While the EUR/USD held on to its ECB-induced gains, the bearish fundamental realities confronting the currency pair were confirmed on Feb. 7. To explain, while euro bulls think that the ECB will have a hawkish awakening, I warned on Feb. 4 that the prospect was much more semblance than substance.

I wrote:

"With the ECB’s monetary policy statement reading that '“from October onwards, the Governing Council will maintain net asset purchases under the APP at a monthly pace of €20 billion for as long as necessary to reinforce the accommodative impact of its policy rates,”' how can the ECB raise interest rates if it still plans to purchase bonds past October 2022? Think about it: Lagarde said that '“we will look at net asset purchases first.”' And if ending QE is the first step in the process, then the ECB is nowhere near the second step."

To that point, ECB President Christine Lagarde told the European Parliament committee on Feb. 7:

“There are no signals that inflation will be persistently and significantly above our target over the medium term, which would require measurable tightening.”

She added:

“We have to bear in mind that demand conditions in the Euro Area do not show the same signs of overheating that can be observed in other major economies. This increases the likelihood that the current price pressures will subside before becoming entrenched, enabling us to deliver on our 2% target over the medium term.”

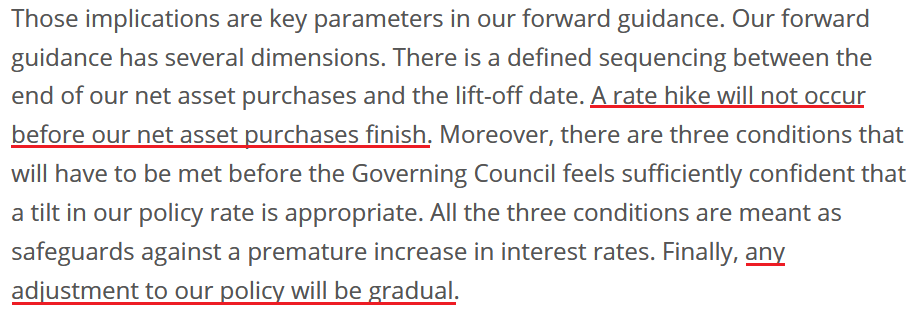

For context, investors have priced in two ECB rate hikes in 2022. However, with the central bank still planning to purchase bonds “from October onwards” and Lagarde saying that rate hikes will only be considered thereafter, short-term sentiment should crumble over the medium term.

Source: ECB

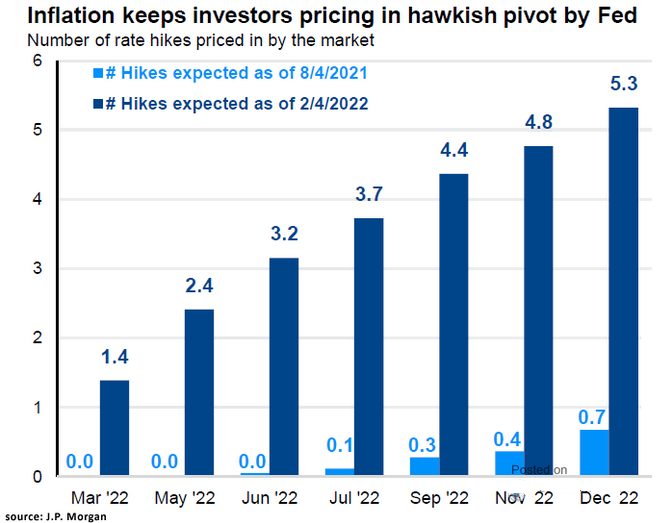

On the flip side, U.S. inflation is materially outperforming the Eurozone. With the pricing pressures depressing consumer confidence and hurting U.S. President Joe Biden’s re-election prospects, the Fed doesn’t have time for “gradual” adjustments.

To explain, the light and dark blue bars above track the number of Fed rate hikes priced in during different time periods and 2022 dates. If you analyze the light blue bar furthest to the right, you can see that investors expected less than one rate hike by December 2022 on Aug. 4. However, fast forward six months, and the dark blue bar furthest to the right shows that investors expect more than five rate hikes by December 2022, as of Feb. 4.

