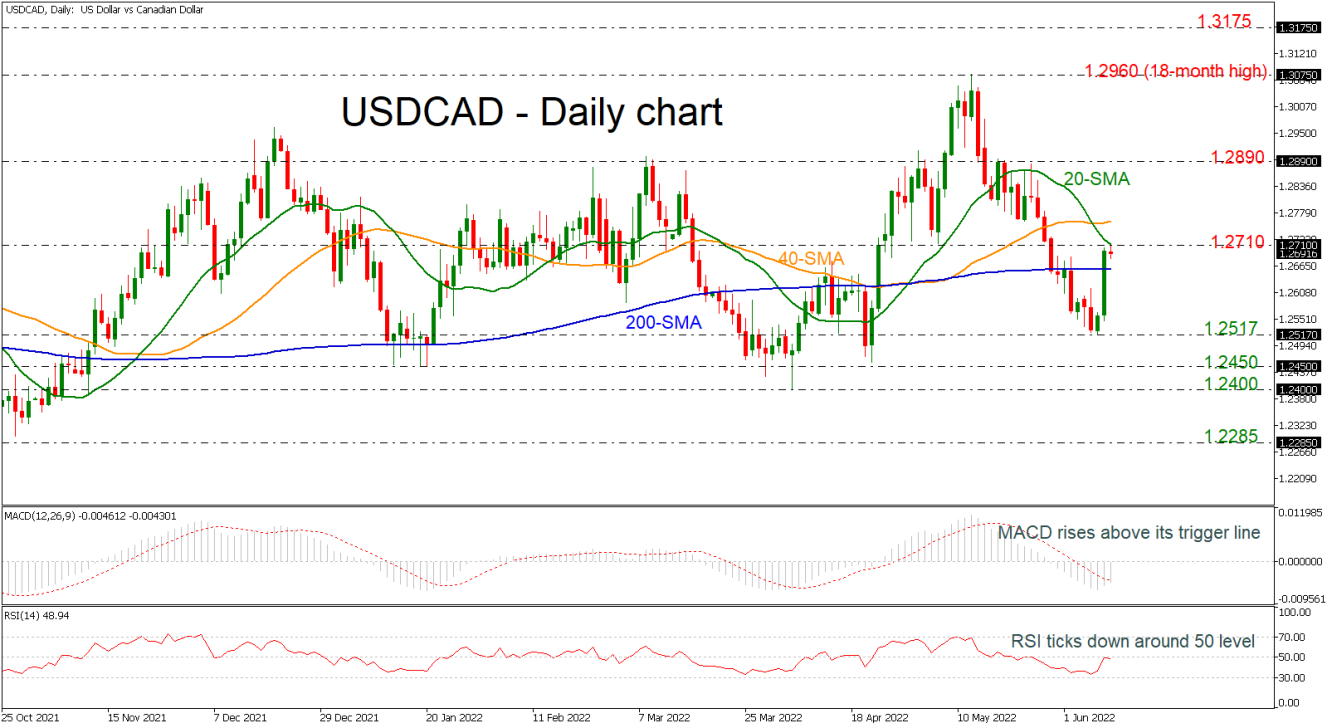

The pair is flirting with the 20-day simple moving average (SMA) and is failing to continue the buying interest.

Technically, the MACD oscillator is gaining momentum above its trigger line and below the zero level, while the RSI is appearing flat near the neutral threshold of 50. In trend indicators, the 20- and the 40-day simple moving averages (SMAs) posted a bearish crossover in the previous sessions, mirroring the downside move from the 18-month peak of 1.2960.

Should the pair stretch north, the 40-day SMA at 1.2760 could provide immediate resistance before the pair touches the 1.2890 barrier. A significant step higher could bring the bullish sentiment back into play, sending the price probably towards the 1.2960 barrier.

On the flip side, the 200-day SMA currently at 1.2655 may halt the bearish movements, while even lower, it may meet the 1.2517 support. If traders continue to sell the pair, the price could hit the 1.2450-1.2400 region ahead of 1.2285.

To sum up, the market is expected to hold bullish in the very short-term if the pair jumps above the short-term SMAs. However, in the broader outlook the outlook is still neutral-to-bullish.