The sticky problem that just won’t go away

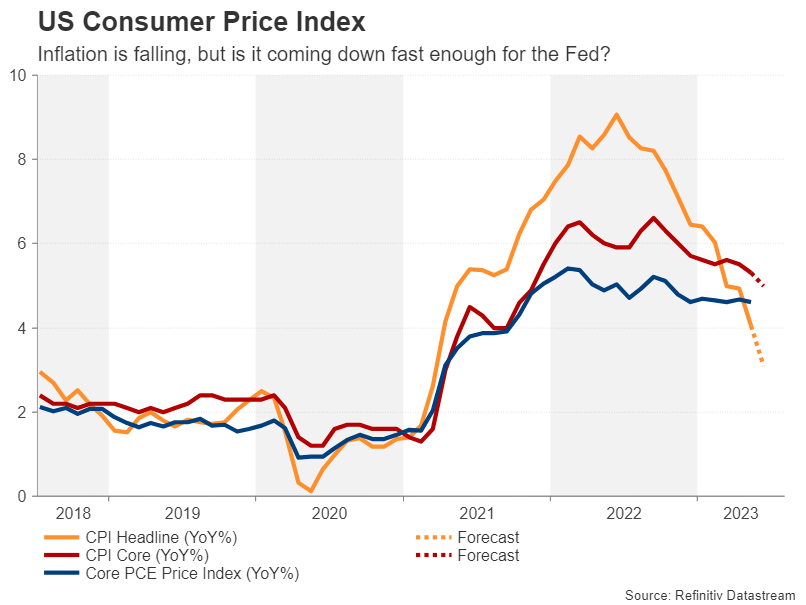

Central banks appear to have won the initial fight against skyrocketing prices but the war on inflation isn’t quite over as there is now a new battle – sticky inflation. This couldn’t be more evident in the United States where inflation rose quickly to peak just above 9.0% exactly a year ago and appears to be falling just as fast. However, core inflation, which is a more reliable indicator of what’s happening to price pressures underneath the surface, has remained stubbornly high, declining only marginally this year.

Core CPI stood at 5.3% y/y in May, fractionally lower from 5.7% in December but significantly above the headline rate of 4.0%. The picture is even worse when looking at the alternative core PCE price index, which has been stuck between 4.6% and 4.7% since December.

(Slowly) Going in the right direction

When viewed against an ongoing tight labour market, a flatlining trend in core inflation well above the 2% target is hardly what the Fed was hoping it would have achieved by mid-year, having raised rates by 500 basis points in the course of just 15 months. The June figures are not anticipated to provide much relief either.

Whilst the headline CPI rate is forecast to have plunged to a more than two-year low of 3.1%, the core rate is expected to have made more gradual progress, slowing to 5.0% in June. On the face of it, there is nothing too alarming about either figure as both are headed in the right direction. However, with the core measures still printing so high above the target, the Fed cannot afford to take its eye off the ball.

It explains why FOMC members have maintained such a strong bias for more tightening even though they decided to keep rates on hold in June. Chair Powell has been defending the move as simply a further downshift in the pace of tightening rather than a pause and although markets are not entirely convinced, they are growing increasingly doubtful about the likelihood of a rate cut in the first half of 2024.

Downside risks for euro/dollar

Moreover, with the US economy still in a somewhat better shape than the Eurozone, which is losing momentum faster, a further steepening of the market-implied rate path for the Fed poses a significant risk for euro/dollar given that more rate increases are currently priced in for the ECB.