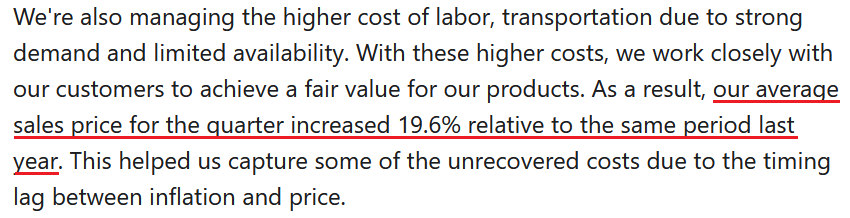

Expanding on inflation, Tyson Foods (NYSE:TSN)—the largest food company in the U.S.—released its first-quarter earnings on Feb. 7. CEO Donnie King said during the Q1 conference call:

“In the quarter, our cost of goods sold was up 18% relative to the same period last year. We are seeing higher costs across our supply chain, including higher input costs such as feed and ingredients. We're also managing the higher cost of labor and transportation due to strong demand and limited availability.”

Moreover, CFO Stewart Glendinning added:

“We saw continued inflation across the business, in some instances, up 20% to 30%. Notable examples were labor, grain costs, live cattle and hog costs, and freight costs.”

How is the company responding to the inflationary pressures?

Source: Tyson Foods/The Motley Fool

Some Things Never Change

Thus, with relative inflation tilted heavily in the U.S.’s direction, the Fed has much less wiggle room to remain dovish. As a result, while I’ve stated this on numerous occasions, the Fed and the ECB are worlds apart.

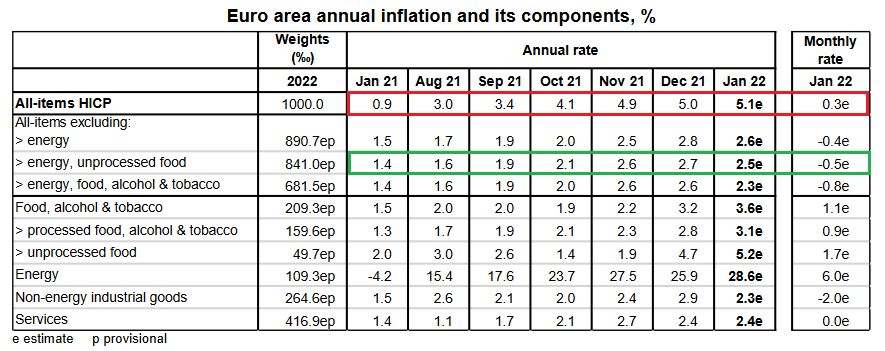

To that point, I highlighted on Feb. 4 how Eurozone core inflation decelerated in January and how the media’s alignment of U.S. and Eurozone inflation dynamics lacks fundamental credibility.

I wrote:

Source: Eurostat

"To explain, follow the trajectory of the red rectangle above. As you can see, headline inflation (which includes food and energy) went from a 0.9% year-over-year (YoY) increase in January 2021 to a 5.1% YoY increase in January 2022. Pretty troublesome, huh?

"However, if you focus your attention on the green rectangle, you can see that Eurozone core inflation (which excludes food and energy) declined from 2.7% YoY in December 2021 to 2.5% YoY in January 2022. As a result, while investors assume that abnormally high headline inflation will elicit a hawkish response from the ECB, the reality is that oil and gas remains the region’s only problem."

