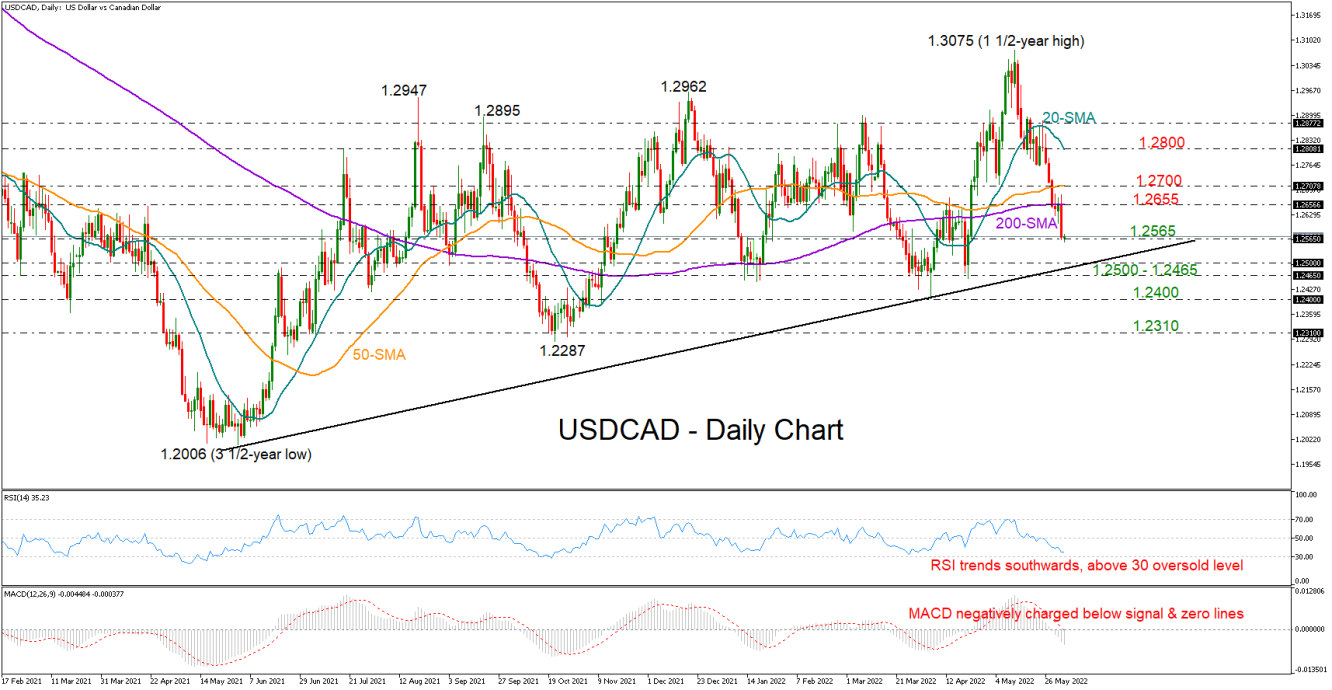

USDCAD lost the battle with the 200-day simple moving average (SMA) on Thursday and tumbled to a three-week low of 1.2556 after two days of waiting to cross above the line and the 1.2655 resistance.

The price is currently trading near a familiar constraining zone, which has been frequently limiting upside and downside moves around 1.2565 for more than a year now. Questions, however, are rising about whether it will successfully stage a meaningful rebound at this point as technical signals keep deteriorating. In momentum indicators, the RSI is clearly trending to the downside below its 50 neutral mark and is still some distance above its 30 oversold level. Similarly, the MACD remains negatively charged below its red signal and zero lines, painting a blurry picture for short-term trading too.

If the sell-off intensifies in the coming sessions, the next turning point could develop within the 1.2500 – 1.2465 region, where the tentative ascending trendline drawn from the 1.2006 bottom is also passing through. Should the bears accelerate below 1.2400, the door would open for the key 1.2310 territory.

Alternatively, a bounce on 1.2565 may see a test around the 200-day SMA at 1.2655, while slightly higher, the 50-day SMA at 1.2700 will be closely watched as well before the focus shifts to the 20-day SMA at 1.2800.

In brief, USDCAD is expected to extend its bearish cycle in the short term, likely bringing the 1.2500 mark next under the spotlight.

USDCAD lost the battle with the 200-day simple moving average (SMA) on Thursday and tumbled to a three-week low of 1.2556 after two days of waiting to cross above the line and the 1.2655 resistance.

The price is currently trading near a familiar constraining zone, which has been frequently limiting upside and downside moves around 1.2565 for more than a year now. Questions, however, are rising about whether it will successfully stage a meaningful rebound at this point as technical signals keep deteriorating. In momentum indicators, the RSI is clearly trending to the downside below its 50 neutral mark and is still some distance above its 30 oversold level. Similarly, the MACD remains negatively charged below its red signal and zero lines, painting a blurry picture for short-term trading too.

If the sell-off intensifies in the coming sessions, the next turning point could develop within the 1.2500 – 1.2465 region, where the tentative ascending trendline drawn from the 1.2006 bottom is also passing through. Should the bears accelerate below 1.2400, the door would open for the key 1.2310 territory.

Alternatively, a bounce on 1.2565 may see a test around the 200-day SMA at 1.2655, while slightly higher, the 50-day SMA at 1.2700 will be closely watched as well before the focus shifts to the 20-day SMA at 1.2800.

In brief, USDCAD is expected to extend its bearish cycle in the short term, likely bringing the 1.2500 mark next under the spotlight.