The US inflation report noted higher-than-expected price rises, triggering a boost to the dollar and a pullback in US major index futures.

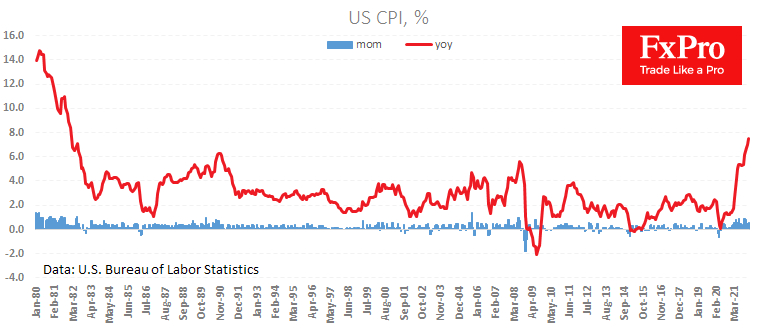

The price index for January rose 0.6% to an annual rate of 7.5%. The report dashed hopes that the monthly price increase was slowing, as analysts expected a slowdown to 0.4% after December's 0.5% jump.

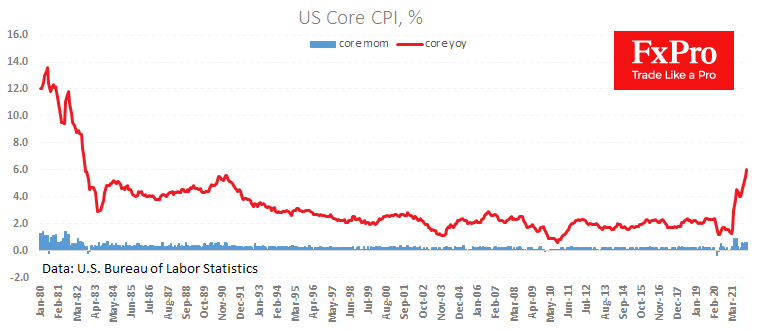

The core index added another 0.6% last month, accelerating to 6.0% y/y, the highest level since August 1982.

Thus far, there are few signs of a slowdown in inflation which requires the Fed to take active steps to tighten monetary policy. As might be expected, the stronger-than-expected rise in prices caused a sell-off in US equity futures, with the NASDAQ losing 2% and the S&P 500 1.3%.

The dollar index immediately gained 0.4%. For the dollar, the current inflation report could be the starting point for a new upward momentum as it virtually unleashes the Fed for a high-profile first move with a key rate hike of 50 points in five weeks.

Rising inflation above expectations and new signs that the inflation trend is taking root could reinforce dollar purchases as markets will immediately put into the price a higher chance of a 50 point rate hike in March and set up a determination for further hikes. And that promises to be bad news for the markets.