The most traded currency pair in the market starts a new week of May with a decline. EUR/USD is now retreating to 1.0860.

The US dollar has risen noticeably because of increased demand for safe-haven assets. Investors are concerned about inflation in the US as well as the growing global economic crisis.

The US currency was well-supported thanks to the rising US treasury bond yield. The Michigan University statistics presented on Friday demonstrated that the CCI could drop to 57.7 points in May from 63.5 points earlier. This made market participants speculate again about the likelihood of another interest rate hike at the next Fed meeting in June.

The market is now estimating a 13% probability of an interest rate hike, although this was zero before the Michigan University data publication.

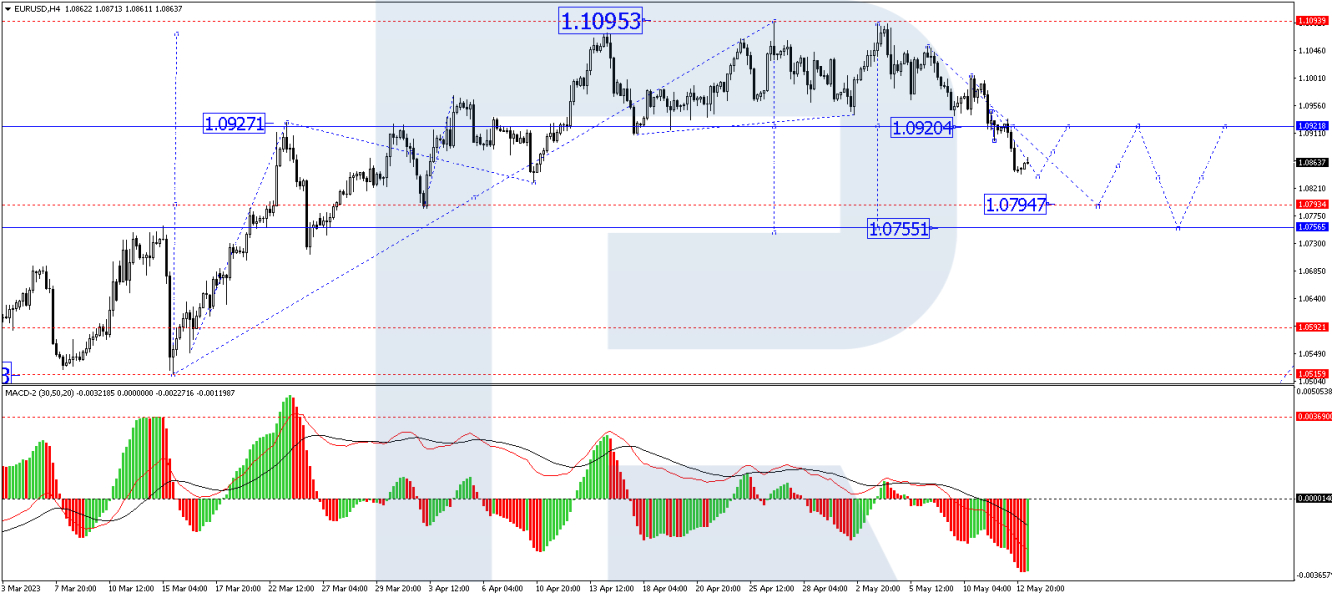

On H4, EUR/USD has formed a consolidation range around the 1.0920 level. The market continues developing a third wave of decline, moving down from it. Next, a link of correction to 1.0920 is expected, followed by a decline to 1.0755. This target is local. Technically, this scenario is confirmed by the MACD: its signal line is below zero, directed strictly downwards, aiming at renewing the lows.

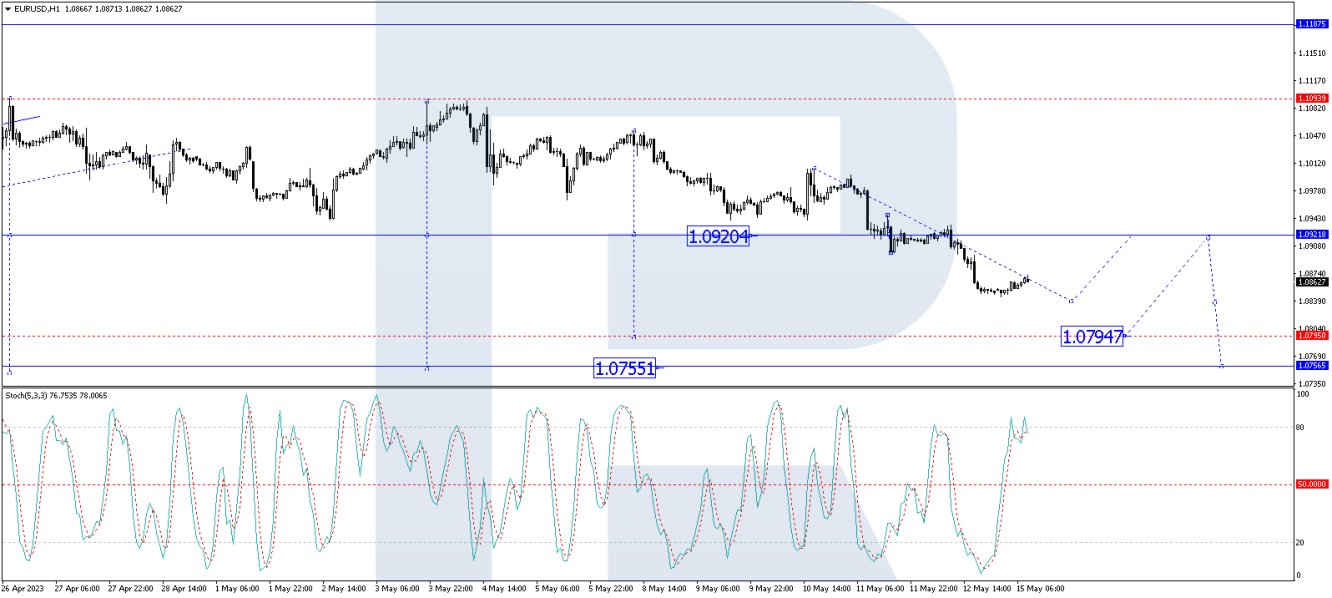

On H1, EUR/USD continues developing a declining wave to 1.0837. After the price reaches this level, a link of correction to 1.0920 is not ruled out. Next, a decline to 1.0795 could follow. Technically, this scenario is confirmed by the Stochastic oscillator: its signal line is near 80. It might decline to 50 today; if this level breaks, the indicator could reach 20.

Disclaimer: Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.