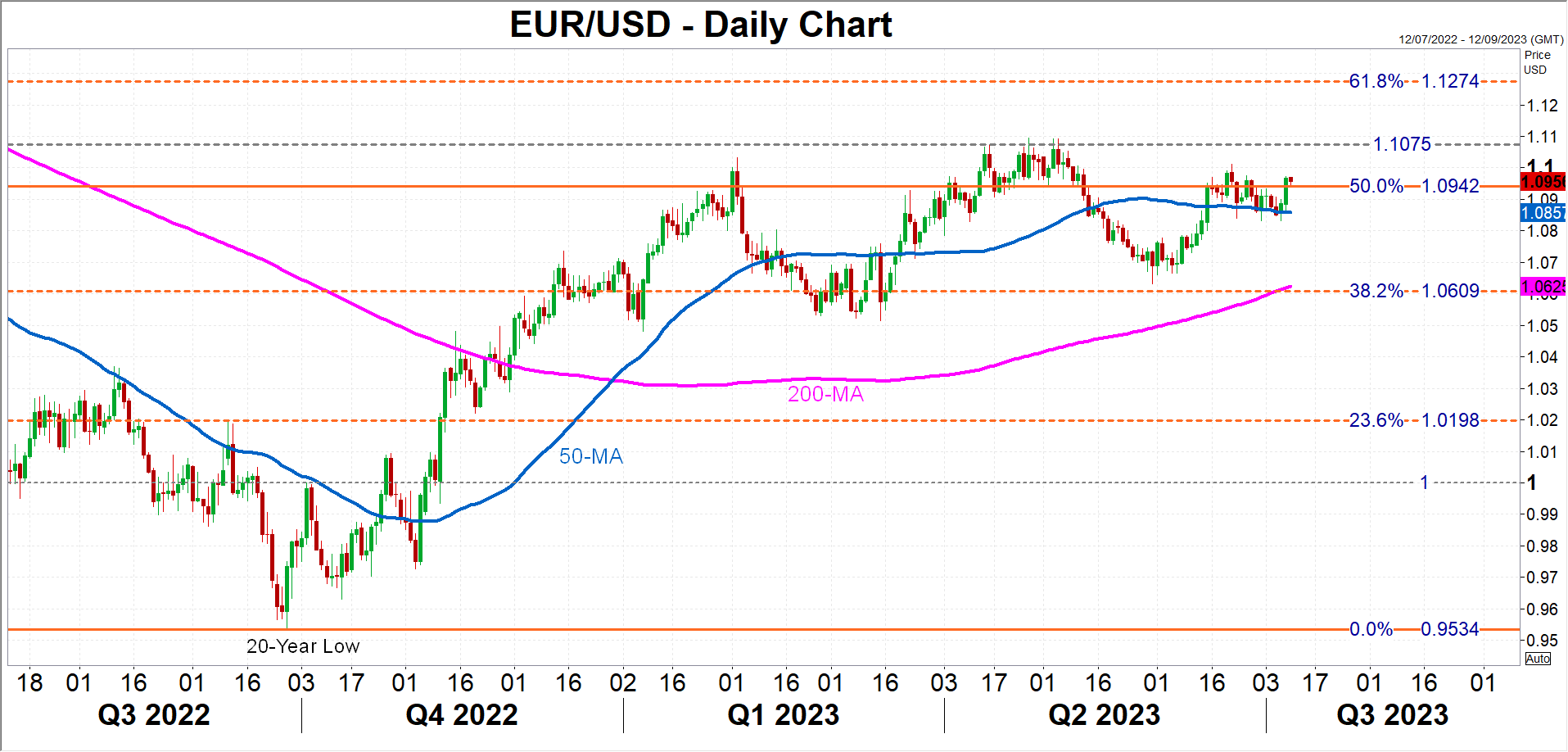

A stronger-than-expected CPI report would push up the odds for a 25-bps rate rise in July as well as for an additional hike later in the year. The euro could potentially tumble towards its 38.2% Fibonacci retracement of the January 2021-September 2022 downtrend in the $1.06 region, which lies between the March and May lows.

However, if the inflation data is on the soft side, particularly if core CPI falls more than expected, the euro could have another attempt at overcoming the $1.1075 resistance before eyeing the 61.8% Fibonacci of $1.1274.

Diverging paths

More broadly though, the dollar’s outlook has become somewhat complicated, not just because of the Fed’s foggy policy outlook, but also because of the varying degrees of divergence with other central banks.

The pound for example is the least likely to suffer should the Fed not disappoint in hiking again as the Bank of England is almost guaranteed to do the same to tackle the UK’s persistent inflation problem. The yen on the other hand is in danger of revisiting the more than three-decade lows from October 2022 as the Bank of Japan has yet to signal its willingness to begin the process of unwinding its massive stimulus.