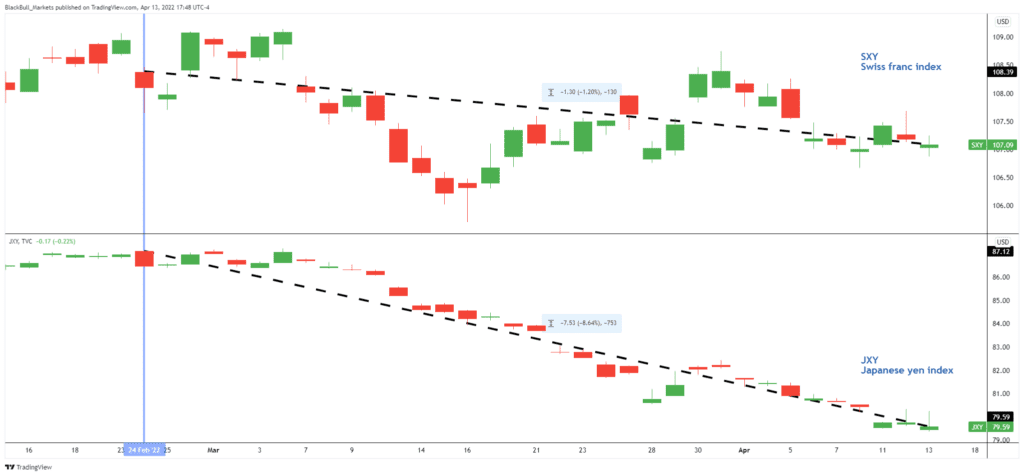

The USD has lived up to its classification as a safe-haven currency since the beginning of Russia’s invasion of Ukraine. Other safe-haven currencies, such as the Swiss franc and the Japanese yen, have failed in this respect.

Both have lost strength over the past month and a half. The Swiss franc index has fallen 1.2% over this time, while the Japanese yen has plummeted 8.6%.

The physical approximation of Switzerland to the Ukrainian border might explain why the Swiss franc has failed to live up to its safe-haven status.

The same reasoning cannot be applied to the yen as Japan has a 5000-mile wide buffer between it and the locale of the conflict.

Nevertheless, Switzerland is not the only European country that has been affected by the Ukraine invasion, many of them being direct or close neighbors of Ukraine.

