Despite the well-known inverse relationship between USD/CAD and the price of oil, the two have moved up in tandem on numerous occasions in recent weeks. And while the surges in crude can be attributed to the persisting global tensions following Russia’s invasion of Ukraine, explaining USD/CAD ‘s swings is not that easy.

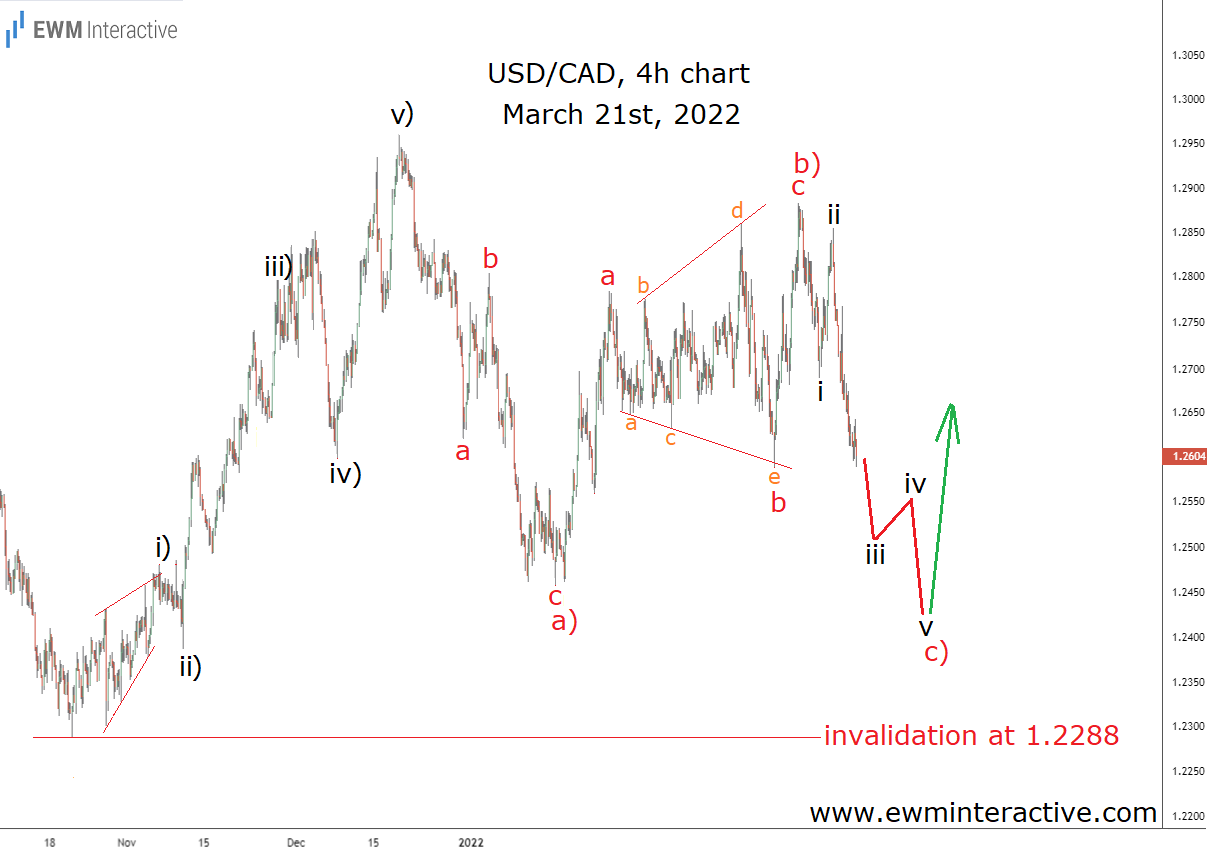

So instead of searching for logical explanations that won’t do us any good anyway, we focus on the Elliott Wave patterns the pair has been drawing. For instance, we’ve been tracking a bullish 5-3 wave cycle for over a month now. The chart below helped us stay ahead of both the bullish reversal near 1.2400 and the following 500-pip surge to over 1.2900 so far.

A month and a half ago, USD/CAD ‘s 4h hour chart revealed that the recovery from 1.2288 to 1.2964 had an impulsive structure. This meant that the uptrend was supposed to resume once the following correction was over. The correction, by the way, looked like an a)-b)-c) flat correction. Wave a) was a simple a-b-c zigzag and so was wave b). It is interesting to notice that wave ‘b’ of b) was a rare expanding triangle pattern.

Similar Elliott Wave setups occur in the stock, crypto and commodity markets, as well.

