Gold and the USDX reacted vigorously to the worrisome news concerning Eastern Europe. However, only the latter can be calm about its medium-term future.

As geopolitical tensions uplift gold, silver and mining stocks, they’re in rally mode each time a doom-and-gloom headline surfaces. However, while the ‘will they or won’t they’ saga commands investors’ attention, the USD Index continues to behave rationally. For example, while volatility has increased recently, the dollar basket has held firm.

To explain, I wrote on Feb. 17:

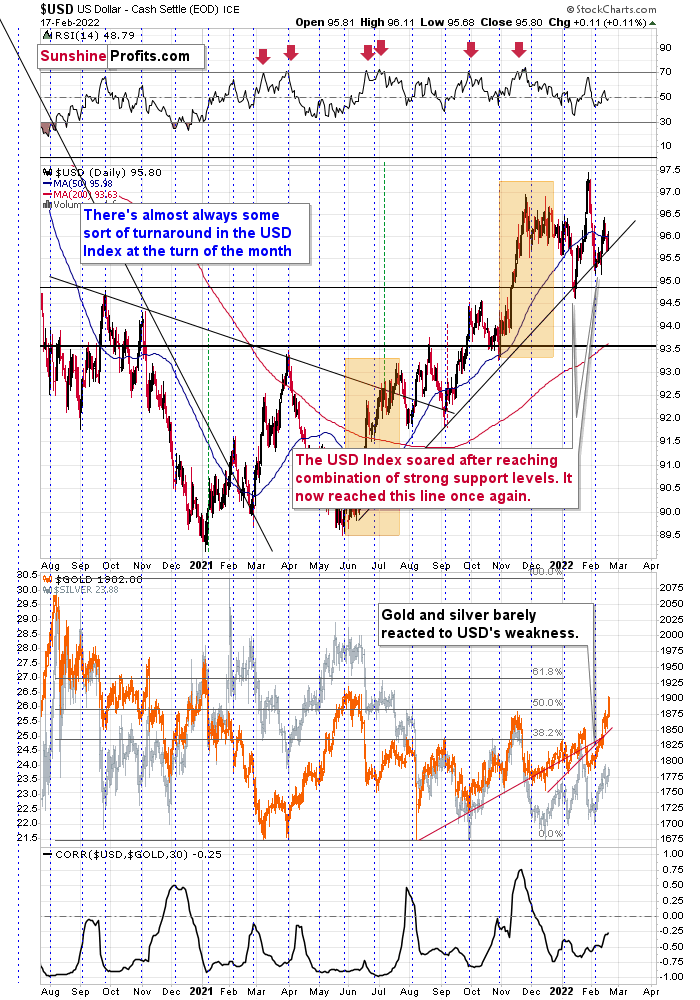

The USD Index is at its medium-term support line. All previous moves to / slightly below it were then followed by rallies, sometimes really big rallies, so we’re likely to see something like that once again.

Such a rally would be the prefect trigger for the triangle-vertex-based reversal in gold and the following slide.

Please see below:

Furthermore, the USD Index’s recent pullback was far from a surprise. For example, I highlighted on numerous occasions that the greenback is nearing its weekly rising resistance line, and the price action has unfolded as I expected.

Moreover, while overbought conditions resulted in a short-term breather, history shows that the USD Index eventually catches its second wind. To explain, I previously wrote:

I marked additional situations on the chart below with orange rectangles – these were the recent cases when the RSI based on the USD Index moved from very low levels to or above 70. In all three previous cases, there was some corrective downswing after the initial part of the decline, but once it was over – and the RSI declined somewhat – the big rally returned and the USD Index moved to new highs.

