- Dollar Index at so-called inflection point, pending Fed chatter on rates and CPI

- DXY down 2nd week in row, short-term potential to rebound

- Inflation reading might have to be a blockbuster number to convince Fed to hike

The dollar is said to be at an “inflection point” as markets digest more chatter by Federal Reserve policy makers on interest rate possibilities while awaiting Thursday’s all-important Consumer Price Index update for September.

Actually, inflection point can be likened to a politically correct, albeit fashionable, way of characterizing a market development where the ultimate direction or outcome is something we can never be sure of.

Often, we have more than one idea where things could lead to and inflection point serves as a good catch-all, or hedge, to where they might end up. It’s something analysts periodically use, especially in times of great market uncertainty, to describe a market that’s paused, awaiting a catalyst or two, before proceeding.

It seems appropriate now to be used on the dollar, which in the near-term could experience more downside like Tuesday’s or reverse direction to regain its mantle from two weeks ago to start a new spike higher.

Charts by SKCharting.com, with data powered by Investing.com

At the time of writing, the Dollar Index, or DXY, was at 105.83, flat on the day but down 0.23% on the week after just two days of trading. The weekly slide was sharper than the 0.17% drop for all of last week. From its 11-month high of 107.35 on Oct. 3 that earned the “Dollar King” tag, the index was also down 1.44%.

For what it’s worth, DXY’s consecutive decline for five days places the index at the 5-day Exponential Moving Average, or EMA, making a negative cross below the Daily Middle Bollinger Band that indicates weakness, though short-term recovery is still possible.

The index, according to studies carried out by Investing.com with our regular collaborator SKCharting.com, has the potential to return to 106 and retest 107 highs if the September reading for the CPI turns out to be higher than forecast — raising the prospects for a Federal Reserve rate hike in November.

Yet, the reading of Fed tea leaves from remarks made by officials of the central bank over the past 24 hours suggest little appetite for a hike next month that would be advantageous to the greenback.

If the CPI reading disappoints dollar bulls, then our chart projections suggest a drop to as low as 104.40 in the near term, marking a one-month bottom.

We’ll study a breakdown of these projections in our technical outlook for the CPI but first, let’s take a contextual look at the variables and market factors that are at play.

What CPI Could Be Like

Ahead of the release of the CPI update on Thursday, headline inflation has been projected by Wall Street’s economists to grow at 3.6% year-on-year in September versus August’s 3.7%.

Month-on-month, the consensus is for a growth of 0.3% from a previous 0.6%.

As for core CPI, the inflation component stripped off volatile food and energy prices, the forecast is for a 4.1% growth year-on-year from a previous 4.3%. Month-on-month, the projection is forecast to stay flat at 0.3%.

