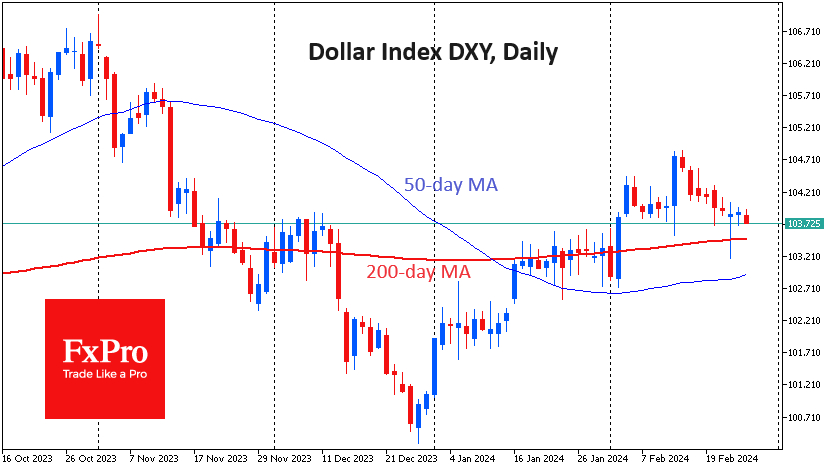

The Dollar Index is giving up positions painfully slowly. It is under pressure for the ninth session in a row, but at the same time, the market is unable to accelerate or break this downtrend. Individual currency pairs are now testing critical local levels. The ability to finally break through them could set the trend for the coming weeks.

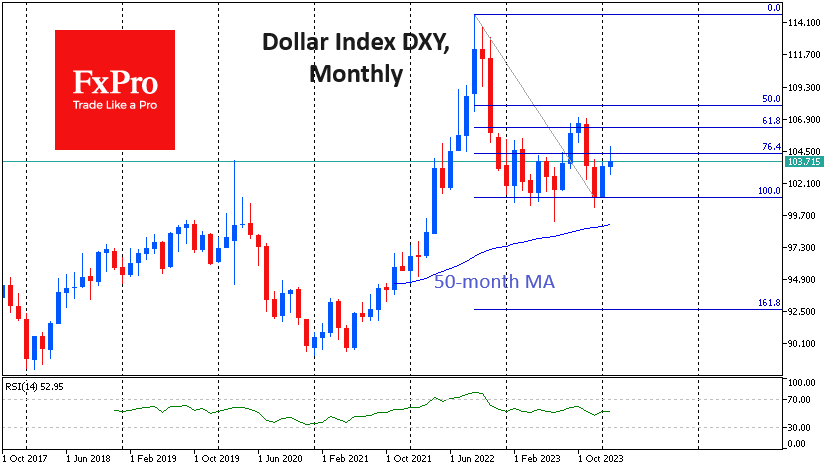

The Dollar Index has fallen from a high of 104.85 on February 14th to 103.7. This level was strong resistance from late November to early February. It could now act as support. This is also a historically important level for the Dollar Index as it was the peak in March 2020, which took 26 months to overcome.

It is logical to expect increased volatility in this area as this is where global trend selection takes place. A decisive move lower will open a quick path to last year's lows around 100.0. Approaching these levels will make the main scenario a further multi-month decline in the US currency, with a final target in the 90.0-92.5 range.

The ability to develop an offensive from these levels would demonstrate the strength of the dollar bulls after the pause. In this case, the DXY could quickly return to last year's October-November highs near106.8. This, in turn, should be followed by a recovery of the dollar to multi-year highs towards 114.5-115.0.

Keeping the dollar in balance this week rests on the shoulders of the 10 FOMC members who are scheduled to speak this week. On the macro data front, the market will be watching Thursday's Personal Income and Expenditure and PCE price indices.

On the technical front, the EUR/USD, AUD/USD, and USD/CHF are all trading around their 200-day moving averages, the GBP/USD is trading around its 50-day MA, and the USD/JPY is approaching 151 level, where the pair made a brutal multi-week bearish reversal in October 2022 and November 2023.

The FxPro Analyst Team