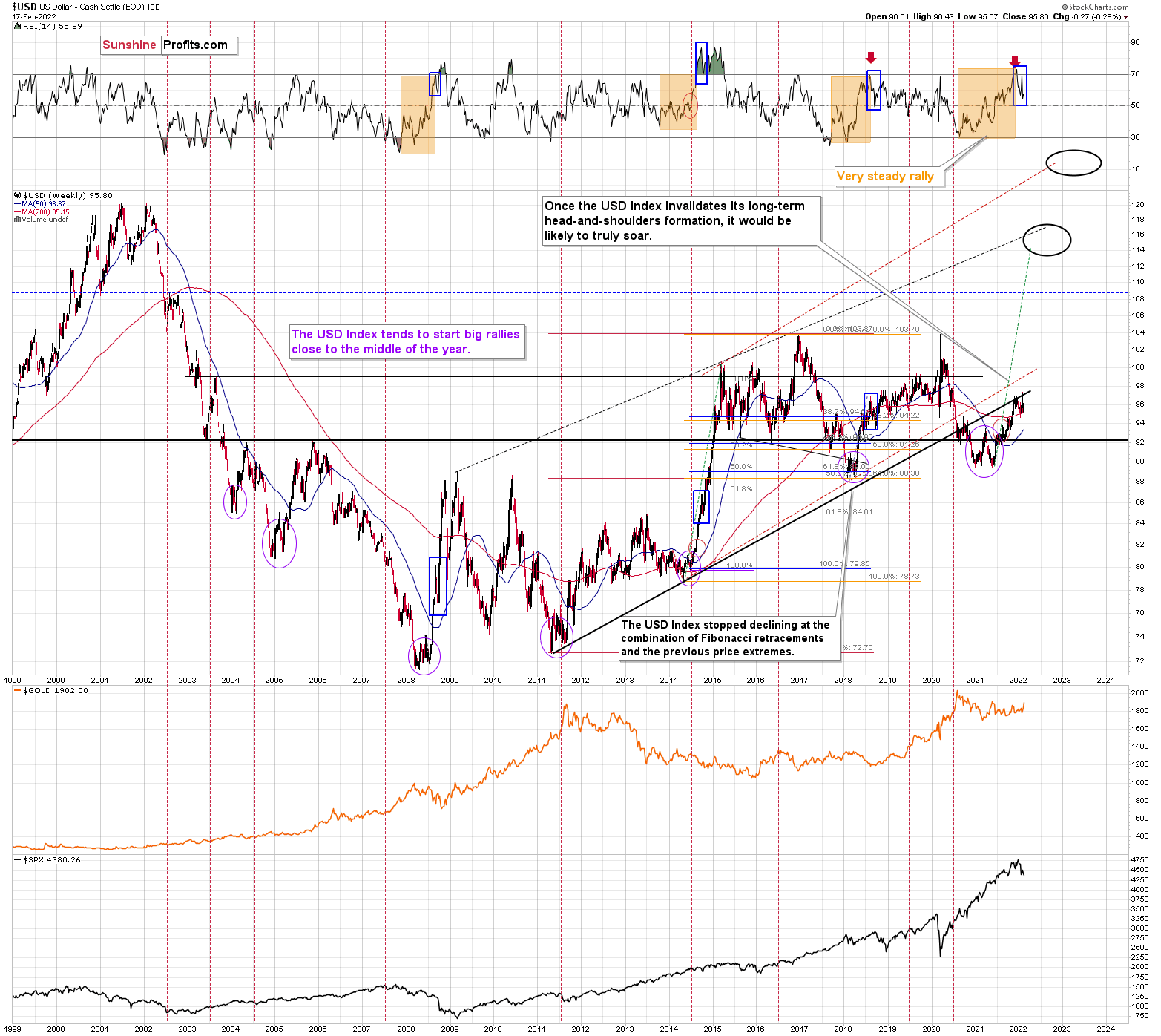

As a result, with the USD Index showcasing a reliable history of profound comebacks, higher highs should materialize over the medium term.

Please see below:

Just as the USD Index took a breather before its massive rally in 2014, it seems that we saw the same recently. This means that predicting higher gold prices (or those of silver) here is likely not a good idea.

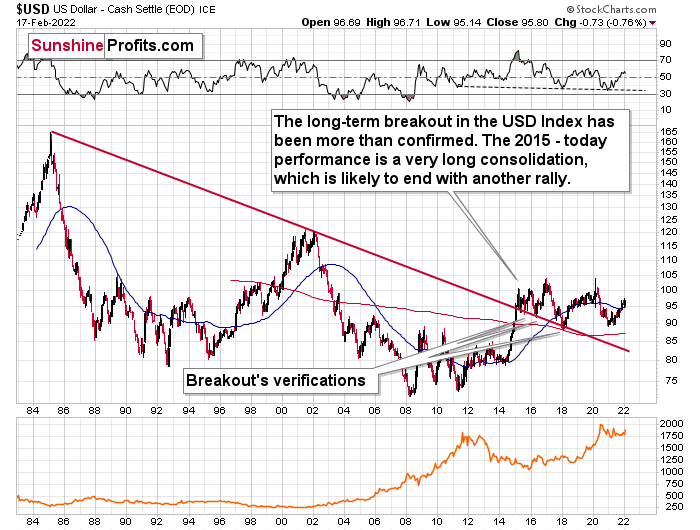

Continuing the theme, the eye in the sky doesn’t lie, and with the USDX’s long-term breakout clearly visible, the wind remains at the dollar’s back. Furthermore, dollar bears often miss the forest through the trees: with the USD Index’s long-term breakout gaining steam, the implications of the chart below are profound. While very few analysts cite the material impact (when was the last time you saw the USDX chart starting in 1985 anywhere else?), the USD Index has been sending bullish signals for years.

Please see below:

The bottom line:

With my initial 2021 target of 94.5 already hit, the ~98-101 target is likely to be reached over the medium term (and perhaps quite soon). Mind, though: we’re not bullish on the greenback because of the U.S.’s absolute outperformance. It’s because the region is fundamentally outperforming the Eurozone. The EUR/USD accounts for nearly 58% of the movement of the USD Index, and the relative performance is what really matters.

In conclusion, the financial markets remain on Russia-Ukraine watch. While gold, silver, mining stocks, and the USD Index whipsaw on the news, the technical and fundamental backdrops support higher prices for the latter, not the former. Thus, while geopolitical tensions are always short-term bullish for the precious metals, the rush is often short-lived. As a result, the trios’ downtrends that began in late 2020 will likely resurface once the headline-driven market returns to normal.