Hiring slowdown? Not yet

Market participants are turning pessimistic about the economy, sensing a slowdown in growth around the corner. Mortgage rates have gone through the roof in recent months and that has already started to impact the housing market, with home sales falling sharply in recent months.

Meanwhile, businesses are warning they could lay off workers as they struggle to manage costs. Rising inflation is threatening to eat into profit margins and many juggernauts like Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) have already announced plans to freeze hiring.

And if this shift is happening at trillion-dollar companies, it is most definitely happening in smaller firms too, where labor costs make up a larger share of total expenses. In other words, executives are looking at a potential slowdown in America and an even worse environment abroad, and have therefore started to play defense.

On the bright side, it is probably too early for all this to show up in this dataset since the shift is just beginning. It is likely a story for the summer.

Solid report expected

Nonfarm payrolls are expected to clock in at 320k in May while the unemployment rate is seen at 3.5%, which would be the lowest in five decades. The forecasts are supported by the S&P Global composite PMI that showed another healthy increase in employment. However, jobless claims rose during the survey week, which suggests layoffs are becoming more frequent.

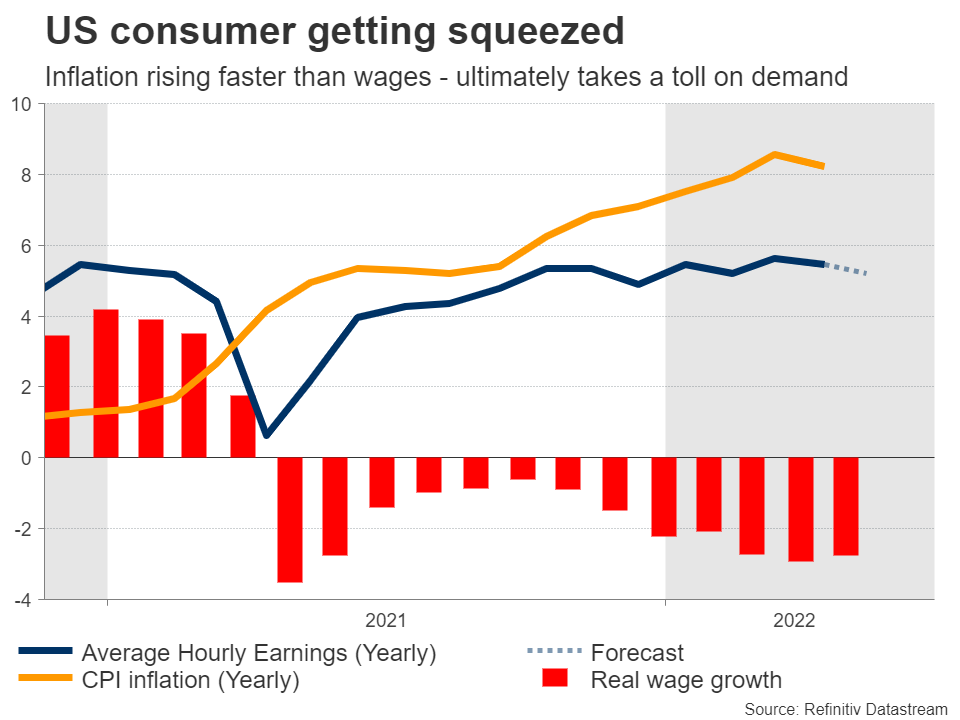

If the employment data is solid overall, traders will turn their focus to the wage component. Job gains are a backward-looking metric whereas wages are considered a forward-looking indicator that can predict inflationary pressures. That’s why the Fed and investors pay such close attention to it.

Wage growth is expected to have lost some steam, with average hourly earnings forecast to slow to 5.2% in yearly terms from 5.5% previously.

Trading playbook and dollar outlook

In the markets, the classic playbook is that the dollar tends to spike higher or lower on the employment report depending on whether it was stronger or weaker than expected, and then retrace the initial move in the following minutes.

This has been a consistent phenomenon over the last couple of years - traders fade the initial spike. Nonfarm payrolls have essentially turned into an intraday volatility event, not something that can start entire trends like in the past.

In the big picture, the outlook for the dollar seems positive despite the latest pullback. The Fed intends to press ahead with raising interest rates, and even though the US economy seems to be losing power, the situation in Europe and China is much worse. And if there is a global recession, that usually benefits the dollar as capital flows into the reserve currency.

Until the outlook for economic growth in the rest of the world begins to improve, it’s difficult to call for any trend reversal.

Taking a technical look at euro/dollar, the pair seems to have been rejected from its 50-day moving average, which also suggests the latest move was a correction and not a reversal. If sellers manage to pierce back below 1.0635, their next target could be the 1.0465 region.

On the upside, a move back above the 50-day MA and the 1.0780 area could open the door for another test of 1.0940.

Ahead of the official employment data on Friday, the ADP jobs report and the ISM manufacturing PMI on Wednesday could give investors a taste of what to expect.