Inflation and the Fed

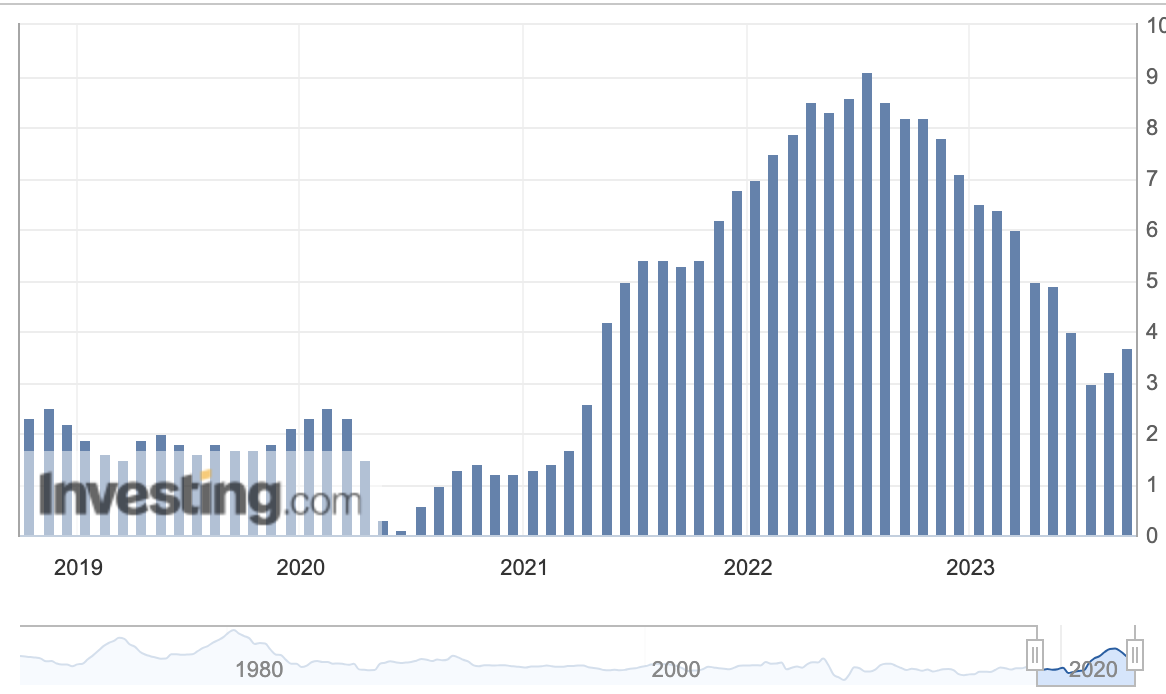

The CPI hit four-decade highs of more than 9% per annum in June 2022 due to trillions of dollars of federal relief spending following the 2020 coronavirus outbreak. The Fed responded with its most aggressive rate hikes in 20 years, going from a base rate of just 0.25% in March 2022 to 5.5%. Those Fed actions pushed inflation down to 3.0% per annum by June this year. It is from this point that price pressures have begun to grow again, reaching 3.7% by August.

While pandemic-related spending is in the rear-view mirror and the CPI has stabilized at below 4% per annum now, a robust labor market has allowed Americans to continue spending, preventing the Fed from achieving its target for inflation.

US jobs growth smashed forecasts again in September, with the 336,000 new non-farm payrolls reported by the Labor Department coming in at 80% above August numbers, suggesting fresh inflationary pressure for the Fed to contend with. It was the highest job creation since January’s 517,000 and came in way above the 187,000 growth in August and the average 170,000 number forecast for September by Wall Street economists.

In all likelihood, the inflation reading has to be a blockbuster one to convince the Fed that a hike is necessary in November.

Neel Kashkari, president of the Minneapolis chapter of the Fed, said the central bank might not have to raise rates any further to cap inflation as the months-long bond market selloff could temper rising prices despite strong labor and wage growth.

“It's certainly possible that higher long-term yields may do some of the work for us in terms of bringing inflation back down," Kashkari said.

The benchmark yield on the 10-year US Treasury note hit a 2007 high of 4.887 on Friday.

But the Minneapolis Fed chief also conceded that if yields were surging on expectations that the central bank would indeed follow through with more rate hikes, then it must have to do just that.

“If those higher long-term yields are higher because their expectations about what we're going to do has changed, then we might actually need to follow through in their expectations in order to maintain those yields," he said.

Kashkari’s colleague Raphael Bostic, who is Atlanta Fed president, meanwhile, said he thought rate hikes were simply no longer necessary as monetary policy was restrictive enough to deliver the central bank’s target for 2% inflation.

“We don't need to increase rates any more,” the Atlanta Fed chief said. “If things come in differently from my outlook, we might have to increase rates. But that's not my current outlook.”

The Fed hiked interest rates 11 times between March 2022 and July 2023, adding 5.25 percentage points to a prior base rate of just 0.25%, to contend with inflation which reached 40-year highs of above 9% in June 2022.

At the time of writing. money-market traders have assigned a probability of just 12% for a quarter-point hike in November, data showed.

CPI/Dollar Index Scenarios

- Scenario 1 - Same or Higher CPI:

If CPI numbers are unchanged or come higher, we are likely to witness a bounceback to immediate resistance at the 5-day EMA of 106.00, beyond which the previous day-high of 106.25 would serve as the next resistance.

If the greenback’s rally continues, look for a further recovery toward the 106.60 - 106.70 levels.

- Scenario 2 - Lower-Than-Expected CPI:

If CPI numbers show a decline, the current downward correctional wave in DXY may extend further to 105.55 and reach critical support at 105.40. From there, it could break further below to major support and a correctional wave that could target 104.80 and 104.40.

***

Disclaimer: The aim of this article is purely to inform and does not in any way represent an inducement or recommendation to buy or sell any commodity or its related securities. The author Barani Krishnan does not hold a position in the commodities and securities he writes about. He typically uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables.