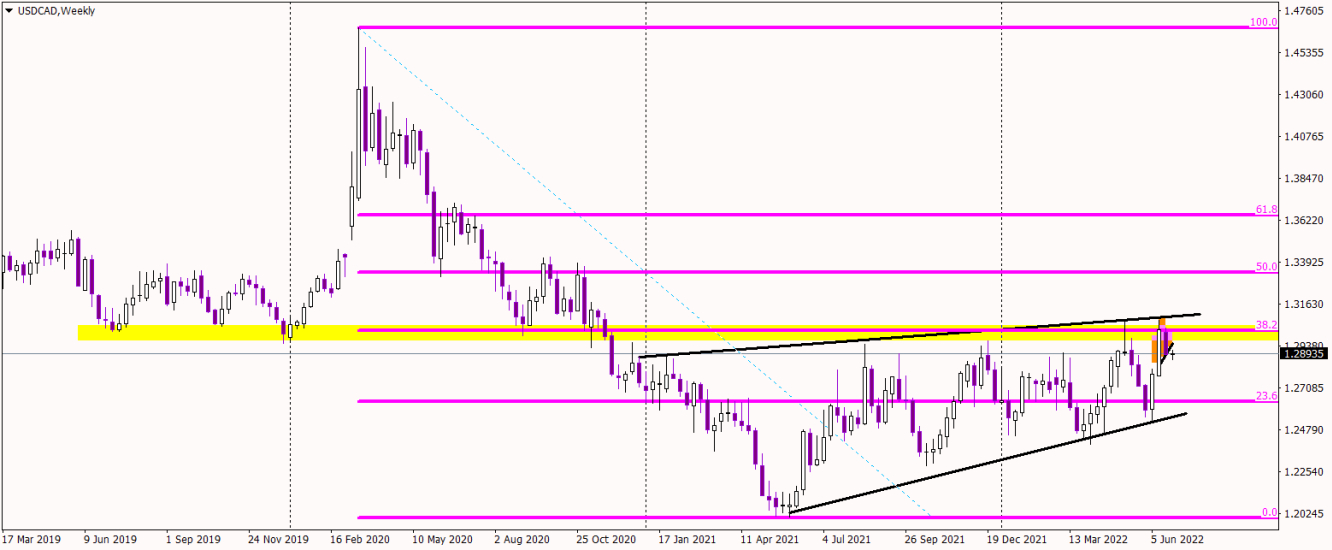

We’ve spotted a great selling opportunity on the USD/CAD and it’s a great occasion for both the mid and long-term. First, let me show you the big picture and the handsome price action that can be seen on a weekly chart.

So, the main thing on the weekly chart is that the price is in a long-term down-trend. Most recently, we were in a bullish correction, but it doesn’t change the long-term mood. A correction managed to test a key resistance on a psychological barrier of 1.3 (yellow). It was a crucial level for the past four years and is still crucial now.

1.3 is additionally in the same place as the 38.2 % Fibonacci, which only strengthens this area. USD/CAD tested that resistance twice, and both were unsuccessful. That creates a double top formation.

Interestingly, if we look closer, the second top is a smaller Head and Shoulders pattern at the same time! This pattern is already up and running as the USDCAD managed to break its neckline. With this, we have a sell signal on both time horizons: mid-term and the long-term. A potential target is on the 23.6% Fibo and the lower line of the wedge. With all that, the chances that we will get there are pretty high.