- USDCAD is in the red today, tests the support of the 200-day simple moving average

- The mixed momentum indicators complicate the outlook

- The SMAs’ convergence could open the door to a sizeable move ahead

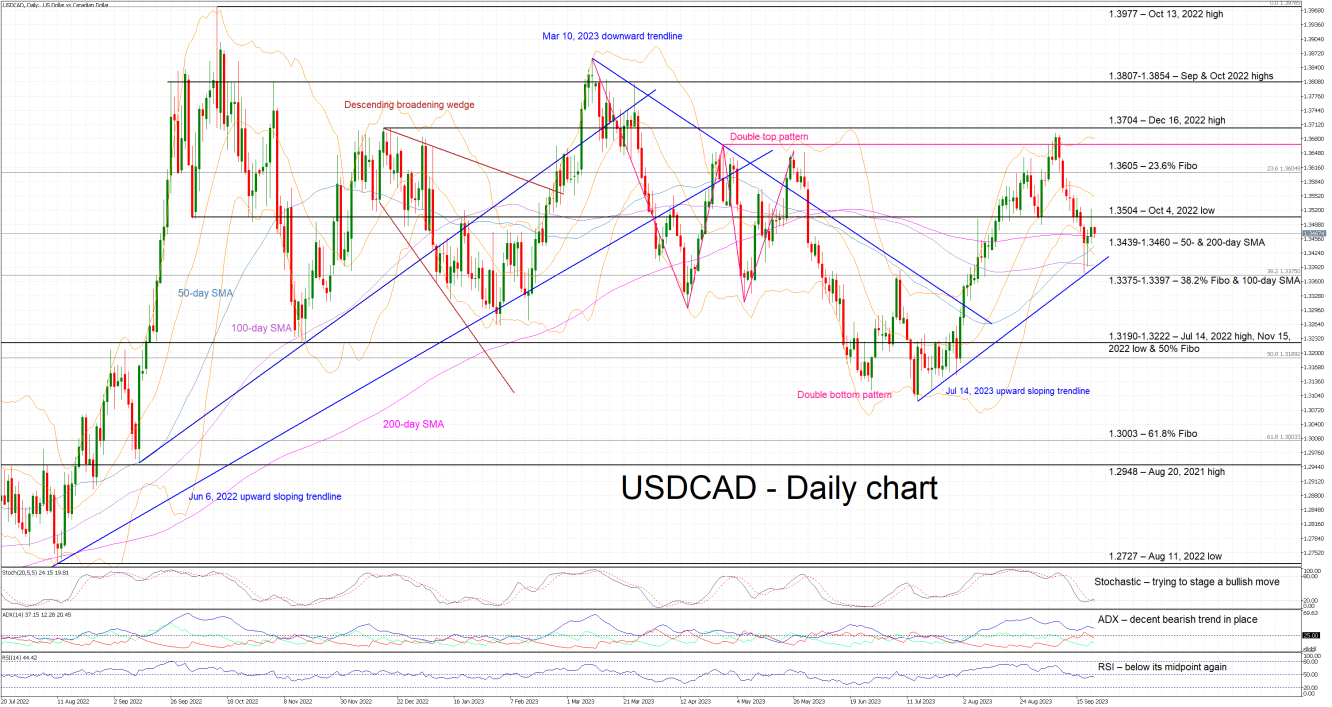

USDCAD is moving lower today after bouncing off the July 14, 2023 upward sloping trendline. The downleg since the September 7, 2023 peak has been impressive but the path appears to be trickier at this stage, especially as the bulls have decided to react more forcefully. Interestingly, the convergence of the SMAs is probably opening the door to a sizeable move soon but it is also elevating the importance of the 1.3439-1.3460 region.

Amidst this price action, the momentum indicators are currently split. On the one hand, both the RSI and Average Directional Movement Index (ADX) confirm the current bearish tendency in USDCAD and therefore are supportive of the bears’ intentions. On the other hand, the stochastic oscillator is once again spoiling the bears’ party. It is trying to edge above both its oversold territory and moving average. If successful, it will send a strong bullish signal.

Should the bulls try to capitalize on a likely bullish signal, they would try to keep USDCAD above the busy 1.3439-1.3460 area that is populated by the 50- and 200-day SMAs. They could have a go at overcoming the October 4, 2022 low at 1.3504 and then potentially set their eyes on the 23.6% Fibonacci retracement of the April 5, 2022 – October 13, 2022 uptrend at 1.3605.

On the flip side, the bears are probably feeling confident and preparing to break the 1.3439-1.3460 area. They could then target the busy 1.3375-1.3397 area, defined by the 38.2% Fibonacci retracement and the 100-day SMA, and the July 14, 2023 upward sloping trendline. They could then have a look at pushing USDCAD even lower, towards the key 1.3190-1.3222 range.

To sum up, USDCAD bears are probably taking a breather but appear ready for another pullback. However, the mixed momentum indicators are complicating the outlook.