Since the U.S. dollar plays such a strong role in global economics, we thought it appropriate to see how it is performing versus other currencies and investments.

For the U.S. consumer, a strong USD means U.S. goods are more expensive in foreign markets. For U.S. companies that buy or sell products/services globally, a strong USD means they are less competitive. A strong dollar is a significant headwind that erodes the profits of U.S. multinationals.

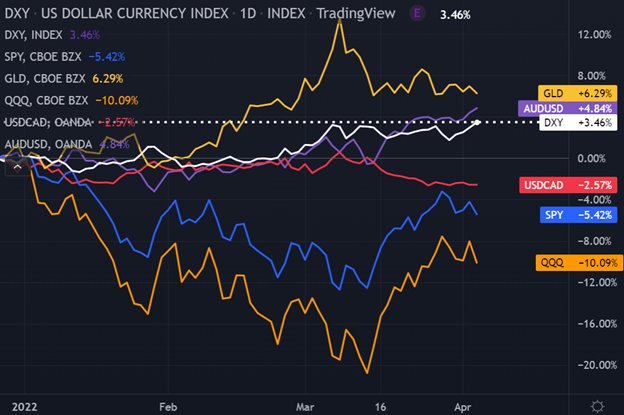

Since we trade and invest in ETFs, it is especially interesting to see how the USD has been trading in 2022 compared with SPDR® Gold Shares (NYSE:GLD), SPDR® S&P 500 (NYSE:SPY) and Invesco QQQ Trust (NASDAQ:QQQ). Gold is the top performer, followed by the Australian dollar (AUD) and the U.S. dollar. We can also see on the following chart the recent recovery rally in both the SPY and QQQ. Amazingly, the QQQ has recovered half of its 2022 loss in just the last few weeks.

DXY – Daily Comparison Chart

www.TheTechnicalTraders.com - TradingView

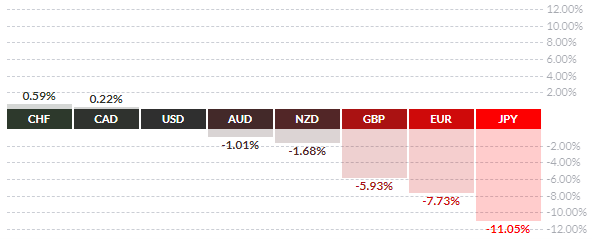

U.S. Dollar Vs. Major Currencies Performance Mixed

The following chart from www.finviz.com shows us that the USD has strengthened vs. the Japanese yen, the euro, the British pound and the Switzerland franc. But also that the USD has weakened vs. the Australian dollar, New Zealand dollar and the Canadian dollar.

The AUD, NZD and CAD reflect the impact of rising energy and commodity prices. The JPY reflects Japan’s negative interest rate as well as its dovish economic policy, while the EUR, GBP and CHF are suffering from capital outflows due to the impact of Europe’s Russia Ukraine war.

U.S. Dollar Year To Date Relative Performance Vs. Majors

U.S. Dollar Appreciated 11.19%

Since May 25, 2021, the USD has been steadily appreciating as a stand-alone market. We can also see that the USD has been in a bullish upward-sloping channel. The USD has offered many buying opportunities at both its bottom trend line as well as its Fibonacci support levels. It continues to make higher highs and higher lows.

The USD remains attractive as it is the primary reserve currency for government central banks. The FED, with its recent rate hike, has signalled that it is planning on additional increases. The USD is considered a safe-haven investment and benefits from rising energy prices as the U.S. is a major producer of global oil and natural gas.

DXY Daily Chart

www.TheTechnicalTraders.com – TradingView

Australian Dollar Gained 45.15%

The Australian dollar enjoyed a strong rally in 2020 as it gained more than 45%. After hitting resistance at its 1.618 Fibonacci extension, the AUD corrected about 38% of its up-swing. This correction ended when buying resumed at the AUD previous high or the 1.000 support level. Since Jan 2022, the AUD has already appreciated about 9%. This is similar in both percentage and time frame to the S&P 500 and the Nasdaq 100 equity markets.

AUD/USD – Daily Chart

www.TheTechnicalTraders.com – TradingView