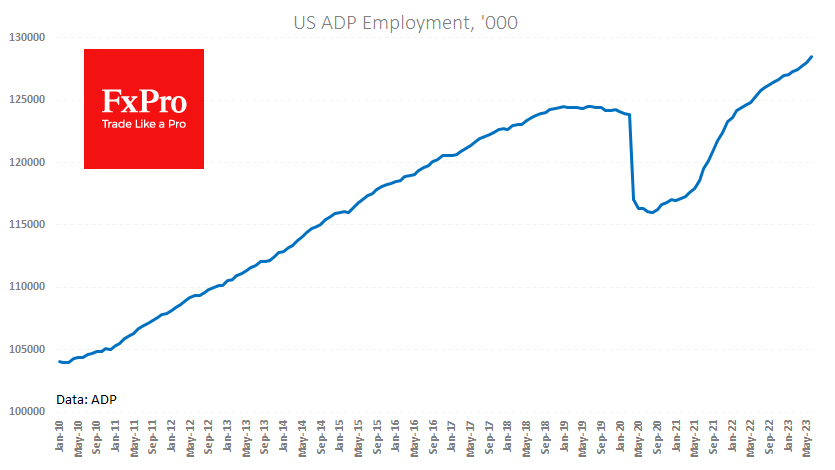

ADP released another super strong job report for the US, noting private sector employment growth of 497k in June. This is more than double the expected 226k growth and completely contradicts the idea that the world's largest economy has entered or is close to a deep recession.

A gain of almost half a million jobs in one month promises a noticeable boost to Americans' income and spending, the main driver of US GDP. Although the APD data has repeatedly contradicted official statistics, it is one of the most influential labor market indicators ahead of tomorrow's official release.

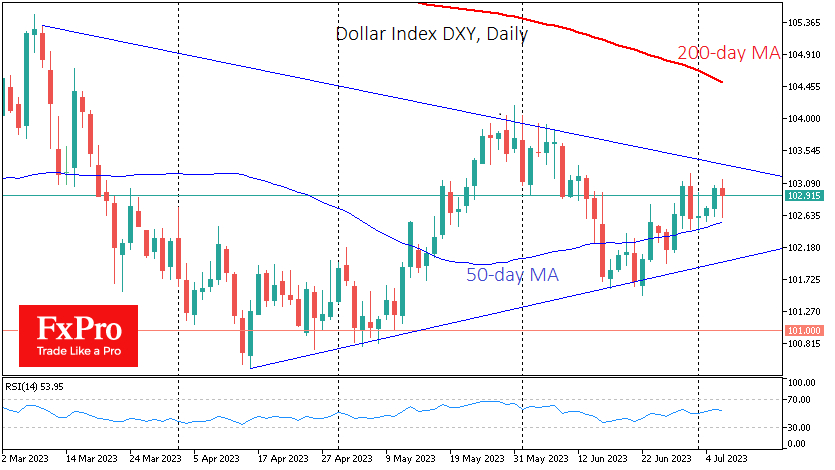

If the official statistics confirm the current data, markets should be prepared for further decisive rate hikes. And that could be bad news for equity indices as rising bond yields become increasingly attractive on a risk/reward basis, increasing the chances of a correction in the Nasdaq100 and other major indices.

At the same time, a strong labour market could revive interest in the dollar, which has recently lost ground. The Dollar Index rose 0.3% immediately after the ADP release, recouping much of its intraday losses. However, this move could be extended as the DXY defends a position above its 50-day moving average, confirming a bullish medium-term trend.

The FxPro Analyst Team