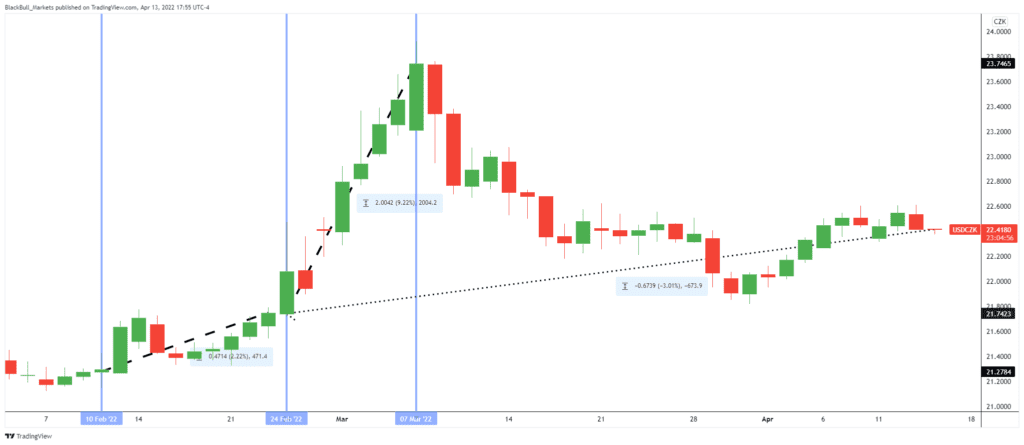

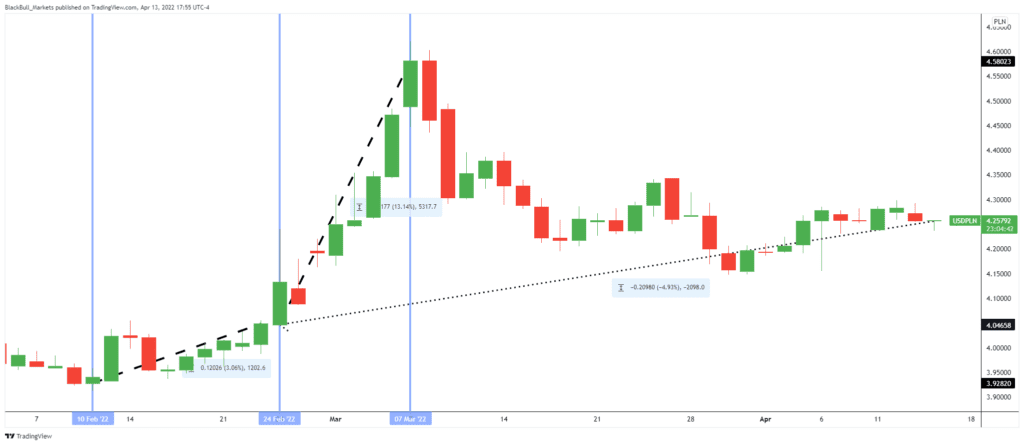

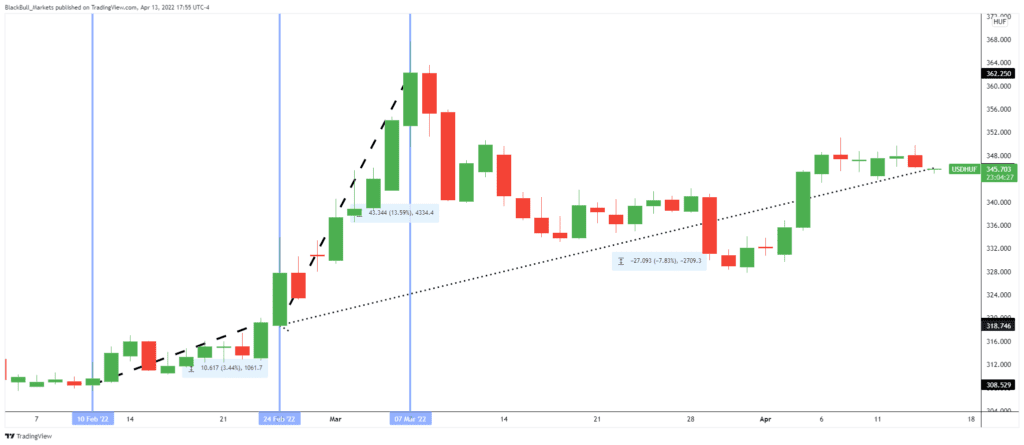

The currencies of several close and bordering countries of Ukraine have followed a similar pattern since Russia entered Ukraine for its ‘special military operation’ on 24 February 2022.

The Czech koruna, Polish zloty, and the Hungarian forint each spent the period between Feb. 24 - Mar. 7 considerably weakening against the US dollar. The US dollar strengthened in a range of 9% to 14% against these pairs.

The two weeks before 24 February saw gradual but moderate de-risking in these European currencies, with the US dollar gaining in the range of 2% to 3.5%.

Strangely, significant movement was seen on the bookends of this period, on the Feb. 24, Mar. 6, and 7. All the stranger for the very sharp reversals that took place on Mar. 8 and 9.

This may have been when it became evident that Russia had botched its invasion.

The reversals that occurred were not entirely successful in erasing the losses the currencies made since 24 February. The Czech koruna has fared the best during this affair so far, weakening by only -3% and followed by the Polish zloty at -4.9% and the Hungarian forint at -7.8%.