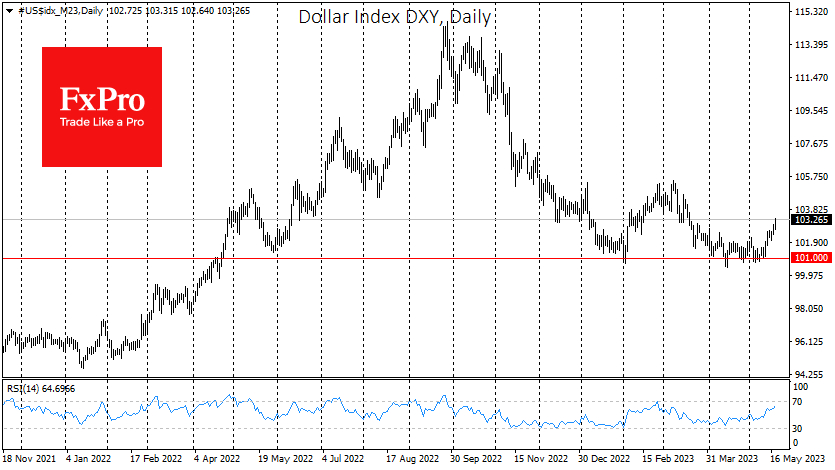

The US dollar has strengthened against its major rivals over the past two weeks, gaining 2% against a basket of major currencies. The Dollar Index surpassed 103, a level not seen since the second half of March.

Notably, the rally in the US currency has been accompanied by a rally in equity indices, an odd couple. The dollar is rising, along with the chances of another rate hike in the middle of next month. The market is now pricing in a 30% chance of another hike, up from almost 0% at the start of May.

The odds that the Fed could make one more hike, rather than sit still before a reversal as widely expected by analysts, are rising amid relatively hawkish comments from Fed members. The market had previously made the mistake of assuming that the Federal Reserve would follow the pattern of the past few decades of avoiding recessions by easing policy.

But comments from central bank officials and monetary policy experts increasingly suggest that the Fed will follow the behaviour of Volcker in the 1980s, who did not fear recession for the sake of beating inflation.

In addition to the fundamental backdrop, it is also worth noting that the Dollar Index has found support in dips below 101. The same area corresponded to a psychologically significant 1.10 in EURUSD and was close to 1.25 in GBPUSD.

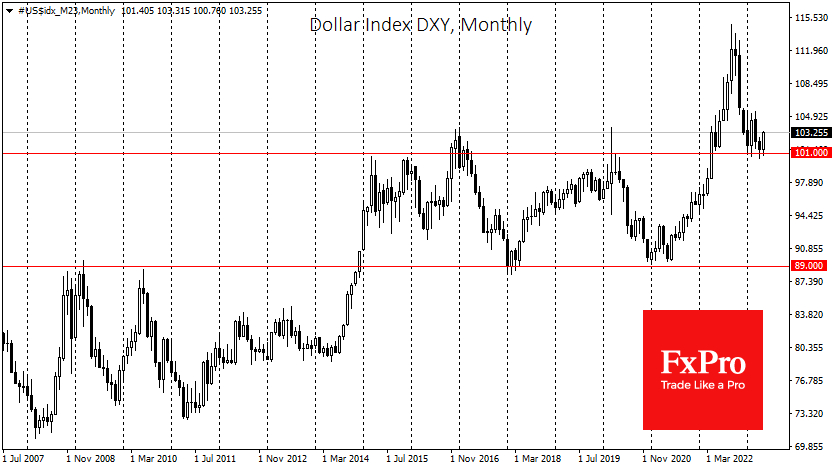

From a historical perspective, the current battle for the dollar could be decisive for many quarters. Until 2022, the Dollar Index was yet to gain a strong foothold above this level. Last year, however, it was a real breakout for the Dollar Index, which rose almost 15% before turning around.

It may be that we now see former insurmountable resistance become strong support. We saw a similar exit for the DXY in late 2014 and 2018, and 2021. But the fundamental basis was the zero-interest rate policy, where the Fed's interest rates were higher than its competitors.

Looking deeper into history, we can easily see that in the era of traditional monetary policy, before 2008, the dollar was chronically falling as the Fed's competitors were far more successful in suppressing inflation.

It is worth being prepared for the short-term bounce that the Dollar Index is currently experiencing, followed by a long-term reversal to the downside. From a technical point of view, we note that the index has already accumulated local overbought conditions, suggesting a corrective pullback, at least in the short term.