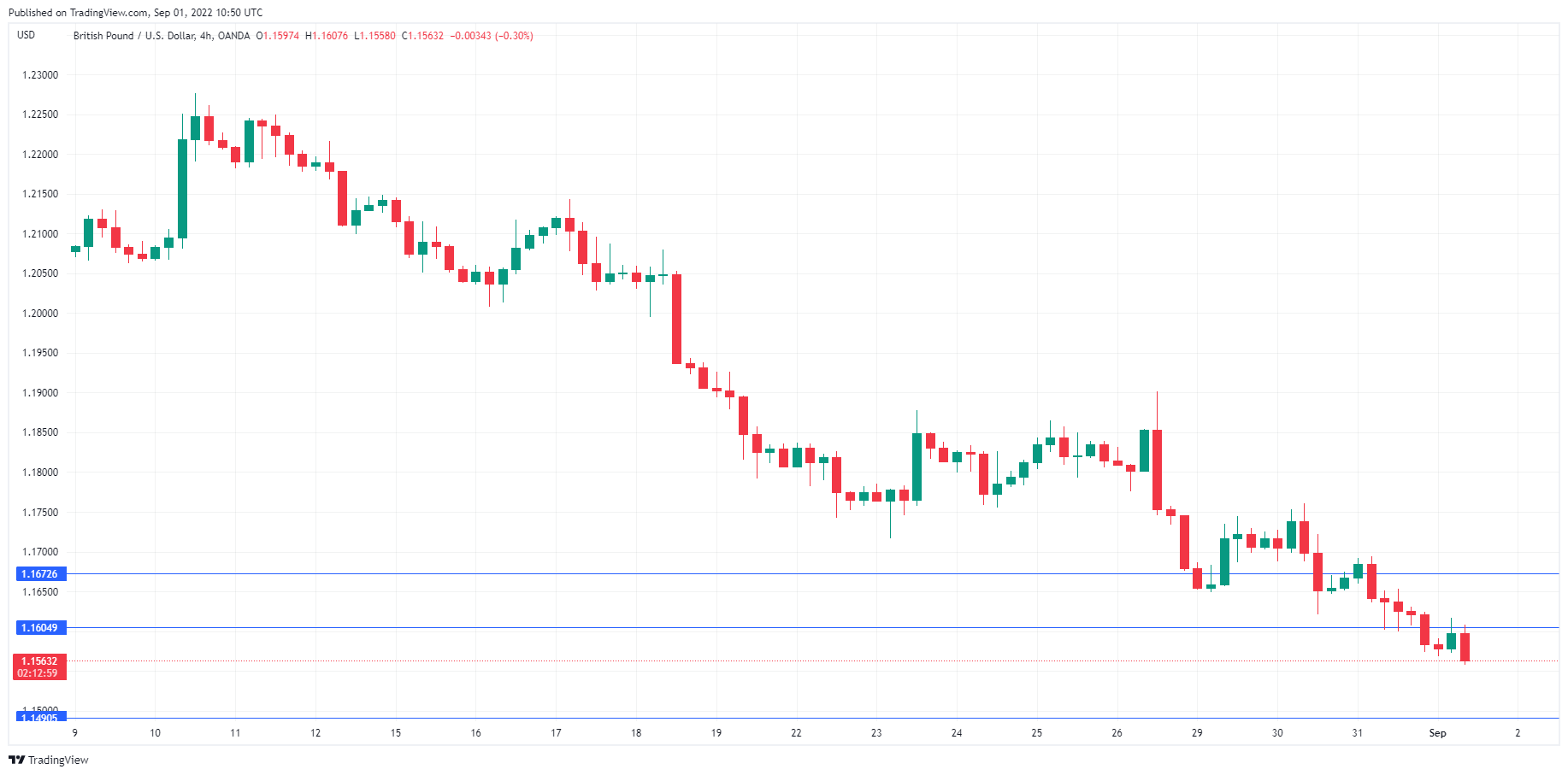

The British pound can’t buy a break and has fallen for a fifth straight day. GBP/USD is trading at 1.1586 in Europe, down 0.29%.

UK Manufacturing PMI contracts

The UK manufacturing sector has been struggling for quite some time, and in August, manufacturing production declined. Manufacturing PMI fell to 47.3 in August, down from 52.1 in July. This marked the first contraction (a reading below 50.0) since May 2020, during the first COVID lockdown.

The PMI decline reflected a range of problems, including supply chain disruptions, port congestion, and shortages of raw materials and workers. With inflation still on the rise and fears of a recession, the manufacturing sector faces plenty of headwinds, and things could worsen before they improve.

Market attention now shifts to one of the key events on the economic calendar, Friday’s US nonfarm payrolls. On Wednesday, the ADP Employment report showed a drop to 130k new jobs in August, down from 270k.

The reading was well below the estimated 288k and the lowest level since August 2021. The ADP release is not considered a reliable gauge for nonfarm payrolls but still garners close attention as it could point to a trend in job growth.

August Nonfarm payrolls are also expected to drop, with a consensus of 300k, following the massive 528k gain in July. A reading of 300k or higher would point to solid job growth and would likely give the US dollar a boost, as it would give the Federal Reserve the green light to continue with its aggressive rate-tightening cycle.

Conversely, a weaker-than-expected reading would raise doubts about the Fed’s pledge to stay aggressive, leading to a rotation out of US dollars.

GBP/USD Technical View

- GBP/USD is testing support at 1.1672. Below, there is support at 1.1604

- There is resistance at 1.1786 and 1.1854