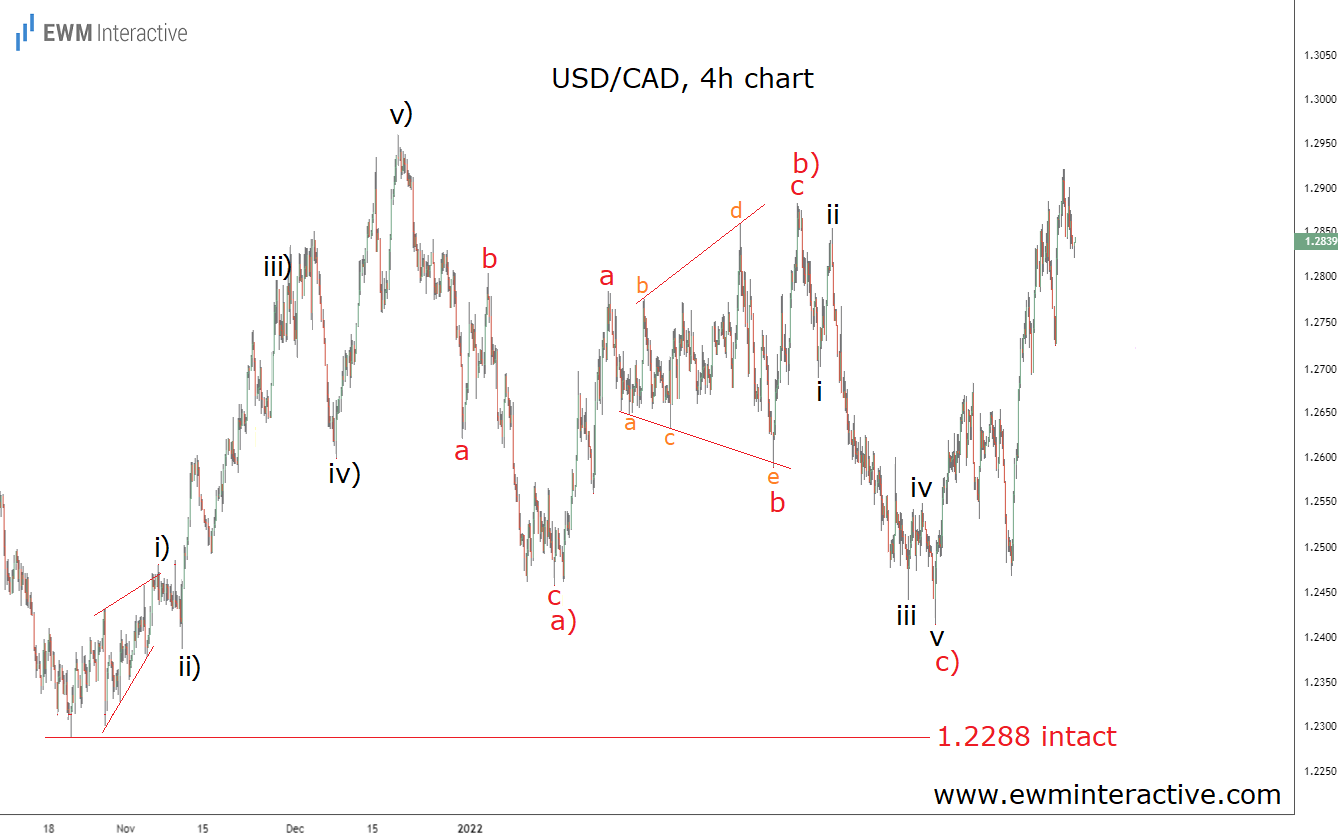

If this count was correct, wave c) was likely to evolve into a five-wave impulse, labeled i-ii-iii-iv-v. A drop below the end of wave a) was likely to occur before wave c) was over. On the other hand, in order for the positive outlook to survive, a bullish reversal had to form above 1.2288. From the distance of the first week of May now, we can see that is exactly what happened.

Wave c) did evolve into an impulse and did breach the bottom of wave a), but the bears couldn’t drag the pair below 1.2403. Following the bullish reversal on Apr. 5, USD/CAD climbed to 1.2914, adding over 500 pips in less than a month. Our invalidation level at 1.2288 was never put to a test.

We have no idea how is the Fed going to deal with the surging inflation. We have no clue to what extent the latest lockdowns in China are going to disrupt global supply chains. Nor do we know how the war in Ukraine is going to develop. All we know is that Elliott Wave analysis is a powerful ally in any market. We plan to keep relying on it to guide us in these uncertain times.