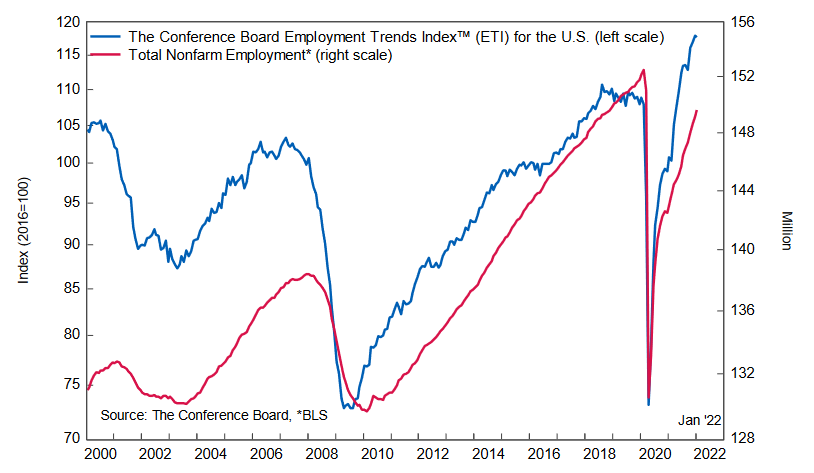

Also noteworthy, the second half of the Fed’s dual mandate is to ensure a healthy U.S. labor market. Whether it’s nonfarm payrolls, nonfarm job openings, or NFIB employment data, it’s not hard to find a job in the U.S. Thus, when combining inflationary pressures with employment outperformance, there is little reason for the Fed to perform a dovish 180.

As evidence, The Confidence Board released its Employment Trends Index (ETI) on Feb. 7. While the index declined from 117.94 in December (an upward revision) to 117.64 in January, Frank Steemers, Senior Economist at The Conference Board, said:

“It appears that the Omicron variant did not impact job growth as much as initially feared. Solid job growth is likely to continue over the next months."

Moreover, he added:

“Employers appear to be managing these pandemic disruptions better, even as many workers called in sick or had to quarantine in January. On the other hand, employers are still trying hard to hold on to their workers in a tight labor market. Hiring and retention continues to be a challenge which we do not expect to dissipate anytime soon, especially for employers of manual labor and services.”

For context, “a tight labor market” and “retention” issues only increase wage inflation. However, the important point is that the U.S. labor market remains healthy enough for the Fed to forge ahead with rate hikes.

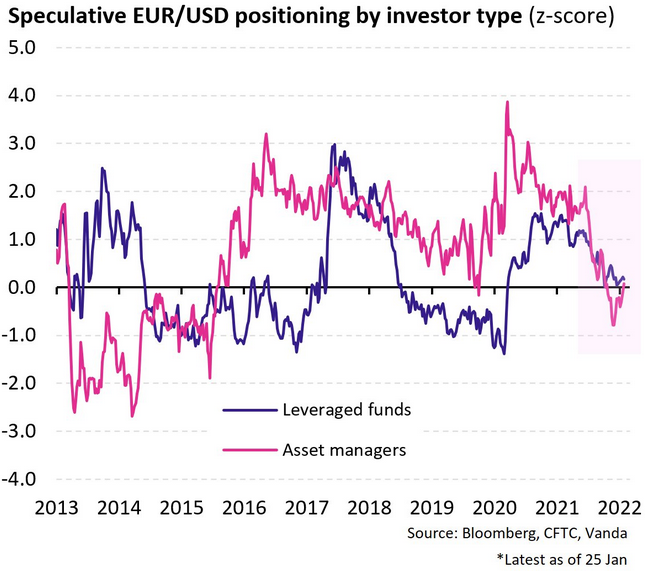

Finally, while the EUR/USD attempts to defy fundamental gravity, the currency pair’s sell-off in 2021 was likely far from capitulation. As a result, there is plenty of room for speculators to recalibrate their positions.

The blue and purple lines above track the speculative EUR/USD positioning of leveraged funds and asset managers. If you analyze the right side of the chart, you can see that both are roughly flat (near zero). However, if you focus your attention on the blue line, you can see that leveraged funds’ EUR/USD shorts were much higher during the periods from 2014 to 2020 (depicted by the blue line falling below zero).

Similarly, asset managers’ EUR/USD shorts were also much higher from 2013 through 2015 (depicted by the purple line falling below zero). As such, bearish EUR/USD sentiment still has room to increase, and neutral positioning means that a short-squeeze is unlikely to occur.

The bottom line? While the USD Index's recent weakness may seem troubling, the greenback’s fundamentals remain robust. Despite the short-term sentiment shift, several corrective downswings occurred throughout the USD Index’s bullish journey in 2021. Moreover, with the Fed still well ahead of the ECB, harsh reality should confront the EUR/USD over the medium term.

In conclusion, the PMs rallied on Feb. 7, as commodities were in style once again. However, with the U.S. 10-year Treasury yield gunning for 2% and the USD Index poised for a recovery, a reversal of fortunes will likely occur over the medium term. As a result, lower lows should confront the PMs over the next few months.